Cash is King: Treasury Supply & Repo Investing

A confluence of structural federal budget deficits, a continued increase in US Treasury supply across the yield curve, decreased bank balance sheets and the US Federal Reserve announcing this month their need to expand bank reserves with T-bill purchases: Lends itself to a very opportunistic short and longer term, low risk investment opportunity for long cash investors through Repurchase Agreements (Repo).

A Sharpening Competitive Dynamic

As the Fed expanded its balance sheet coming out of the financial crisis, banks were flooded with excess reserves. Essentially, reserves above and beyond what the Fed normally requires them to hold. Since then, the Fed Funds rate has been managed by a system of what is called ample reserves and controlled by two administrative rates: Interest on Excess Reserves (IOER) and Reverse Repo Transactions (RRP). The goal was to ensure that the Effective Funds Rate to trade within the band the Fed set at each meeting. With a few exceptions over the course of the last few years, the EFF has cooperated with the Fed’s goal of controlling the benchmark rate through IOER and RRP, helping form the foundation of most other money market and short end financing levels.

Repo Financing

A repurchase agreement, or repo, is an agreement between a buyer and seller in which the buyer agrees to buy securities from a seller for cash, selling them back at a specified later date. Repurchase agreements are similar to collateralized loans where the value of the collateral is typically above the cash amount that is borrowed. In most cases repo agreements are over-collateralized. Cash providers in repurchase agreements typically include money market funds, insurance companies, corporations, municipalities, central banks and commercial banks that have excess cash to invest. Conversely, on the other side, dealers and depository institutions rely on borrowing cash against long positions in securities to finance their net inventory and balance sheet positions creating a link between rates in the fed funds market and those in secured short-term money markets.

Treasury Supply & Repo Rates

There is a broad range of assets which may be pledged as collateral in a repo agreement. It is common though, for most of the activity to be in highly liquid and rated securities such as: US Treasuries, government agencies, mortgages and corporates.

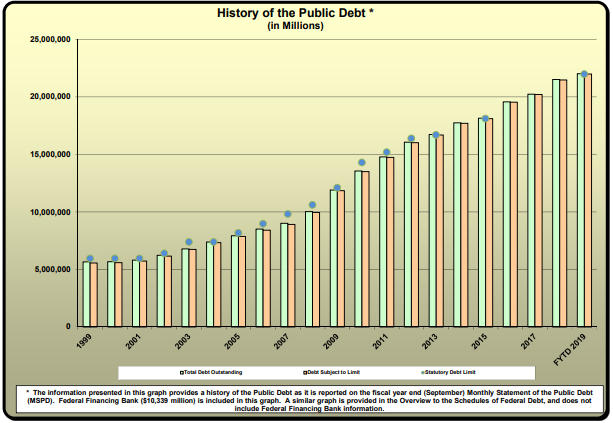

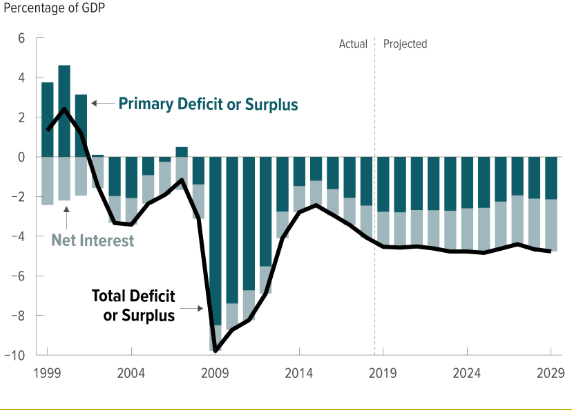

Over the past 10 years, the US Treasury market has grown by over 8 trillion in outstanding debt. This steady increase in supply has been exacerbated even over the past few years, despite the economy growing at the fastest pace in several years; something referred to as procyclical deficits.

This past summer it was announced a deal was reached on the debt ceiling. In conjunction with that the projected deficit will be over a trillion dollars with $300 billion in new spending. And much of the funding for the spending increases is being reflected in short end Treasuries at the very front of the yield curve.

The result of this supply dynamic has created very attractive repo rates for lenders of cash, as dealers that underwrite Treasury debt for the US Treasury Department have seen their inventory levels rise and can offer more attractive rates to lend their inventory and borrow cash.

For context, this year we have seen interest rates decline significantly because of various factors including a shift in Federal Reserve policy, a slowing global economy and negative global yields.

