November 2019

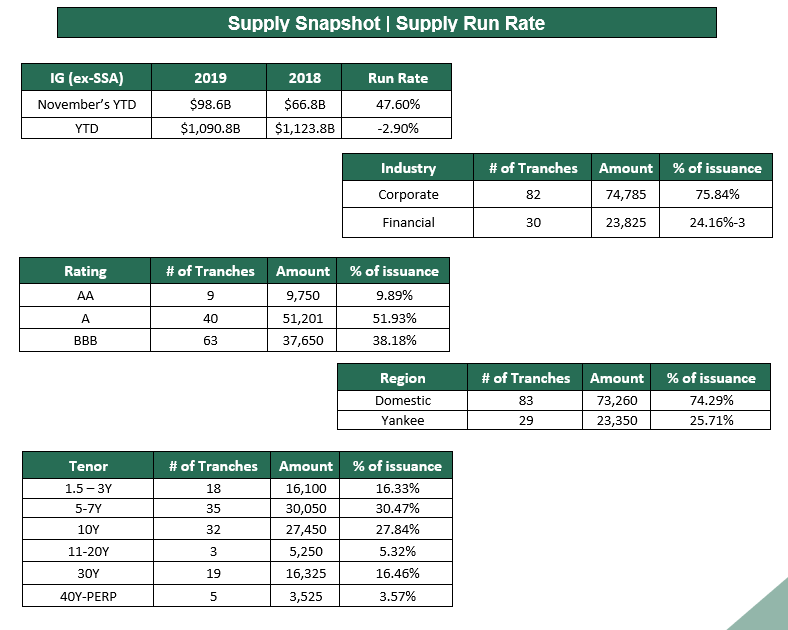

New Issue Investment Grade Credit had a strong November with issuance of nearly $100 billion which has provided much needed paper to a market where investor demand continues to outweigh supply. The U.S. investment grade credit market continues to see strong demand with buyers gravitating to new debt as well as secondary paper. The strong demand for new issues has been very clear when looking at deal book sizes and that has given syndicate desks the ability to provide clients with better pricing due to strong investor demand. Novembers new issues come on the heels of a record September for issuance of $158 billion which was 3rd largest all time and October which closed out the month at $68.6 billion. Novembers $98.6 billion eclipsed last year’s $66.8 billion up 47.6% and took year to date totals to $1.098 trillion trailing last year by just 2.9%.

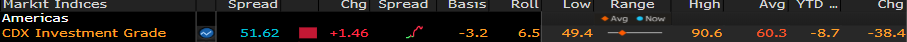

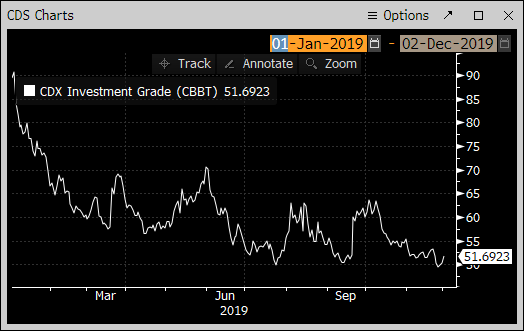

IG Credit spreads for the month of November were 5-20 basis points tighter driven by strong client demand from investors and a wall of cash chasing US credit assets. Investor demand remains robust and strong investment grade fund flows for the week ending 11/29/19 and $4.5 billion after more than $5 billion the previous week which was the 5th largest on record are contributing to a strong credit market. The global negative yield story has buyers flocking to the US markets looking for yield in both sovereign and IG credit debt. Credit indices for the month of November are at the tight ranges of the year further illustrating the move in credit spreads. The CDX Investment Grade Index closed the month at 51.69 just off the month to date & year to date low of 49.4 (11/26/19). The CDX investment grade index began the year 1/1/19 at 90.6 after a 1 year high level of 95.6 on 12/24/18. (see chart below) The Bloomberg Barclays US Agg Avg Oas is closing out the month at 105 just off the year to date and month to date tights of 104 after starting the year at the highs of 1.57 also illustrating the massive grind tighter in US credit year to date. (chart below)

CDX Investment Grade Index

Bloomberg Barclays US Agg Corporate Avg OAS

IG credit flows for the month of November came in at $281.5 billion vs October at $327.1 billion and September at $303.8 billion. Demand for credit in November continued in a big way and Net Client Buying came in at $3.2 billion (October was $3.8 billion & September was $3.3 billion net) . The bulk of net client buying for November was in the 1-3yr part of the curve ($2.3 billion) as well as the 3-7yr part of the curve($1.78 billion) with the Financials sector making up 82% of the bulk of Net buying. (See IG Credit Flow chart below)

|

Total Volume |

Dealer to Client Volume |

||||

|

Sector |

Volume(M) |

Buys(M) |

Sells(M) |

Net(M) |

B/S% |

|

Total |

281,524,170 |

92,012,504 |

95,257,105 |

-3,244,601 |

49.00% |

|

Financials |

100,304,463 |

31,604,846 |

34,268,797 |

-2,663,951 |

48.00% |

|

Technology |

20,512,922 |

6,363,053 |

6,740,664 |

-377,611 |

49.00% |

|

Consumer Discretionary |

18,405,015 |

6,027,734 |

6,294,966 |

-267,232 |

49.00% |

|

Health Care |

34,000,514 |

11,159,249 |

11,390,855 |

-231,606 |

49.00% |

|

Industrials |

16,813,774 |

5,740,476 |

5,920,859 |

-180,383 |

49.00% |

|

Communications |

19,306,648 |

6,059,841 |

6,078,926 |

-19,085 |

50.00% |

|

Energy |

24,910,321 |

8,419,139 |

8,414,773 |

4,366 |

50.00% |

|

Utilities |

15,485,802 |

5,835,396 |

5,706,213 |

129,183 |

51.00% |

|

Materials |

9,171,202 |

3,371,311 |

3,200,904 |

170,407 |

51.00% |

|

Consumer Staples |

22,613,509 |

7,431,459 |

7,240,148 |

191,311 |

51.00% |

Investment Grade Credit ended November with a robust new issue calendar, strong client demand and good volume in secondary paper. Credit Indices continue to trade at or close to Year to date tights and we continue to see demand for US investment Grade paper from clients. December projections for New Issues are calling for $25 billion in new supply and the bulk of the supply should come in the next two weeks before the final FOMC meeting. The U.S. investment grade credit market remains on strong footing as we enter the final month of the year but any issues with the trade deal and talk of tariffs continues to be a setback and will weigh on the market. Credit Indices, Net Client demand numbers and credit spreads will be the first signs to signal something is brewing in the Credit markets.