The Fed Has No Choice

Interest rate differentials, in a perfect world, form the basis of currency exchange. This is not a perfect world. The most recent interaction on Friday between the US and China, coupled with Chairman Powell expressing the Fed’s uncertainty regarding their role in the trade war, has elevated the risk of a full-blown currency war. Lower relative funding costs and more US dollars will be needed to counter a continued global response. We started it, and we need to finish it.

And with the President and Fed Chairman Powell growing further apart, the United States is poised to struggle. The Trade War Intensifies. Global Central Bank “interdependence” post-GFC is calling for more local ‘dependence’ between Trump and Powell. More volatility ahead.

China is a Currency Manipulator, Negative Rates and USD Shortage

US rates are high relative to the rest of the world. On the surface it’s a good thing; The US is doing great and the rest of the world just isn’t. Tough for them and great for us.

“Except, it’s not so easy. At some point, rates and funding levels coupled with levels of access matter. We are at that point.

We speak day-to-day about negative yields and their implications. Yet, not all negative yields are created the same. And depending on the funding base of your home country, what’s negative for one could be positive for another. Currency hedging matters as does credit quality.

We spend a great deal of time discussing ‘Fed independence’ these days. And mainly as it relates to our own country: Potus and Powell.

We believe what will be front and center in the coming months will be reality of short-term global central bank interdependence; unintended consequences of a coordinated , yet unavoidable global central bank framework coming out of the GFC.

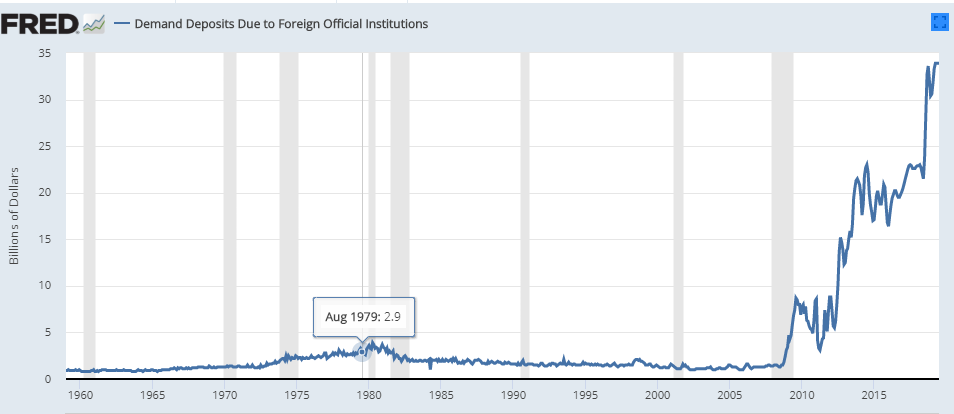

As global central banks continue to fight back from the negative effects of a growing global trade war, the funding rift and rate advantage of owning US dollars is creating the desire for more and more US dollars. Similar to the dynamic we are seeing with global negative yields where ‘buying begets buying’.

When a particular funding rate becomes an outlier in an advantageous way, AND it’s accessible, consequences exist.

The US Fed Funds rate is an outlier. Our piece from early July, 2019 below:

https://www.linkedin.com/pulse/ff-rate-becoming-outlier-gregory-s-faranello-cfa/

On August 18, 2018- I reached out to a very senior banking executive in the United States and said this:

“The wild card, to me at least, is not the monetary policy creating the issues per se, but the fiscal (Trump) side. Should the fiscal issues intensify clearly this will (should) have policy implications. The risk scenario would be a continuation of both the monetary and fiscal side skewing toward extreme $ strength creating dislocations we have not seen in quite some time. Let’s see how this plays out in the Fall”

Extreme US dollar strength is a threat to the global system. We live in a world, despite the the Fed making a Pivot and having 100-basis points of easing priced into the forward USD OIS curve, the dollar continues to strengthen. Two forces at odds, monetary and fiscal, and taking our currency in the same direction.