The increase in outstanding Treasury debt versus the Effective Funds Rate

This dynamic has created in some cases what is referred to an inverted yield curve, whereas very short T-bill rates trade at higher yields than US Treasuries for longer maturities. So, investors are being compensated most for participating in the very shortest rates.

The supply demand factors of US Treasuries have thus created an environment where higher, and very attractive rates are being offered to lenders of cash like corporates and money market funds in the overnight market.

The Move from LIBOR to SOFR & Why Higher Repo Rates Matter

In mid-2017, the Alternative Reference Rates Committee (ARRC) endorsed SOFR (The Secured Overnight Financing Rate), as the preferred rate to replace Libor. SOFR is now being published daily by the Federal Reserve Bank.

SOFR is a broad and directly observable measure of the cost to borrow cash overnight and collateralized by Treasury securities through repurchase agreements. The general collateral repo (GC) repo market is what keeps the US government securities market functioning daily.

In choosing SOFR as the preferred choice to replace Libor, the regulators were seeking an index that was fully transaction based, include a robust underlying market covering broader segments of the repo market (Tri-party + cleared FICC bilateral repo) and a rate that correlates with other money market indexes (EFF, Overnight Bank Funding Rate, IOER and Tri-Party GC).

The basis swap spread between US LIBOR & SOFR Rates

Libor currently references some $200 trillion worth of financial contracts across Derivatives, Loans, Securities, Mortgages and Business and Consumer Loans. Given the sheer nature, size and complexity of the market in conjunction with an impending 2021 phase out target date, the repo market will continue to grow in size and significance over the next few years as Libor gets replaced.

What Happened Recently with Repo?

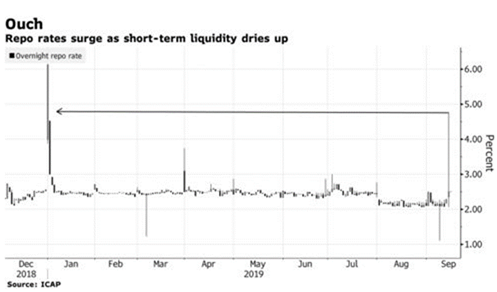

In the middle of September, the Repo market experienced a sharp and unexpected spike in short term financing rates. Although some of the events which caused the short term cash squeeze were known (settlement of recent long end Treasury supply, corporate tax needs impacting money market funds and short-end Treasury supply counter to historical seasonal activity), the addition of the unexpected Saudi attack and the likely short-term need for additional USD drove an extended need for cash within the US banking system.

Although the confluence of events was unfortunate, the recent spike in Repo rates exploited several aspects of monetary, regulatory and fiscal policy, highlighting the need for change on the part of the current Fed framework to address the changing landscape and variables impacting an otherwise normal and safely functioning market. Many of these issues have been known and the direct result of policies adopted over the past 10 years either directly from the US government or Federal Reserve.

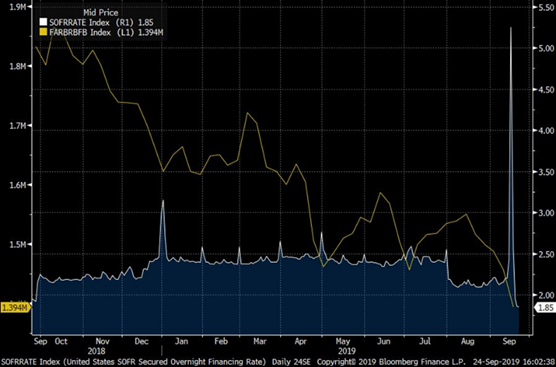

Perhaps even more importantly, with the Fed now publishing SOFR on a regular basis, and several firms involved in the issuance of SOFR-linked debt, the recent spike in Repo rates did not go unnoticed by the current Libor end-user. Since the underpinnings of the SOFR setting lies within the broader Repo market, short term spikes in the secured US funding markets have a direct impact on SOFR levels.

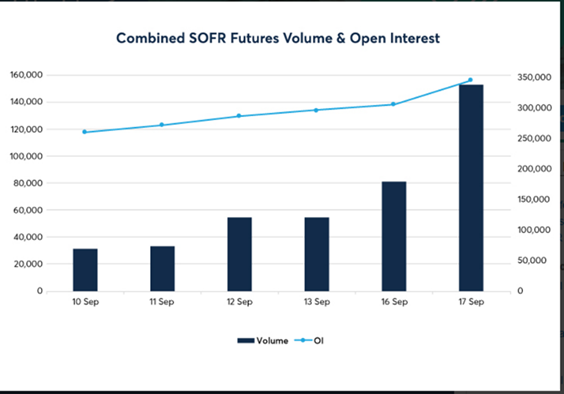

The chart below highlights the increase in trading volumes for SOFR off the back of the recent Repo distortions.

