AmeriVet Weekly Muni Snapshot

|

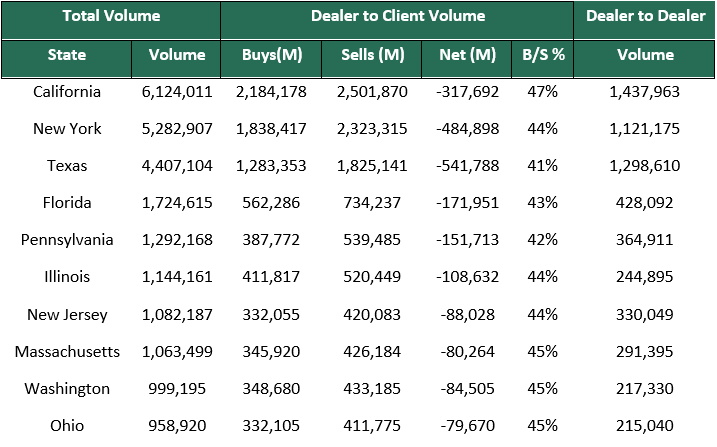

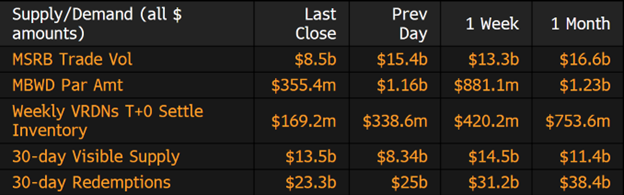

Municipal New Issuance: The negotiated calendar totaled to just over $8 billion for the week, this was one largest supply we have seen in months. The largest deal of the week which AmeriVet was part of the Selling Group, was the $950 million NYC Transitional Finance Authority which saw good demand for their bonds. The second largest deal of the week was the $931 million California Community Choice Finance Authority Clean Energy Project. One deal that gained a lot of attention, but not for high demand, was the $500 million Alabama Correctional Institution which slashed $200 million. Some muni-bond managers chose not to participate in the deal as it would be funding prisons as well as the yields were not high enough. Municipal Secondary Trading: With the early close on Friday, secondary trading only totaled to around $37.4 billion for the week with the bulk of the trading happening on Wednesday and Thursday. With the rally we had last week, we saw about 57% of all secondary trading being clients purchasing bonds from dealers. According to Bloomberg, client’s bids-wanted totaled to about $5.43 billion for the week with four of the days having over a billion listed up for the bid. |

|

|

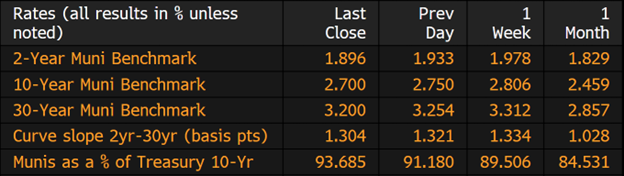

Municipal Spread: For the second straight week in a row, we have seen yields fall, which is a welcome sigh of relief as we have seen yields as low as 0.67% back in February to as high as 2.97% back in April on 10-year notes. Yields on 10-year notes fell by 10 basis points for the past week to 2.70% and have fallen about 20 basis points in the last two weeks. Although we’ve had two weeks of rallies, we still need to be cautious in the next few weeks as we have the July Fed meeting as well as the end of the bond-buying program in which we could see yields rise slightly this month. Even though we had a rally, muni bonds underperformed compared to Treasuries as 10-year notes are now yielding 93.68% of Treasuries compared to 89.50% a week ago while the 10-year ratios were at 84.53% a month ago. We also saw the muni curve flatten slightly for the week as the gap between yields on short-term and long-term bonds flatten by 3 basis points to 130 basis points. |

|

|

Muni-bond funds continue to see investors pull cash out of muni-bond mutual funds. According to Refinitiv Lipper US Fund Flows data, investors pulled about $1.3 billion last week, marking the fourth straight week of outflows and 19th out of the past 20 weeks of outflows. Investors have pulled a record $88 billion for muni funds this year as investors continue to have concerns with inflation as well as aggressiveness of the Fed to combat inflation by raising rates. |

|

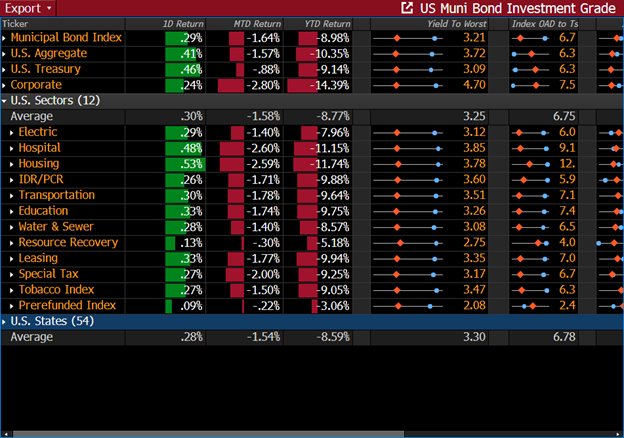

With the 1st half of the year over, municipal bonds continued to struggle losing about 3% for second quarter and about 9% year-to-date. Taxable muni bonds have suffered the most this year losing about 13.97% this year. Not too far behind are high-yield munis which have lost 11.77% for the year. Short-term bonds have actually fared the best this year as they are flat for the year. The muni market has posted a record loss for the first half of the year, with yields on 10-year and 30-year bonds rising by about 170 basis points this year. As we shift our focus from high inflation to a possible recession, we could see investors jump back into the fixed income markets as recessions tend to be favorable the fixed income markets which will limit some of the losses we’ve had in the first half of the year. |

|

|

|

Municipal Supply: With the July 4th holiday on Monday, the municipal bond negotiated calendar will be very light with an expected size of $2.5 billion for the week with two deals covering over half of the issuance. The largest deals of the week will be the $1.5 billion Denver Colorado Airport Systems Revenue bonds followed by the $700 million Triborough Bridge and Tunnel revenue bonds which AmeriVet will serve as a Co-Manager on. |

|