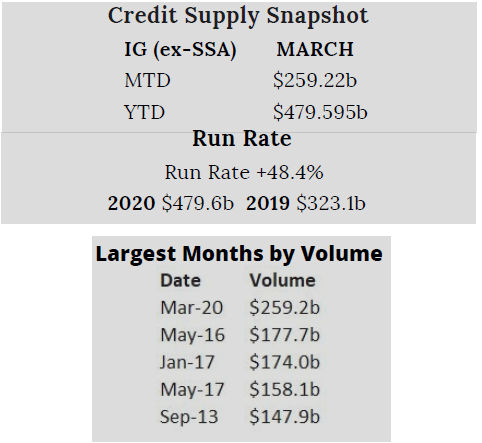

March 2020

In reviewing the month of March, a few things come to mind: the

coronavirus, family, health, liquidity, the new issue calendar and spreads.

The credit markets closed out February under extreme volatility after

rising concerns about the rapidly spreading coronavirus and its effect

on the markets, economy and earnings.

I am not sure we could have predicted what was in store and how it

would unfold over the next four weeks to close out the month. $259.2

billion priced for March; a new record that was well above estimates. We

entered last month with the credit markets frozen, spreads widening

daily, wild swings in credit and equities and the markets in freefall. The

demand for secondary credit that we had seen for the past few months

was gone.

As we closed out the past week, a number of items have changed to help

the overall trajectory of credit; a combination of monetary and fiscal

stimulus has dramatically improved the credit backdrop, opening the

floodgates of new supply that have led to shattered weekly and monthly

records. The monetary and fiscal stimulus was the boost the markets

needed to get credit calm and stable and allow credit to flow freely to

close out the month.

We are by no means out of the woods a long uphill battle remains.

Getting new issues to come to market and having credit trading daily was

vital and the Federal Reserve did their job to make that happen.

IG Credit spreads for March were on a wild ride with massive swings and

volatility we have not seen since the financial crisis. Spreads gapped 75-

125 basis points wider and in some cases more, at one point in the month

(roughly 3/18-3/24) spreads were as much as 200-300 basis points

wider, the height of volatility last month.

Investor demand in March dried up for secondary paper which lead to

massive client selling. The CDX Investment Grade Index closed the month

of March at 127.80 in from the monthly high of 154.30 on 3/20/23. The

CDX investment Grade Index opened last month at 65.1 and last traded as

low as 44 on just 2/13/20 further illustrating the volatility we have seen in

credit for the past 6 weeks (see chart below).

CDX Investment Grade Index

The Bloomberg Barclays U.S. Agg Avg Oas closed out March at 272, the

high was 373 on 3/23/20 after opening the month at 124 further

illustrating the massive swings and volatility seen in credit (see chart

below).

Bloomberg Barclays US Agg Corporate Avg OAS

IG credit flows last month came in at $599 billion vs February at $428 billion vs January at $457 billion vs December at 260.1 billion. Demand for credit in March dried up completely with the markets experiencing extreme volatility and clients selling paper to lower exposure and get more liquid. Net Client selling for March came in at $17.1 billion in very, very stark contrast to December, January and February, which were all net client buying months (February $677 million net buying, January was $3.9 billion net buying & December was $7.3 billion net buying). The bulk of net client selling for March was in the 7 to 12-yr part of the curve ($7.6 billion, 12-yr and longer $5.9 billion, 3 to 7-yr $3.5 billion), with the Financials sector coming in at $10.2 billion and dominating the Net Client selling (see IG

credit flow chart below).

March IG Credit Flows

March IG Credit Maturity Flows

Massive swings in the market were unprecedented and the Federal Reserve’s actions were needed, necessary and warranted. It has helped bring stability to a market that was trading on fear, lack of liquidity and shear panic.

We have stabilized for the moment and that is a positive sign but the ramifications on the long-term effects of the coronavirus are a big unknown. How long, when and what are the market questions. The simple answer is we will get through this together and all be stronger in the end for having lived through the month of March 2020 and beyond.

We begin a new month and hope springs eternal for the month of April, but make no mistake, we are in a health crisis and we do not know when it will end. We need months of stability to weather the storm and the volatility that remains here for the near term, at least. The volatility that had frozen the new issue market has now given way and the fact that credit is flowing again is a very positive sign.

One step at a time and the markets will find their way at some point. We cautioned in February’s Credit Snapshot that Credit Markets would be quick to react to developments from the coronavirus and the treasury market that will affect credit clients buying habits on the curve and could start to hinder investor demand.

The markets have reacted and last month was the only “March Madness” we got to see. Credit Markets saw a 100-300 basis point swings and widening in spreads, historic Treasury yields and massive buying of New Issue supply and what seemed like endless selling of secondary paper. The effects of the coronavirus are going to continue to take time to unfold and these effects will not fully be seen for months or years, as the effects on

the economy and earnings become evident.

I began this March review with a few things that come to mind, but in closing the only thing I think we all really care about are family and health; everything else will take care of itself in due time.

We will all get through this together!

Stay safe and be well.