AmeriVet Weekly Muni Snapshot

|

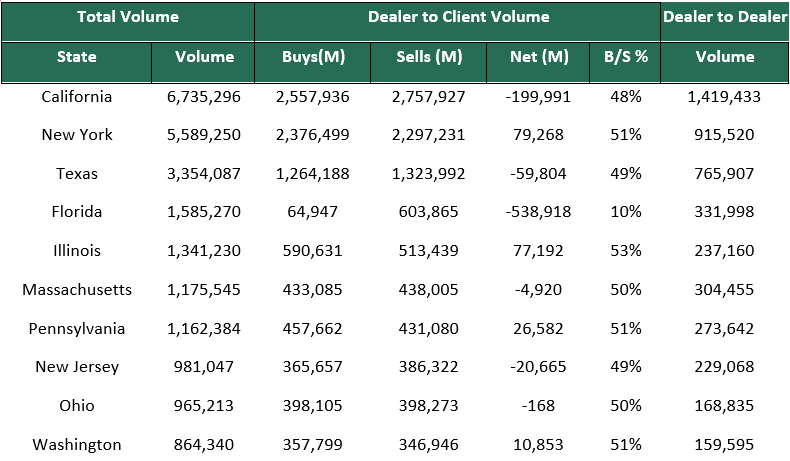

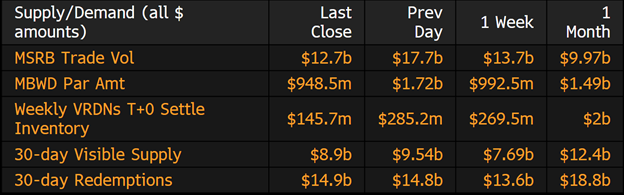

Municipal New Issuance: The holiday shortened week saw a decent sized calendar of just over $4.7 billion for the week with three deals being over $500 million. The largest deal of the week was the $543 million Maryland Economic Development fund. The University of Minnesota issued $500 million in taxable bonds. AmeriVet was in one issue as a Co-Manager for the week which was the $500 million Harvard College taxable issue. Although pricing bonds has been hard this year as rates having been on the rise, Harvard College was able to see robust demand as their bonds were well oversubscribed allowing them to tighten the issue from +105 to +90. Bond issuance has been down roughly 8% from a year earlier as rising rates are leaving States and Local governments less willing to borrow. Municipal Secondary Trading: With a holiday shortened week, secondary trading was just $36.7 billion for the week, with half of all trades coming were clients buying. Although we only had four days of trading, we did high volume of trading due to a small new issue calendar as well as the continued volatility in the markets. We continue to see elevated levels of bids-wanted this year as investors continue to pull money from mutual funds. According to Bloomberg last week we saw over $8 billion in customer bids-wanted with $2.1 billion just on Tuesday alone as selling pressure continues to mount among state and local debt markets. |

|

|

Municipal Spread: Municipals continue to struggle as we saw yields rise across curve with yields on the 10-year notes rising by 10.4 basis points to 2.48%. Even though we saw rates rise last week, Municipals did outperform slightly compared to Treasuries as 10-year ratios is now yielding 87.7% compared to 89.36% the prior week. We did see the Municipal Bond curve steepen by just 1 basis points for the week to 83 basis points. Although it was a holiday shortened week, we continued to see volatility as well as rising rates in the markets as traders continue to be concerned with rising inflation as we saw inflation hit its highest in 40 years. Municipal Bonds have lost an average 7.51% so far this year as inflation woes continue. |

|

|

Investors continue to pull money out of Municipal-Bond mutual funds as investors pulled $4.1 billion from those funds last week, the fourth largest weekly outflow on record according to Refinitiv Lipper US Fund Flows data. This was the ninth straight week of outflows which consisted of eight weeks of $1 billion of outflows. Mutual funds should continue to see outflows until at least the next Fed’s meeting in May where it Is expected that they will hike by 50-basis-points. Inflation has been a big concern for investors. |

|

Municipal Bond issuance has been down considerably this year with issuance being down roughly by 8% from this time last year, but the one area that area that is significantly down is taxable issuance. Taxable issuance was popular the past two years, but with rising rates taxable debt sales has dropped 39% this year. Taxable Municipals sales surged in 2020 and the first half of 2021 totaled to almost a third of the primary market but has slowed to just 17% of this year’s issuance. Taxable debt sales have only totaled to just around $19.5 billion, a far cry from what we saw this time back in 2021, as the appeal of taxable municipals sales has all but dwindled with rising rates. Taxable refunding issuance is also significantly down this year as well with taxable refunding issuance down by 57%. This comes to no surprise as the Fed has begun to raise rates to combat inflation which has had some adverse effects. Taxable bond returns have also suffered greatly this year as they are down 12.21% year-to-date. |

|

|

Municipal Supply: As we return from the easter holiday shortened week the negotiated calendar for the third week of April will have an estimated volume of $3.8 billion for the week. We are only expected to see one deal that is over $500 million, which will be the $854 million Iowa Finance Authority for the Iowa Fertilizer Company Project. The next largest deal is the $272 million State of Texas General obligation deal consisting of taxable and tax-exempt bonds. The State of New Jersey Higher Education Student Assistance Authority will be issuing $266 million in tax-exempt bonds. |

|