AmeriVet Weekly Muni Snapshot

|

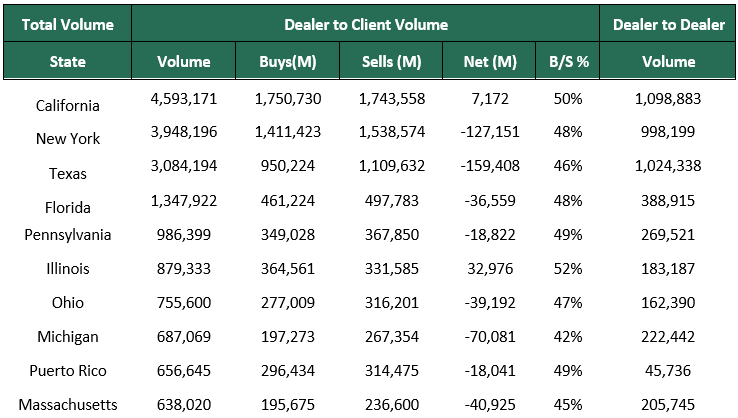

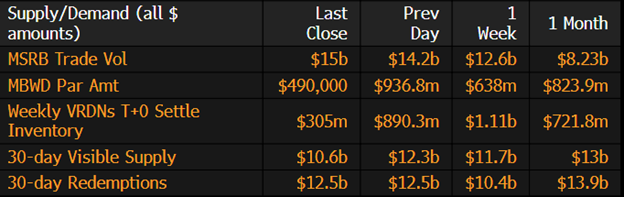

Municipal New Issuance: The negotiated calendar for this past week totaled to just over $5.3 billion for the week as many issuers took a pause from issuing as the we had the Passover holiday and Good Friday this past week. Just one issue took up almost half of the issuance which was the $2.5 billion State of California issue which AmeriVet was in the Selling-Group. The second largest deal of the week was the $974 million San Francisco Public Utility Commission issuance. The State of California issuance was well oversubscribed with majority of the demand being in the front end. Municipal Secondary Trading: Trading for the week totaled to roughly $27.89 billion for the week as many took Friday off for the Good Friday holiday. Client’s bids-wanted was also down for the week. According to Bloomberg, clients put up roughly $3.77 billion up for the bid. |

|

|

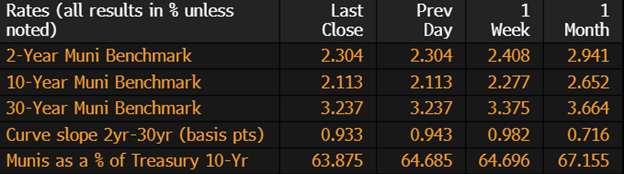

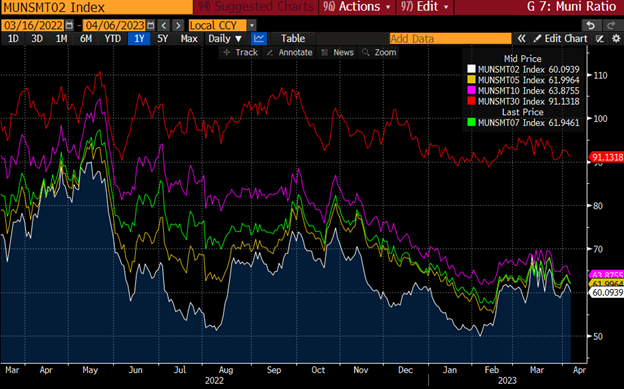

Municipal Spreads: Munis continue to surge this past week as economic data this past week indicated a softer economic outlook causing traders to move to safer investments. Muni bond yields across the curve fell again last week with 10-year notes falling by 16.4 basis points to finish the week at 2.11%. With the rally in munis, we were able to see the 10-year ratio fall once to 63.87% compared to 65.62% from the prior week. The muni curve flattened by 3.4 basis points to 93 basis points last week as traders and investors continue to favor the short end due to recent economic data that continues to revive recession fears. |

|

|

According to Refinitiv Lipper US Fund Flows data, investors pulled about $92 million from muni-bond funds last week which follows the prior week’s outflow of $194 million. Investors have added about $1 billion this year to muni funds. Although we have seen positive inflows this year, the majority of the inflows were in the first month of the year. |

|

After another week of falling yields, we are still continuing to see ratios to be rich, more in particularly in the front end. Ratios in bonds maturing in 10-year and in are averaging about 62%. We are in extremely rich territory for the short end as we are starting to see ratios fall closer to their record lows back in February of this year. Investors should start to look at going further out into the intermediate part of the curve as ratios are somewhat more friendly. |

|

|

Municipal Supply: The negotiated calendar for the week will total to about $4.22 billion with the largest deal being the State Public Works Board of California which plans on selling $467 million. The next largest deal of the week will be that $368 million Idaho Housing and Finance Association issuance. AmeriVet will be in one issue this week which will be the $25 million Maryland Department of Housing and Community Development as a Selling-Group-Member. |

|