November 2020

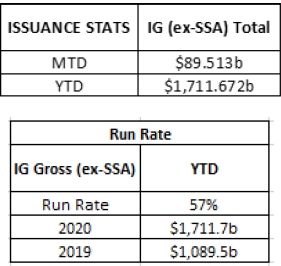

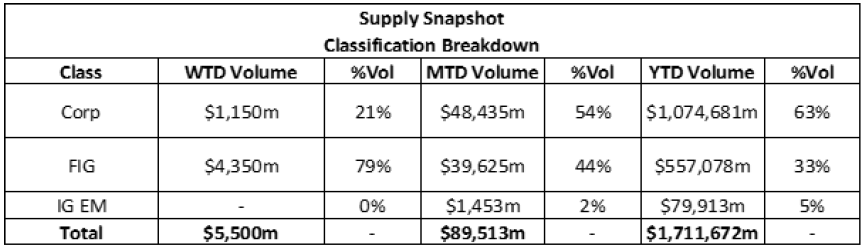

The credit markets in November saw $89.513 billion in new deals while spreads on secondary paper tightened for the month amid continued volatility surrounding the presidential election and positive news on the COVID-19 vaccine front that dominated risk assets. Spreads moved tighter in November and continued the trend seen in October as spreads in credit trade anywhere from 15-75 basis points tighter on the month.

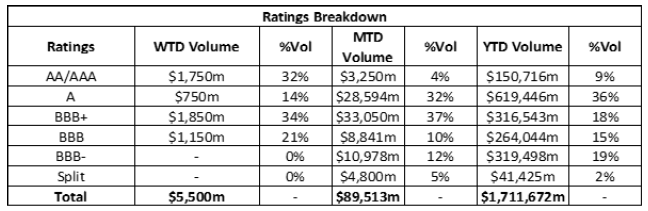

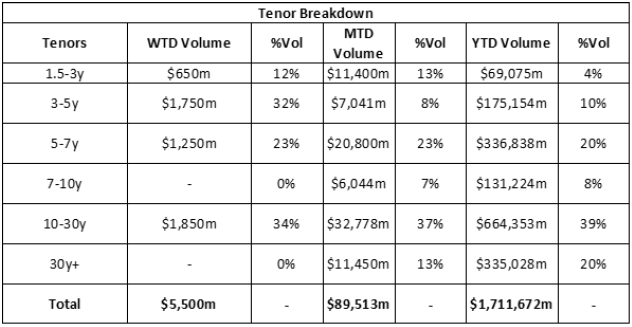

The New Issue calendar topped monthly estimates of $75 billion. Early in the month the market was consumed by the Presidential Election and an economy that has been challenged daily by spikes in the coronavirus but positive news surrounding a vaccine that Pfizer, Moderna and other drug makes will submit plans to the FDA put a charge in risk assets and the markets.

