Here’s Where the 10-Year Treasury Yield is Headed in 2020 as Brexit and U.S.-China Trade Headwinds Clear Away

Yet Ed Al-Hussainy of Columbia Threadneedle says the widespread belief that bond yields will stay range-bound is a “bunch of garbage,” and that history showed that long-term yields ended up being more volatile than expected, with the benchmark bond yield often seeing shifts in the vicinity of a 100 basis points in each of the last few years.

Al-Hussainy conceded though that it was difficult to imagine a repeat of this year, when the 10-year note yield from peak to trough fell around 1.20 percentage points and briefly threatened to establish a new all-time low, last set in June 2016 at 1.35%.

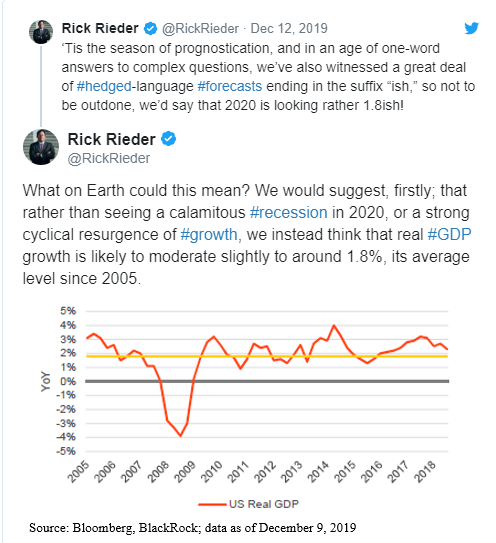

Persistent fears that the U.S. economy would eventually succumb to global growth headwinds and suffer its first recession since 2007-2009 led to a buildup of bullish sentiment in Treasurys and doubts whether stocks could continue to ring in new records.

The sharp slide in yields helped favor both stocks and bonds this year, and the Fed’s three rate cuts helped stimulate financial conditions and keep the economy growing at an even keel. The S&P 500 SPX, 0.17% is up 27.5% year-to-date as a result, albeit after suffering a brutal pullback in December 2018.

Year-to-date, $789 billion has poured into bond mutual funds and exchange-traded funds, as $203 billion left stock-market funds, according to data from the Investment Company Institute.

If investors start to feel more confident in the economy’s resilience again in the new year, funds could flow back into equities and out of bonds.

However, even PineBridge Investments, Michael Kelly, said it was difficult to envision a mauling of the bond bulls, which have been consistently rewarded throughout the last three decades for their willingness to hold debt securities that have offered ever-dwindling yields.

Forecasters have historically drawn out a consistently upward trajectory for economic growth, interest rates and thus Treasury yields, only to find they were wrong time and time again. The three decade long bull run has frustrated speculators as inflation and growth have steadily dwindled.

Read: Phase 1 of U.S.-China trade deal cuts some tariffs, eliminates new ones planned for Sunday

Looking ahead for next week, investors will see U.S. purchasing managers indexes for both the manufacturing and service sectors, industrial production data, existing home sales, and personal consumption expenditure numbers.

See: Economic Calendar

Investors will also see a trickle of earnings reports in the last week before the Christmas holidays, with Fedex FDX, -0.65% , Micron Technology MU, -1.32% , General Mills GIS, +0.25% and Nike NKE, +1.16% all set to report results next week.

By: Sunny Oh