Chart below shows the recent spike in SOFR in conjunction with the decline in Excess Bank Reserves.

The Fed Expands Balance Sheet with Purchasing the Short End: T-Bills

On October 11th, and to separate this month’s policy decision on the 30th from the funding issues, the New York Fed announced its ambition to begin a permanent increase in bank reserves through the purchase of T-bills.

Statement Regarding Treasury Bill Purchases & Repurchase Operations from the New York Fed

“In light of recent and expected increases in the Federal Reserve’s non-reserve liabilities, the Federal Open Market Committee (FOMC) directed the Desk, effective October 15, 2019, to purchase Treasury bills at least into the second quarter of next year to maintain over time ample reserve balances at or above the level that prevailed in early September 2019. The Committee also directed the Desk to conduct term and overnight repurchase agreement operations (repos) at least through January of next year to ensure that the supply of reserves remains ample even during periods of sharp increases in non- reserve liabilities, and to mitigate the risk of money market pressures that could adversely affect policy implementation.”

There has been much debate over whether the purchases were like those we saw coming out of the GFC, and the Fed was quick to defend the purchases as “technical”. Certainly, and open to debate in our view is that the purchases are not intended as QE, and thus the reason the Fed is keeping the purchases at the very short end of the curve. Nonetheless, the reserve balances were one of several reasons given for the funding distortions. Many have also pointed to several regulatory burdens put in place on the larger banks over the last 5-10 years which are restricting the use of cash. These explanations all seem to carry merit in our view.

From a yield curve perspective, the Fed is not only lowering the absolute level of funding, they are now conducting short end purchases as well. And when looking at the recent statement from NY Fed President Williams, there appears to be a reluctance to tweak the regulatory calculations. From Williams’ speech a little over a week ago:

“Williams said the central bank’s moves to boost the level of reserves through the increase of its $3.6 trillion portfolio would take into account such “unintended consequences” regardless, and that the capital requirements were “there for a reason”, citing the soundness of the biggest U.S. banks.”

So, the point here, is when looking at Williams’ comments on reserves versus the regulations, should changes not come on the regulatory front, the emphasis on the aggregate reserve levels may very well play a greater role going forward and lend itself to more short end buying over time, not less.

Is There Enough T-Bill Supply? T-Bill Rates Make New Lows and Spreads Widen to Repo

Within the recent discussion on the Fed’s T-bill purchase program, have been questions over the available pool of securities versus the size of the announced program (400-450 Billion through the 2nd Quarter of 2020 to start).

Amongst the largest holders of T-bills are money market accounts, which are now faced with a double edge sword: The Fed is lowering absolute rates and buying the very short end of the Treasury curve simultaneously. Reinvestment risk on steroids.

