AmeriVet Weekly Muni Snapshot

|

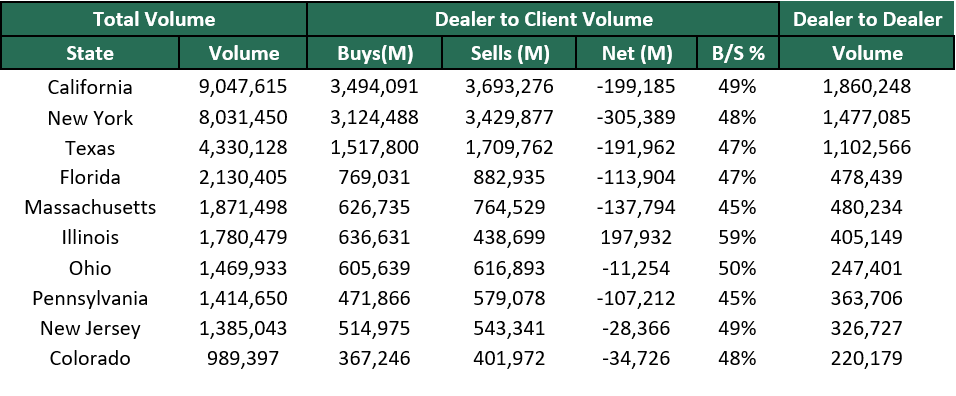

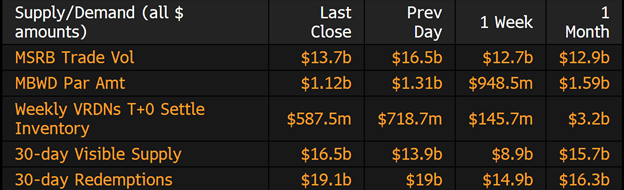

Municipal New Issuance: With the holiday shortened week behind us, the negotiated calendar for the prior week totaled only to just $3.3 billion as many issuers choose to place their issuance on a day to day basis as yields continue to rise and investors continue to hold off on purchasing until yields stabilize. Despite having yields rising, some issuers were able to sell this past week with the largest deal of the week was the $838.7 million Illinois Finance Authority revenue bond issue. AmeriVet was in the second largest deal of the week as a Co-Manager, which was the $207 million Massachusetts Development/Harvard University Green Bond issuance. The Harvard University issue saw large demand as the deal was tightened by 10 basis points even as yields continue to rise. Municipal Secondary Trading: With everyone back from the Easter holiday, the secondary trading volume totals increased from the prior week totaling to over $49 billion making it one of the highest trading volume weeks this year. This abnormal trading volume was mostly due in part to the volatility in the markets as well as the large cuts in MMD in which we saw yields rise by over 19 basis points across the curve. With the big cuts in MMD, we continue to see large amounts of weekly customer bids-wanted with a weekly total of over $8.4 billion for the week with every day having over $1 billion in bids-wanted. |

|

|

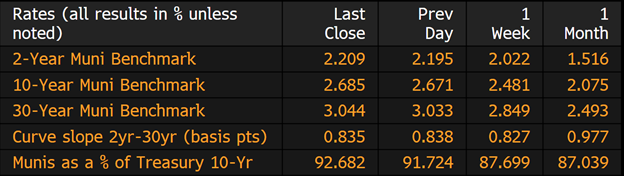

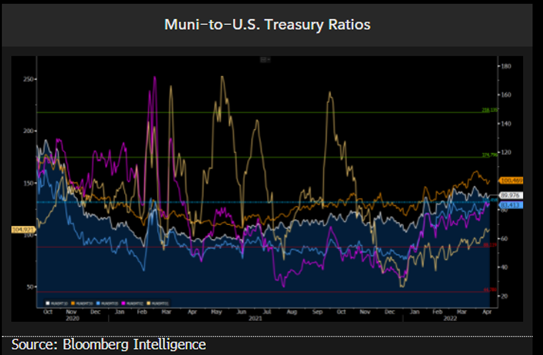

Municipal Spread: Yields once again rose for the week with yields on benchmark 10-year notes rose by 20 basis points to 2.68%. Yields have risen considerably in the past 30 days as yields have risen by 60 basis points in that time alone. With yields jumping by 20 basis points, State and local debt maturing in 10 years is now yielding 92.68% of Treasuries, those ratios were at 87% a week ago. Although, we have seen the yield curve flatten in recent weeks, last week we saw the gap between yields on short-term and long-term notes steepen by 1.1 basis points to 84 basis points. Municipal bonds have lost an average 8.6% year to date with the long end of the curve losing over 12% this year. |

|

|

Outflows continue to plague Municipal Bond mutual funds as investors pulled about $3.5 billion from those funds according to Refinitiv Lipper US Fund Flows data. This follows last weeks loss of $4.1 billion and marks 10 straight weeks of outflows. In the last six weeks those funds have lost over $32 billion and have lost a total of 25.6 billion year-to-date. |

|

Municipal Bonds still have not fared well this year with 10-year AAA rated bonds rising by 159 basis points so far while U.S Treasuries have climbed by 143 basis points. This move has left Municipal Bonds looking relatively cheaper compared to US Treasuries. Despite yields rising as well as ratios climbing to over 92% in bonds maturing in 10-years, many investors still have not jumped back to purchasing Municipals. Long term averages for 10-year Muni-to US Treasuries average around 95%, so we are close to that number, but time will tell if investors jump back into purchasing tax-exempts. With persistent uncertainty still in the markets, we look ahead to the May Fed meeting in which many are predicting a large rate hike many may wait until then to dive back in. |

|

|

Municipal Supply: The negotiated calendar will have an expected volume of roughly $8.6 billion for the week, with almost half of the offerings coming from just two issues. The largest deal of the week will be the $3 billion Regents of the University of California Medical Center which will have both taxable and tax-exempt bonds. The Michigan Finance Authority Hospital Revenue Re-funding bonds will be issuing $1.2 billion. The City of Austin Texas will be issuing $417 million for their airport system. |

|