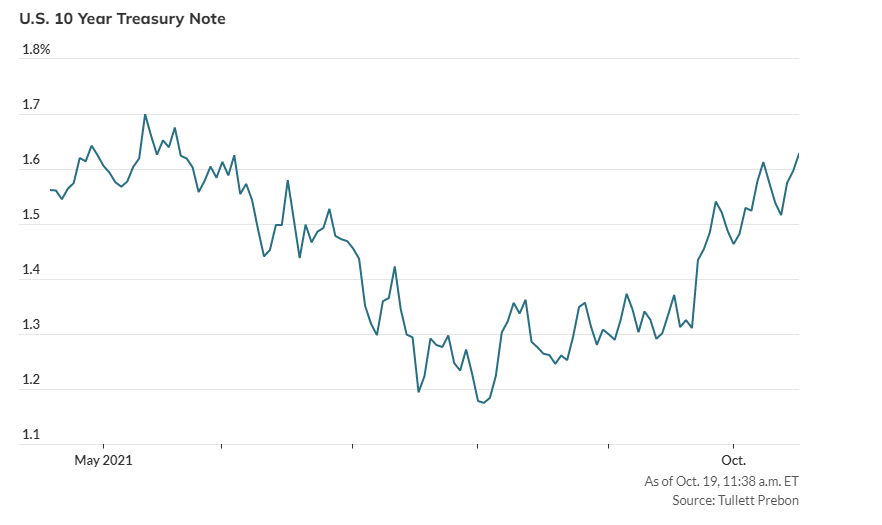

10-year Treasury yield rises back to highest level since June

U.S. Treasury yields climbed on Tuesday, pushing the 10-year Treasury note back to its highest level since around early June, as the stock market rose and investors awaited speeches from Federal Reserve members ahead of the central bank’s next policy meeting in early November when it may announce the start of a reduction in its monthly bond purchases.

What are yields doing?

- The 10-year Treasury note yields TMUBMUSD10Y, 1.627% 1.619%, compared with 1.583% at 3 p.m. Eastern Time on Friday.

- The 2-year Treasury note TMUBMUSD02Y, 0.395% rate was at 0.387%, versus 0.419% a day ago, which represented a new 52-week high for the debt and its highest since March 18, 2020.

- The 30-year Treasury bond TMUBMUSD30Y, 2.080% was yielding 2.072%, compared with 2.015% on Monday.

What’s driving the market?

After a jump Monday, Treasury yields opened steady Tuesday, but began to drift higher late morning as stocks climbed for a fifth day.

On Tuesday, investors will see a host of Fed speakers delivering their final comments before the next policy meeting on Nov. 2 – 3. . Those include San Francisco Fed President Mary Daly, who is slated to deliver introductory remarks at a Regional Banker Forum at 11 a.m. Eastern, Atlanta Fed President Raphael Bostic who will speak twice Tuesday at a Fed conference on careers in economics at 1 p.m. and a discussion with The Hill’s Editor at Large about at 2 p.m.

Meanwhile, Fed Gov. Michelle Bowman and Richmond Fed President Tom Barkin will talk about diversity and economic recovery at a Richmond Fed conference at 1:15 p.m., and the parade concludes with Fed Gov. Christopher Waller offering insights about the economic outlook at the Stanford Institute for Economic Policy Research at 3 p.m.

Moves in government debt are set against expectations that the Fed will start to reduce its $120 billion in monthly purchases of Treasurys and mortgage-backed securities. Some analysts have been concerned, however, that the Fed may need to taper its pandemic-era purchases at faster clip as a prelude to soon lifting policy interest rates to curb inflation.

Yields for debt also have been sensitive to signs of near-term pricing pressures emanating from the energy market, with U.S. crude-oil futures CL.1, 0.86% rising to the highest level in about seven years.

In economic reports, a report on U.S. housing starts and permits for September showed that home builders started construction on homes at a seasonally-adjusted annual rate of 1.56 million in September, representing a 1.6% decrease from the previous month, the U.S. Census Bureau reported Tuesday.

Permitting for new homes occurred at a seasonally-adjusted annual rate of 1.59 million, down 7.7% from August. Economists had expected housing starts to occur at a pace of 1.61 million and building permits to come in at a pace of 1.67 million.

What analysts are saying

“And yes, taper then rate hikes with the market quickly pricing in the latter. In the end, there is plenty of time between now and the middle of 2022,” wrote Gregory Faranello, executive director of AmeriVet Securities, in a Tuesday research note, referring to market-based expectations that the first interest rate hike might occur in the middle of next year.

“And once the taper process begins and rolls into 2022, the markets will reevaluate how quickly the Fed will deliver increases to official rates. In linear fashion (granted, could be quicker as per Powell) at $15 billion per month beginning next month, we end up at the June FOMC. Rate hikes that same month? ”

Please see more at: https://www.marketwatch.com/story/10-and-30-year-treasury-yields-inch-higher-early-tuesday-11634643629