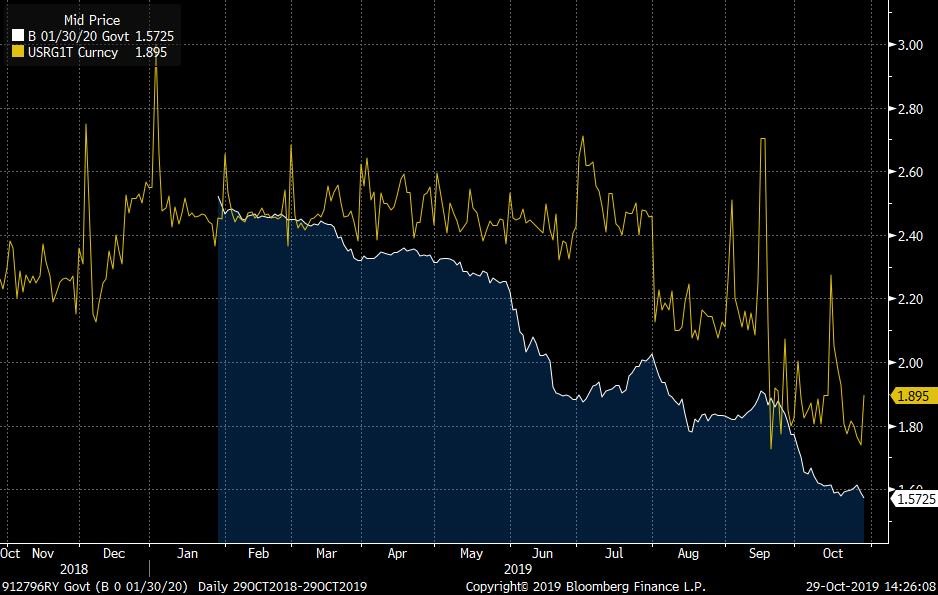

The chart below highlights the growing spread, and a component of the Repo advantage versus T-bill rates, which are now making fresh lows in yield.

Chart on T-bill Rates versus Dollar Overnight General Collateral Repurchase Rates. Overnight Repo in Yellow and T-Bill Rates in White.

In a recent Financial Times article, Deborah Cunningham, chief investment officer of global liquidity markets at Federated Investors, said: “What the Fed will have to pay and who they have to deal with to get the amount of bills they want is not certain at the moment. “They could have to offer some pretty high premiums in order to entice people to sell”.

In other words, money market funds will need to sell their existing T-bill holdings at a premium to adjust for the reinvestment risk of purchasing fresh supply at lower levels as the Fed continues to enact their purchasing plan and the risk of lower absolute funding rates is present with an easing bias.

What is Tri-Party Repo?

Tri-party repo distinguishes itself with the use of a custodian bank, or tri-party agent, acting as an intermediary between two repo counterparties.

The tri-party agent is responsible for the administration of the transaction, including collateral allocation, collateral substitution and marking securities to market.

Eligible collateral profile enables the Repo buyer to define the collateral it wishes to hold against its cash. Things such as asset type, issuer, currency, credit rating, maturity, issue size, etc. are all criteria used in making collateral decisions. Tri-party Repo rates are also being used in the calculation of SOFR making up 40-45% of the transactional based volume in the SOFR calculation. Bilateral Repo comprises the rest.

The Current Dynamics are Here to Stay

The CBO projects the Federal Deficit picture to remain largely the same for the next 10 years anticipating the Federal debt to be roughly 95% of GDP by 2029. This is in conjunction with long term growth rates globally coming down below historical norms.

For the Repo market, the Treasury supply story remains the same as the government battles the structural deficit environment we appear to have entered. More specifically with Repo, and in looking at the collateral options against cash:

General collateral (GC) comprises high quality, liquid assets that are close substitutes to one another—hence, they are lumped together as “general” collateral.

U.S. Treasury bills, notes, and bonds are accepted as GC, as are U.S. Treasury Inflation Protected Securities (TIPS), mortgage-backed securities, and other securities issued by government-sponsored enterprises.

The bottom line here is, although the Fed is buying T-bills, as per the CBO estimates above the overall pool of collateral will still be growing, lending itself to a continued pickup in yield by investing in Repo.

For investors positioned in T-bills, the risk over time is dwindling supply, wider spreads to other products and a steeper short end curve should the Fed continue easing if the economy slows. Given the stigma of traditional Quantitative Easing, the Fed is likely to keep Treasury purchases at the very short end of the curve.

South Street Holdings & the AmeriVet Partnership

Established in 2001, South Street Securities (SSS) is a New York City based, SEC registered, FINRA-regulated broker dealer that concentrates solely on Repo Cash Investment and Security Financing Services.

SSS is a Tier 1 SSS is member of the Fixed Income Clearing Corp. (FICC) with full Repo netting rights. South Street is the only broker-dealer with a Tier 1 FICC membership that is dedicated to Repo financing and cash investing.

SSS has an investment grade rating by Kroll Bond Rating Agency, a nationally recognized statistical rating organization. The firm manages a matched Repo portfolio with roughly $35 billion in total capacity.

