AmeriVet Weekly Muni Snapshot

|

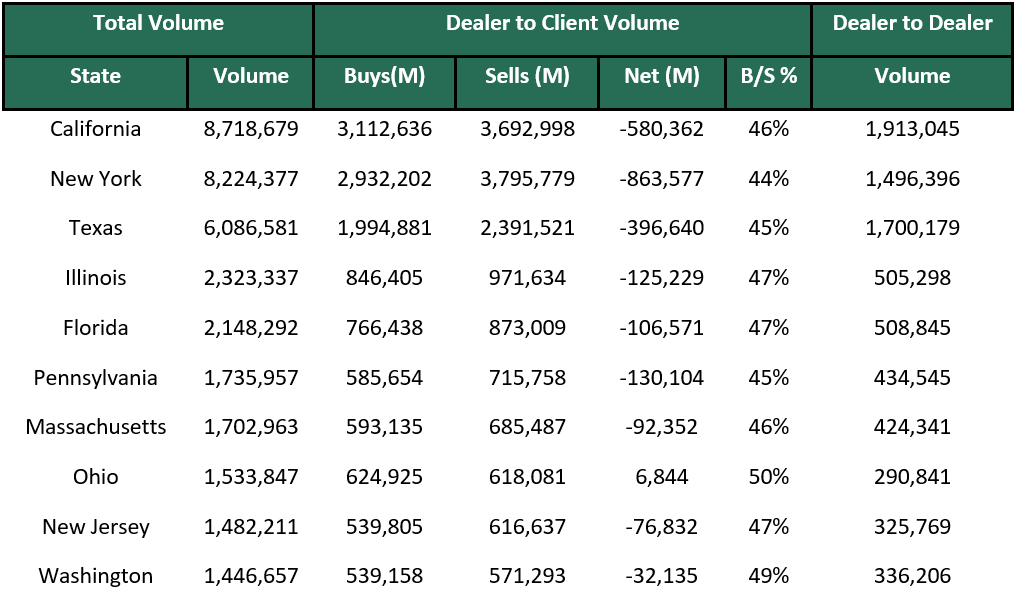

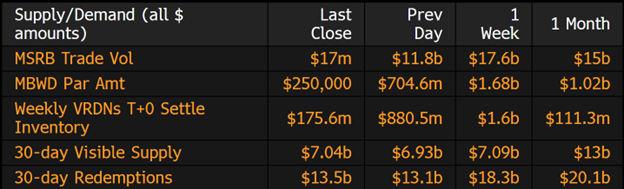

Municipal New Issuance: Last week’s negotiated calendar totaled to roughly $4.3 billion with the largest deal being the $950 New York City General Obligation issue which AmeriVet participated as a Selling-Group-Member. NYC GO also issued $400 million in taxable bonds. The second largest deal of the week was the $500 million California Earthquake Authority which issued taxable bonds. AmeriVet was also in one other issue for the week which was the $167 million California Veterans General Obligations bonds. The NYC GO tax-exempt issue saw an abundance of demand as the issue was 13 times oversubscribed with about $6 billion in institutional orders. Underwriters had to reduce the yields by over 15 basis points from the initial pricing to the final pricing due to the high demand. Municipal Secondary Trading: Secondary trading for the week continues to remain high with secondary trading totaling to roughly $54.3 billion with 54% of the trades being dealers selling to clients. According to Bloomberg, client’s bids-wanted continues to be at elevated levels with clients putting up about $7.99 billion for the week down from the prior week of $8.77 billion. |

|

|

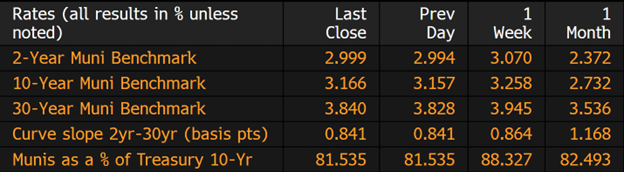

Municipal Spreads: Finally, after a couple of months of rising yields, muni yields fell for the first-time last week since mid-July with 10-year notes falling by 9.2 basis points in the past week to 3.16%. With this rally, munis were able to outperform Treasuries for the week as ratios on 10-year notes are now yielding 81.53% compared to 85.02% from the week prior but still slightly higher than a month earlier of 82.49%. We continue to see the yield curve flatten as the gap between the short-term and long-term munis flattened by 2.3 basis points to 84 basis points. |

|

|

For the 9th straight week, investors pulled funds from municipal bond mutual funds to the sum of $2.1 billion according to Refinitiv Lipper US Fund Flows Data. This follows the prior week outflow of $3.6 billion. We continue to see investors pull investments from mutual funds as growing concerns of a global recession is becoming a reality. ETFs saw inflows this past week to the sum of $1.2 billion, compared to the prior week’s $295 million of outflows. Investment Company Institute has tallied that negative fund-flows has reached over $100 billion for 2022 as investor sentiment continues to be weak due to rising yields. |

|

In the first week of October, municipal bonds had a strong showing as yields fell an average of 5.3 basis points across the yield curve. This is the first weekly drop in yields since the last week of July when 10-year yields had an average yield of 2.32%. With rally in the muni market, munis were able to finally show positive gains. For the week, munis gained an average of 0.83% with the most positive sentiment being in the long end as gains totaled to 1.49% while the short end only showing positive gains of 0.19%. However, this does not mean munis will have a positive return for the month but it is starting to show that muni yields are at their highest in decades. With ratios cheapening, investors are slowly starting to look into jumping back into tax-exempt bonds as well as moving further down the curve. |

|

|

Municipal Supply: With the holiday shortened week, the negotiated calendar will be very light with an expected volume of just $1.2 billion with the bulk of the calendar coming from the $500 million New Jersey Turnpike Authority issuance. The second largest deal of the week will be the $163 million New York State Housing Finance Agency deal which will be issuing sustainability bonds. |

|