2023 Aftershocks

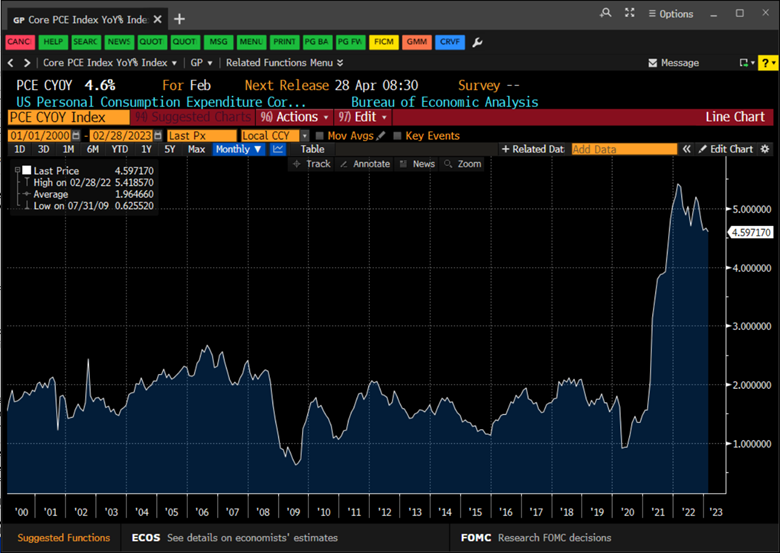

Markets remain very focused on the continued evolution of the banking stresses, inflation, earnings season, and geopolitical risks. Banks: less about contagion (Fed), more about contraction. We believe inflation will continue to come down. We look for Core PCE to move toward 3% in 2023. We also think context and perspective is very important right now. There are no clear answers within this pocket of time. Pathways matter. Interest rates and the real economy. The rate structure and move over the past month will help cushion the banking shock in March. It’s logical for the US Treasury market to price itself lower relative to the Federal Reserve’s terminal rate.

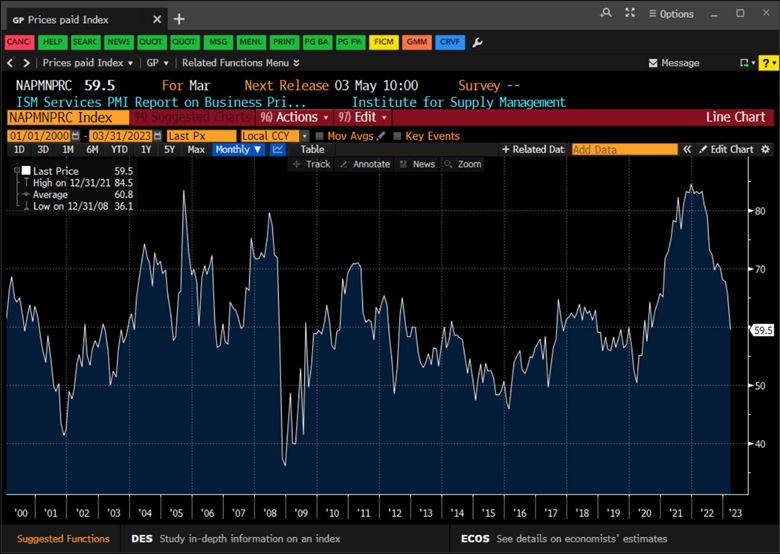

Core PCE and ISM Prices Paid. Inflation has rolled over. It’s rolled over aggressively.

ISM Prices Paid

We disagree, but listening always

The Fed: New York Fed President Williams pushes back on the linkage between the Fed rate hiking cycle and the current banking strains. Again, the separation of financial stability issues from monetary policy. Dismissing the pricing of the forward rate structure similar to Powell. Many of these smaller regional bank shares/models grew with ZIRP, QE, regulatory from 2009 and culminating in 2021 with the largest QE initiative and balance sheet expansion in the history of the Fed’s existence. The charts and balance sheets are clear. Their policies (the Fed) monetary and regulatory (circa 2009) helping to fuel it, and yes policy the other way (circa 2022) is breaking it. The Fed being late and transitory a big part of the catalyst (speed and magnitude of rate hikes). Of course, we don’t expect the Fed to take ownership.

Equity: Silicon Valley Bank. The global pandemic fueled excesses. Central bank and fiscal policy.

