Fed Preview: Third Time a Charm?

The Federal Reserve will meet this upcoming week with a divided committee, uncertain global backdrop and signs that the US is slowing. Although we expect the Fed to lower rates for a third time this year, the pathway forward for future cuts will be less clear and contingent upon the evolving global economy and the strength of the US consumer heading into 2020.

This has been quite a year for the US Federal Reserve. Just around this time last year, the Fed was on course to continue normalizing rates, with a projected Fed Funds rate around 3%. Even when listening to parting words from European Central Bank President Draghi this week, a humble acceptance that the central banks were on the wrong pathway and in need of a change in course was clear.

THE MID-CYCLE ADJUSTMENT

We remember the markets reaction during the July press conference when Powell first mentioned the mid-cycle adjustment. Within minutes he was very quick to indicate this didn’t necessarily mean one cut and done. For sure it didn’t.

So, What Does Mid-Cycle Price Action Look Like? 10-Year Swap Rates (9/18-9/19)

In the ensuing months, Powell and the committee have chosen to lose those words in future correspondences, yet Chairman Powell himself has often referred back to other time frames (1995/1998), whereas small detours were made within a broader normalization of policy.

In the end, time will tell if this is one of those periods, but the key takeaway for the market right now is a real sense the Fed believes in the broader initiative to continue to normalize rates. In many ways, when listening to the committee members, there is a reluctance and a belief that the US economy and consumer is still in a good place. Sure, there has certainly been a clear acknowledgement of the global slowdown, but the consistent message from the Fed lately is one of “this too shall pass”. Despite choosing to not use the words, the Fed is still very much mid-cycle adjustment in our view.

FED SPEAK SINCE THE SEPTEMBER MEETING

Since the September meeting, the Fed has been very challenged. Clearly, most of these challenges involve the distortions in the Repo market. There has also been a great deal of discussion around the economy and current Fed actions to date.

Heading into the meeting this week, let’s take a look at some of the Fed comments of late:

Powell

- US economy faces risks but overall in a good place

- Our strategy and tools have been and remain effective

- Unemployment near half century low

Clarida

- The economy is a good place. One meeting at a time.

- “I am very glad we lowered rates at the last few meeting. That puts us where we need to be”.

- Fed will evaluate whether it has enough cash reserves on its balance sheet.

- “Certainly” ‘discuss’Standing Repo Facility.

Williams

- We’ve got monetary policy in the right place.

- Inflation a little low but close.

Evans

- Fed is in “risk management”

- “Recent weakness hasn’t yet convinced me to cut rates again”.

- Open minded about the next decision.

The committee in general is still divided. And the Fed has played things very close to home with regards to next week’s meeting. The term that continues to surface now is that monetary policy is on “no preset course”. And we believe this to be fundamentally where the Fed is at.

It is important in the context of this week’s meeting to look back at the transformation year-over year from tightening three more times, and now on the cusp of a third interest rate cut in 2019. It’s dramatic, and within the process has involved the Fed, and Powell in particular, to openly accept the Fed was wrong (July 10th, Congress- ‘we were running too tight’).

In much of the discussion this year, Chairman Powell has referred not only to the recent cuts, but the extreme move in longer end rates now lower by 200-basis points since the Fall of 2018. And how the current easing window should not be viewed in just isolation but in conjunction with other rates coming down in overall support of financial conditions.

WHAT’S CHANGED SINCE THE SEPTEMBER MEETING?

