10-Year Yield Hits November 2016 Low as Trump Stokes Trade Fears

Treasury yields fell on Friday after President Donald Trump said he would slap additional tariffs on Chinese goods next month, reigniting fears of a prolonged trade war between the world’s largest economies.

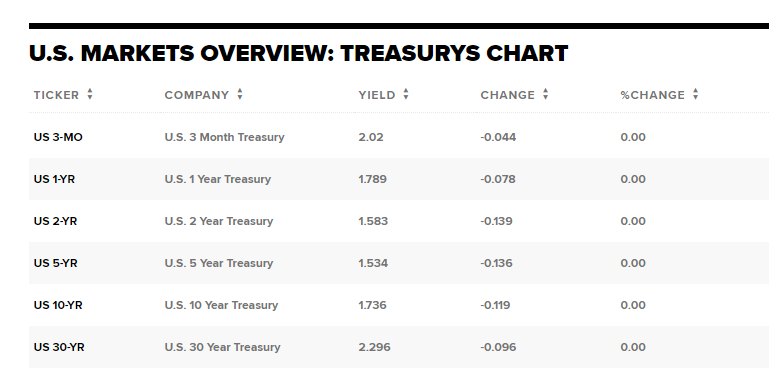

The benchmark 10-year yield fell to 1.867% and hit its lowest level since November 2016 earlier in the day. The 30-year bond rate slid to 2.406%.

On Thursday, Trump said an additional tariff of 10% would be imposed on $300 billion worth of Chinese goods. The levy will take effect from September 1. As a result, investors are rushing into safe haven assets.

China and the U.S. have been engaged in a trade war since last year. The conflict has raised concern over slowing economic growth and diminishing corporate profits.

Gregory Faranello, head of U.S. rates at AmeriVet Securities, pointed out in a note Friday that expectations for a rate cut in September surged following the announcement.

“The trade war has intensified,” he said. “The Fed will not explicitly underwrite Potus’ Trade War, but they most certainly will respond to downside in the real economy.”

Worries over trade overshadowed a solid jobs report. The U.S. economy added 164,000 jobs last month, just below a Dow Jones forecast of 165,000. Wages rose more than expected on a year-over-year basis.

Published Fri, Aug 2, 2019 by Fred Imbert