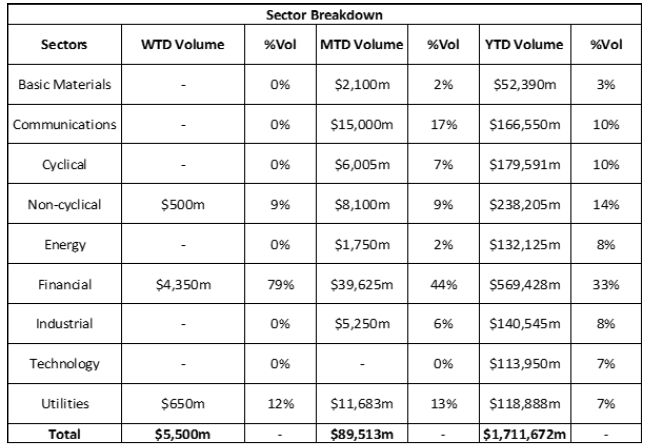

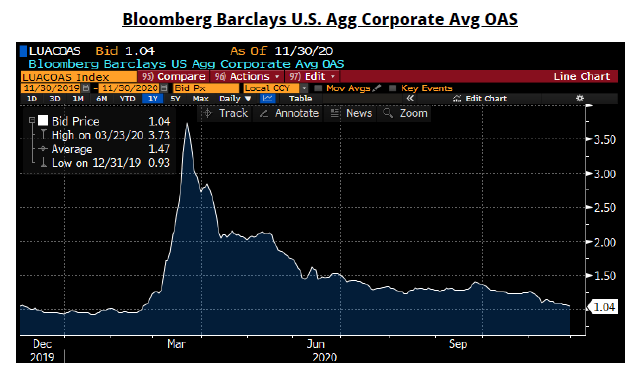

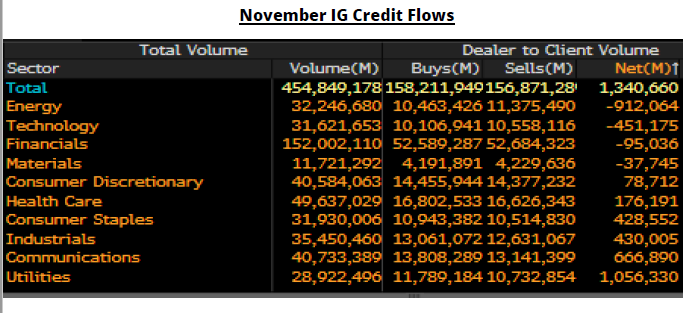

Secondary activity in November saw net client selling of $1.3 billion with Utilities, Communications, Industrials and Consumer Staples leading the pack in client selling. Support from the Fed continues to make a strong impact on the market as monetary and fiscal stimulus programs have solidly helped the credit markets and sustained a backdrop that has given confidence to fixed income investors to continue to buy credit assets. Based on strong market conditions, borrowers continue to capitalize on a historically attractive funding environment and credit spreads are approaching pre-pandemic levels with the IG index closing the month at +104.5, the tightest since February, despite the Treasury’s decision against extending the FOMC’s primary and secondary credit facilities beyond this year. U.S. investment-grade credit spreads are poised to grind tighter from pre-pandemic lows as issuance fades and demand swells.

IG credit spreads for the month of November were 15-75 basis points tighter even as volatility from the election and spiking coronavirus cases remained in the market following positive vaccine news. Despite the volatility that we saw in November, credit performed well and the wide trading ranges we saw in October didn’t exist in November, credit was a steady grind tighter following the vaccine announcements. Credit has been on a crazy ride from the beginning of the year as spreads traded at the year to date tights in mid-Feb then as the coronavirus started to impact the market, spreads pushed out to the wides in mid to late March and then went on a full rip tighter in April that had spreads 50 to 100 basis points tighter. The tightening we saw in May through August had spreads at or approaching pre-COVID levels and in some case tighter. September saw spread widening and net client selling, October spreads were tighter along with November and are now again at or through the tights of the year.

The CDX Investment Grade index opened the month of November at 63.892 and steadily traded tighter for the month and closing out the month at the low 50.965 on 11/30/20 (see Chart Below). The Bloomberg Barclays US Agg Avg OAS closed out the month of November at 1.04 the tights of the month after beginning the month at 1.26 11/2/20 and steadily grinded tighter for the month rapidly approaching the YTD tight of .93 last seen on 1/17/20 (Chart Below).

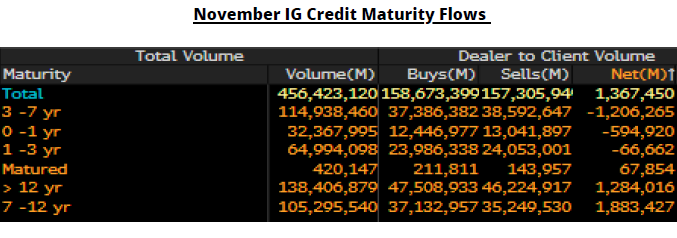

IG credit flows for the month of November came in at $454 billion, just below October’s $495 billion, topping September’s $446 billion versus August’s $411 billion, July at $482 billion, June at $604 billion, May at $598 billion, April at $607 billion, March at $599 billion, February at $428 billion and January at $457 billion. The year to date average monthly volume is $507 billion. November saw strong demand for secondary paper along with a hefty new issue calendar, but November’s spread tightening brought with it $1.3 billion of net client selling, reversing October’s $1.4 billion of net client buying versus net client selling in September of $1.9 billion versus net client buying.

In August of $715 million and $9.303 billion of net client buying in July, June came in at $1.601 billion. The bulk of net client selling in November was in the 7-12-year part of the curve ($1.8 billion), 12-30 year ($1.2 billion), with 3-7 year paper seeing net client buying of just over $1.2 billion, 0-1 year $584 million. Energy led the charge in net client buying with $912 million along with Technology ($451 million), while Utilities ($1 billion), Communications ($666 million), Industrials ($430 million) and Consumer Staples ($428 million) all saw Net client selling. (See IG Credit Flow chart below).

November saw a rebound in the new issue calendar that topped monthly expectations, strong spread tightening and solid secondary trading flows in the midst of uncertainty surrounding the presidential election and spiking coronavirus cases and positive vaccine news. The Federal Reserve’s programs continue to buoy the markets and they have signaled they will keep rates at or close to zero until we get back to unemployment levels close to 3.5%. Spreads moved tighter for the month following a strong move tighter in October. Despite continued spread tightening we saw net client selling of secondary paper in November.

Since March 17, over $1.444 trillion has priced with 2020 supply shattering 2017’s $1.3 trillion record. AmeriVet Securities in November was a Co-Manager on $1.45 billion deal for Pacific Gas & Electric as well as a Co-Manager on $5.75 billion two part deal for JP Morgan, $2.5 billion two part deal for Goldman Sachs, $2 billion deal for Deutsche Bank and a $1.2 billion two part deal for Allstate.

The Allstate transaction solely hired banks owned by minorities, women or veterans for its bond sale, in the biggest corporate deal yet managed only by diverse firms. The Allstate transaction marks the first of substantial size that diverse underwriters are leading without any bulge-bracket banks, according to data compiled by Bloomberg, great job by the AmeriVet team.

As the month of November ends we are anticipating a light new issue calendar for the month of December with $25-30 billion in new supply. December brings positive news for investors, starting with the election as Congress is likely to continue to be split come January which limits the White House and a push for market unfriendly agendas. Positive vaccine news along with spiking COVID cases remain at the forefront of daily conversations and they will likely remain there for the next few months as roll out of the vaccine will take time.