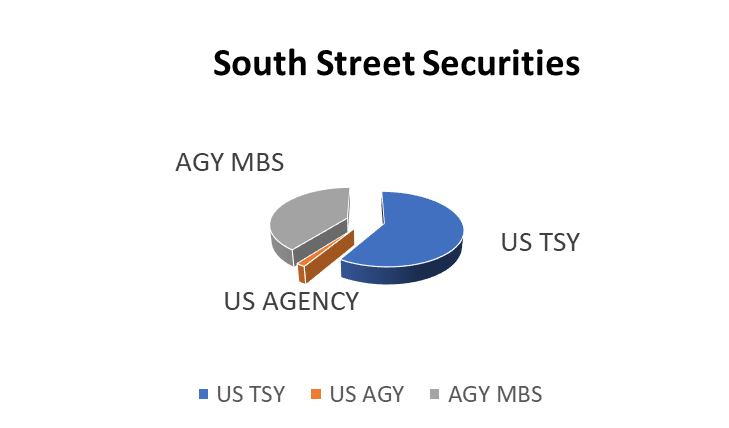

Through its referral agreement with South Street Securities, AmeriVet offers its clients the ability to take advantage of the attractive rate structure of both US Treasury and Agency MBS Repo, with the ability to execute through the experienced trading desk of South Street while simultaneously helping clients fulfill various diversity and inclusion mandates, goals and ambitions.

Fed’s SOMA Holdings versus South Street Securities Repo Portfolio

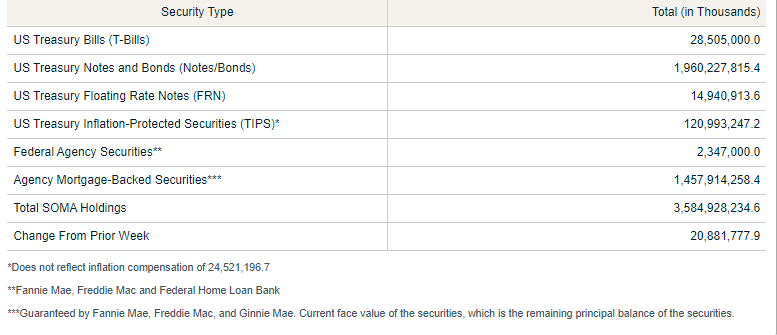

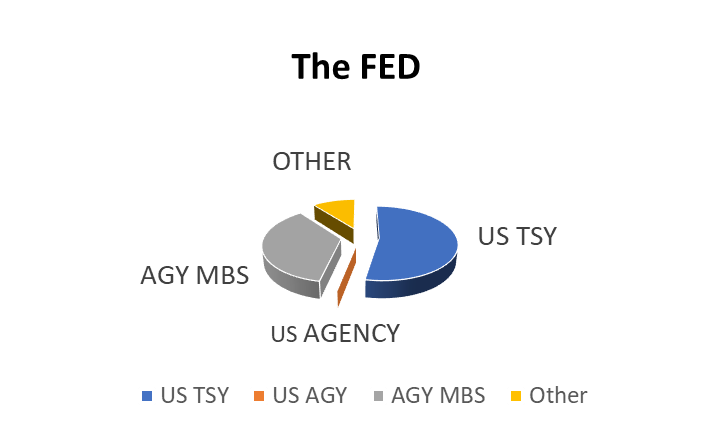

The Federal Reserve System Open Market Account (SOMA) contains dollar-denominated assets acquired through operations in the open market.

The below breakdown is from the NY Fed as of October 23, which demonstrates the Fed’s current holding across very liquid and safe assets including US Treasuries, Fannie Mae, Freddie Mac and Ginnie Mae.

South Street’s Repo Portfolio is Very Safe

The below charts highlight the composition of the Fed’s own portfolio versus that of South Street securities. A side by side view shows the conservative nature of SSS repo portfolio comprised of the safest and most liquid securities offered and backed by the US government.

Summary

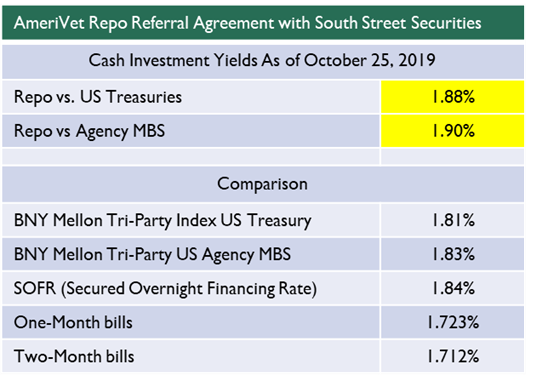

When looking at the longer-term dynamics of our Federal deficits, the continued restrictions on the banking and regulatory side and the Fed’s policy stance on the short end of the yield curve, we believe Repo investing will continue to offer long cash investors attractive rate premiums going forward. Our rates are subject to change daily, but the recent grid below shows the yield pickup of Repo versus other short end cash alternatives.