AmeriVet Weekly Muni Snapshot

|

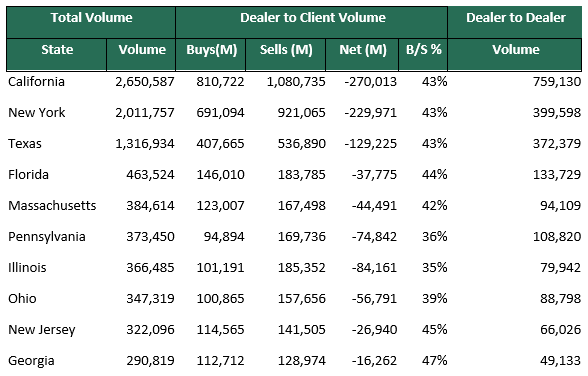

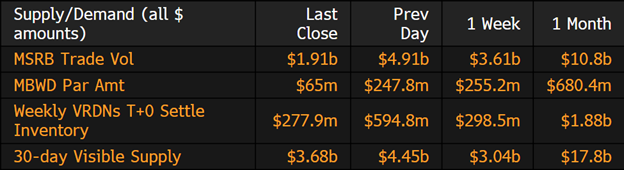

Municipal New Issuance: The negotiated calendar for the final week of 2021 saw very small volume with just $293 million in issuance. The largest deal of the week was the $150 million UIPA Crossroads Public Infrastructure Tax District Revenue bonds. Municipal Secondary Trading: The final trading week of the year saw just $13.4 billion in secondary trading with 58% of all trades being clients buying. It comes to no surprise that we saw very little trading as many decided to take the last few days of the year off. As with trading being light, clients put up very little up for the bid as we only saw $1.37 billion posted up for the bid. |

|

|

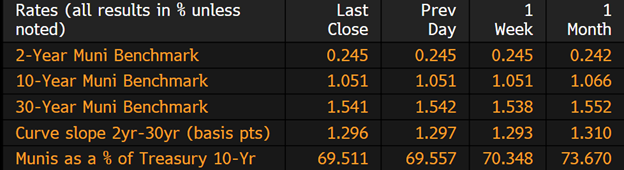

Municipal Spread: The last week of 2021 saw municipal yields remain unchanged as yields on the 10-year stayed flat at 1.05%. One month ago, yields were at 1.06%. Even as yields remained unchanged for the week, they still were able to outperform Treasuries as debt maturing in 10 years is now yielding 69.51% of Treasuries, those same bonds a week ago were yielding 70.34% and one month ago those ratios were at 73.67%. With yields remaining unchanged the spread between short-term notes and long-term notes remained at 129 basis points. |

|

|

According to Refinitiv Lipper US Fund Flows data investors added about $1.2 billion to municipal bond mutual funds which marks the 43rd straight weeks of gains and the 51st week of gains for 2021 with the only of outflows was back in March. This follows last week’s inflow of $1.1 billion. For the year, municipal bond mutual funds have added a total of $86.6 billion. Municipal bonds for the year have returned an average of 1.52% with the biggest gains being in bonds maturing in 22 years or more which returned an average of 3.18% while shorter bonds returned just 0.32% overall for 2021. High yield bonds have had the best returns with high yield bonds returning 7.76% for the year while the investment grade bonds returned just 0.49% for the year. With yields at historic lows in 2021 many investors have moved further down the credit curve which allowed higher yielding bonds have the best returns for 2021. |

|

|

Municipal Supply: To start of 2022 the negotiated calendar will have an expected volume of just $1.7 billion with three deals totaling to over half of the volume. The largest deal of the week will be the $583 million Elizabeth River Crossings OpCo LLC through the Virginia Small Business Finance Agency. Los Angeles Department of Airport will be planning of issuing $503 million in AMT and Non-AMT revenue bonds for private activity and Governmental purpose bonds. Jersey City Redevelopment Agency will offer $123.7m for the Bayfront Redevelopment Project. |

|