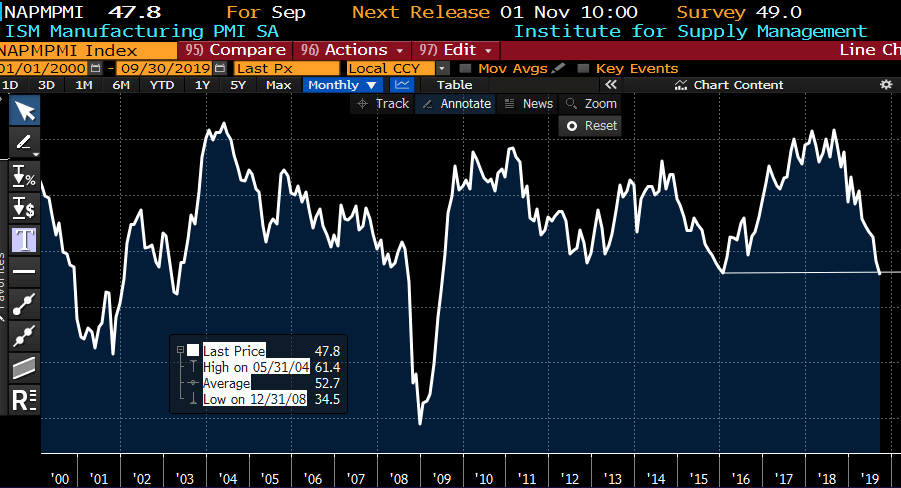

It’s interesting, when you look at where 10-year US rates were coming out of the September meeting, levels are not far from where we are today. In late September, readings on both the manufacturing and non-manufacturing ISM had the market spooked, driving 10-year yields back toward the 1.50% level and skewing the pricing for this month’s meeting toward more liquidity from the Fed and another 25-basis point cut.

We expect the Fed to cut rates again next month. Yet, we are always cross checking our thought process, and after two cuts and one of the biggest central bank shifts in a long time, we have expressed a view that the bar is getting higher for future cuts. In many ways ironic as signs of weakness in the global economy hit the shores of the US last month, and begin to show legitimate concern in forward corporate earning’s guidance heading into 2020.

In the end, though, we ask the simple question: what’s changed since the last meeting?

The data abroad is still very weak. And coming out of the last press conference, Chairman Powell said explicitly, the Fed will be watching the data closely. And data includes global. This week outgoing ECB President Draghi himself indicated he felt the manufacturing weakness was spilling over the the services sector. In the US, the data has been mixed but showing clear signs and validating the Fed’s spirit that the US is not operating an economy in isolation.

The Fed is still in risk management mode. And when you’re in risk management mode, the prudent thing to do is to act proactively. Granted, the Fed has been anything but that. We do feel the recent issues around the Repo distortions served as a wake-up call with the risk of reactive versus proactive posture exploited. Although not perfect, the committee is showing signs of recognition on some of the important issues at hand.

IS THE FED ACTUALLY BEHIND THE CURVE?

Although the Fed has transformed over this past year, the mere fact they were so off course last year doesn’t lead to a warm and fuzzy feeling they finally have it right. In other words, what if this is a full, not mid-cycle adjustment. Certainly, when looking around the globe at the dramatic and real amount of liquidity being pushed out, The Fed is likely to tested in our view.

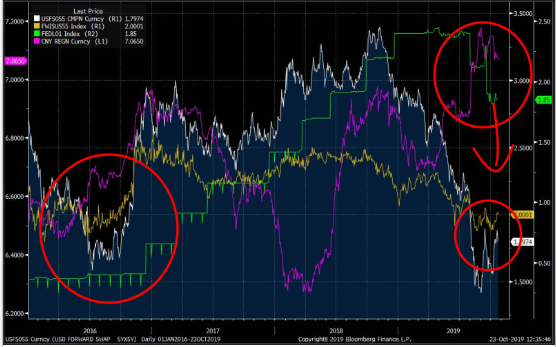

The forces at play: Chinese Yuan, Effective Fed Funds Rate, 5-year forward, 5-year Outright Swap Rates and Inflation Break-evens:

China:

When looking at this chart it tells us a lot. The forces at play in this most recent window of time takes us back to 2016. And within that context we look at the liquidity coming out of China ‘then’, and a Fed Funds rate that was well below ‘today’.

Currencies trade off of a variety of factors, but when many of the major economies have funding levels negative, or at close to zero, it’s relative. China continues to add liquidity to their system while engaging a higher level game around trade as the Fed embarks on a very slow, reluctant approach.

Inflation (From February 2, 2019)

On February 2nd of this year, we penned a piece here on LinkedIn: “Keep a Close Eye on Inflation” . Our excerpt on inflation below:

Our Comments From 2/2/2019 on Inflation:

“By far the most important takeaway, in my opinion, from the press conference are Powell’s comments on inflation. The Fed has a duel mandate and we know that. In a world whereas one end of that mandate appears sound, the Fed is pointing to the inflation numbers for a focal point regarding future policy moves. Inflation expectations, oil prices and even today’s ISM price index clearly points to a disinflationary pocket.

“On a global basis we have been dealing with dis-inflationary forces for many years. Regarding the most recent bout of disinflation, Powell was VERY clear. The Fed’s mandate is symmetric. And when pressed about whether the next move in rates was up or down his answer equally clear: that will depend entirely on the data.