On the geopolitical side clear implications for secular US inflation going forward. One of the largest power-grab initiatives of our lifetime and it’s happening very quickly. What countries/alliances have and don’t have (resources) may be far greater in importance than interest rates levels for the economy. Xi is making his move. And it’s broader than Taiwan. China= Russia (Ukraine resources), Brazil, Saudi Arabia (Oil/OPEC), Africa, Taiwan (supply chain), North Korea, and of late France. On the rise: Gold and Bitcoin with tensions in the seas of China on high alert. The narrative of reserve currency status alive and well as the US faces a contentious debt ceiling debate with the Treasury’s General Account buffering its legal $150 billion floor. The US dollar’s percentage of global trade down significantly. Oh, and the US with regional bank issues. It doesn’t make the Fed’s job easier. And on the fiscal side, with US debt levels higher by $10 trillion since 2019, no powder left. And now being financed at much higher rate levels because of inflation. This is NOT coincidental.

Oil

Gold

We were quick to point out in March when the regional bank issues surfaced the potential impact on the “flow of credit”. This now remains the biggest story in our view moving forward in the US. The surveys were leaning before March (contraction) and consumers are catching on quickly. This is far different than how we look at financial conditions over time: real rates, credit levels, the US dollar, and equities. Who cares what the price of credit is if you can’t access it. Emphasizes private markets going forward.

When the Fed initiated their Bank Term Funding Program it was presented as “helping to increase the flow of credit to households”. But nothing could be further from reality. This program is in place to hold the pieces together and at a much higher cost of funding that zero interest rate deposits. Paying zero on deposits works when the Fed is at ZIRP but not as much at 5%. It may not surface in 1st quarter earnings but likely plays out in the coming quarters. When you replace deposits at zero with OIS +10, it needs to rear its head somewhere as rates likely go even higher in May.

KRE Index. Highlights the 2021 bubble.

For now, the Fed is watching closely. We know the March meeting was a “close” call. But today’s pricing has now skewed the likelihood for another 25-basis points in May between 70-80%. 2-year notes have been leaking a little wider above 4% but have been finding support. Recently, the NY Fed survey this week on consumer expectations: higher inflation and tougher to get credit. Sounds about right. Atlanta GDP Index showing a touch above 2% for GDP. Stagflation in a blender. This first quarter is essentially meaningless with regards to earnings. The landscape changed in March and the expansion of the Fed’s balance sheet increasing bank reserves in response isn’t flowing into the economy. It’s really the second quarter (guidance) where the rubber will likely meet the road.

Fed’s Balance Sheet. Correlation with risk asset is very strong.

So, what matters now?

Pathways. The real economy and interest rates. If the market is priced for another 25-basis points in May the Fed likely takes it. But the bigger picture opportunities lie in the pathway forward (forwards). We will have communication before the blackout period. And even if they deliver their DOT plot: the question remains pause or pivot. Williams saying he’s not paying attention to the market’s future rate expectations. We’ve written from 2022 the battle between the Fed and hungry markets. Initially it will be a pause. But the language will matter (see Bank of Canada).

Markets want the pivot (not a new story), and we have 200-basis points of easing priced in along the timeline NY Fed President Williams indicated the Fed believes they will be down to 2% inflation. Bottom line: credit contraction, earnings contraction, recession, stagflation, potential issues with CRE, and 200-basis points of cuts is the narrative. These narratives have been far from bullet proof.

SOFR spread 2023 versus 2024. The market wants rates down.

We expect more rate volatility as we sort through those issues in the coming quarters. It will simply take time. NY Fed Williams indicating they are not seeing clear signs of credit contraction should come as no surprise. This is the same regime that missed inflation that was looking them straight in the eyes.

The Treasury MOVE (volatility) Index. We reached levels in 2023 unimaginable. 2022 shock. 2023 aftershocks.

Conclusion

The Federal Reserve seems intent on getting to their projected DOT of 5.10%. That would be one more rate increase. This rate hiking cycle is over. Is it pause, pause. Is it a pause, cut. Or do we pause and then hike more. Equilibrium rates are lower than here. The fight against inflation is necessary. But a function of the creators that are now resolving it. We think the rate structure will move lower. And with it a steeper yield curve. The period in 2006-2008 when Chair Greenspan was in charge, it took a year and a half to go from 5.25% to 3.50%. We did that in 2 weeks in March 2023.

Rates are going lower. UST 2-year back 25 years.