“Without question, although the baseline case for the Fed is constructive for the economy, if the dis-inflationary forces being felt by the market at the moment are real, and more importantly sustained, a shift toward looser policy is plausible. And the key word Powell references regarding financial condition changes is sustainable”

Inflation expectations are still numb. And we reference our piece above from earlier in 2019 to highlight the Fed’s current discussion now on inflation shortfalls, importance of the anchoring of inflation expectations and potential changes to the Fed’s framework (the Fed Listens) heading into 2020.

It was a large part of the discussion around the ‘Fed Pivot’ and remains equally so now as actions have turned to easing. And although no decisions around policy changes have been made, the discussion around a need to change thought on the Phillip’s curve and the inflation trade-off has been a real part of the Fed dialogue this year.

Funds Rate

The Fed Funds rate is still too high. As we shared in our piece from February, looser policy beyond the Pivot has been on our mind for quite some time. Initially, we felt rates coming down in the range of 50/100-basis points lower was plausible. Yet, the slow methodical of the Fed, if wrong, can have repercussions.

Interestingly, most of the Fed speak along the way has also expressed the need to move faster, no slower. It hasn’t happened. And at the same time, the dynamics on global trade, China, the European slowdown and Brexit to this day continue to present hope but no real outcomes to influence better economic activity.

Back in early July, and growing increasingly concerned about the Fed’s reluctant policy stance, we wrote an article titled: “The FF Rate is Becoming an Outlier”.

Below is an excerpt from that piece:

“We believe a big part of the disparity lies in a lack of discussion as to where the FF rate should actually be. A premise that higher or lower, where we sit now is appropriate. Clearly the Fed supports their current rate stance, but many indicators are in disagreement. And in now looking at the global rate landscape, conviction toward any one particular rate seems to be insurmountable and now with an obvious skew lower, globally.”

We remain committed in feeling the US Fed Funds rate is too high. The forces in play on a global basis are extremely powerful. And the notion that a manufacturing slowdown, and in perhaps recession, will be contained is at a minimal shortsighted. The greatest risk right now to the global economy is the US consumer. So one logically asks why the most powerful CB in the world is playing cute with the sentiment and mood of its prized possession. We are not suggesting lower rates is the exclusive answer: far from it. But risk of self-fulfilling behavior grows if more time unfolds without the global dynamics changing.

IS THE THIRD TIME A CHARM?

We don’t think so. Although the market is preparing for a tougher road ahead for future cuts.

The Fed has been completely out of sync. And clearly the political dynamics around Potus, the trade war and the “independence balancing act” has not helped.

We believe the Fed will deliver market expectations next week. And our main theme for 2019 has been Market Expectations versus Fed Intentions. There should be no doubt about the Fed’s intentions here: they are nervous and recognize they may not have all the answers.

Granted it’s a ‘different’ approach and the chorus of criticism is loud: the Fed should stick to its game and mandate. But…

Message: The Fed is changing right before our eyes. Algo’s, AI, new policy metrics etc. This is not the Fed of the past. And how they are looking at the domestic and global input and output parameters is changing too. Perhaps not formally yet, but the times we live in are changing and so is the Fed.

“For now, the global forces which continue to disappoint along with inflation expectations showing no signs of recovering will keep the Fed on its toes.”

We don’t expect the Fed to make promises going forward but we do think they will keep the door open if necessary. The common phrase which comes to mind lately with Fed speak is: “no preset” course of action for central bank policy. The data will dictate from here.

Similar to 2016, we will need non-monetary forces to lead us out. Central banks are doing what needs to be done short-term: holding it together. But the real pathway out of this globally, at least for now, will need to come from progress on the trade front. Obviously clarity around Brexit would be welcomed. Less uncertainty.

The scenario, whereas, the Fed still provides liquidity in conjunction with progress on the global trade front, could very well lead to dynamics of longer end rates normalizing, with inflation expectation moving higher and curve steeper. We are not there yet.

This past week we put together a short White Paper on the yield curve heading into the Fed meeting. The curve has not performed consistent with other periods of Fed easing and we do offer reasons why, along with potential outcomes going forward.

Please find our White Paper on the AmeriVet website, and on my LinkedIn page below:

In closing, the dynamics for the Fed will change beyond this week’s meeting. But it’s too premature to think the Fed will lower rates and have conviction to close the door for more cuts down the road.