The exchange rate and US funding markets are sending the leaders of the United States a clear signal:

“There has never been a greater time for the Chairman and the President to have a ‘soft’ alignment. The President and Chairman Powell are talking ‘through’ each other and both missing the bigger picture here”. Ironically, their risk factor is aligned: the US consumer.

The US dollar is in demand. And for real and legitimate reason. The stress in the funding market is clear locally.

The Fed is simply not in a position to sit back and view this scenario with a sanguine approach. Dissenters take note.

At the same time we have an excess collateral issue. As we sift through the carnage of the debt ceiling agreement and continue to run deficits on a ‘pro-cyclical’ basis, dealer balance sheets are mandated locally and still need to contend with global forces.

We opened with the risk factor being central bank interdependence; how, in a perfect world, interest rate differentials dictate proper currency valuation. We are not a perfect world. Let’s take a look:

Vice Chair Clarida from Friday: There’s a “limit to how far US rates can divert from global rates”

From the NY Fed: “Like other factors affecting the level of reserves in the U.S. banking system, an increase in investment in the foreign repo pool results in a corresponding decrease in reserves“

We continue to relate this current period in time to 2016. Below is a WSJ article from back then about the differential in funding levels, access to US dollars globally and the impact on our local market.

Keep in mind, in 2016 we were all closer to the zero-lower bound (ZLB). The period from 2016-2018, we had a window to normalize (raise rates) while the globe watched. And now the biggest tailwind (P) behind that normalization has evolved into the biggest headwind. In the process, our funding rate and currency differential has continued to grow.

https://www.wsj.com/articles/use-of-feds-foreign-repo-program-grows-1456081097

Fed minutes (July)

The Fed at its last meeting discussed the tool-kit. And the ability to not only use the balance sheet going forward, but use it with more force.

Fed- “In particular, a number of participants commented that, as many of the potential costs of the Committee’s asset purchases had failed to materialize, the Federal Reserve might have been able to make use of balance sheet tools even more aggressively over the past decade in providing appropriate levels of accommodation.”

“As a result, the Committee could proceed more confidently and preemptively in using these tools in the future if economic circumstances warranted”

As we progress into the latter half of 2019, the Fed will need to address the global and local dynamics at hand. First and foremost, the absolute level of funding needs to move lower. In conjunction with this, and in response to one of the most extreme global central banks pivots in quite some time, more US dollars will be needed should things intensify from here.

AmeriVet- “Unlike the GFC where CB policy was coordinated with clear purpose, this time around presents interlinkage, yet with competing forces”

The Fed, Jackson Hole and Monetary Policy Collision

When listening to the most recent Fed-speak, we are still in ‘risk management’ mode. The dissenters are consistent, the inflation doves still present (want 50-basis points) and Powell still uncertain as to how global trade impacts policy. He shouldn’t be.

A continued slowdown in the industrial economy warrants action. Just take a look at what’s happening around us. The idea the US will circumvent the global forces is naive, at best.

Let’s take a look at some Jackson Hole comments for context:

Chairman Powell:

“There are, however, no recent precedents to guide any policy response to the current situation. Moreover, while monetary policy is a powerful tool that works to support consumer spending, business investment, and public confidence, it cannot provide a settled rule book for international trade. We can, however, try to look through what may be passing events, focus on how trade developments are affecting the outlook, and adjust policy to promote our objectives”

Vice-Chair Clarida:

US economy is in a good place but uncertainties have increased. Fed will act as appropriate to keep the economy growing. Data has been mixed, but global data is disappointing. Inflation data has been coming in on the soft side. You don’t necessarily want to wait until data turn.

There’s a “Limit to how far US rates can divert from global rates”

We agree with Vice Chair Clarida. Our weekly from July 7th. The FF rate as an outlier:

https://www.linkedin.com/pulse/ff-rate-becoming-outlier-gregory-s-faranello-cfa/

Bullard:

“I think there will be a robust debate about 50, “I think it’s creeping onto the table.”

Negative Rates and Yield Curve

Talk of the town. Yield curve distortion, ‘this time is different’ and the growing pool of negative yielding debt now at over $16 trillion globally.

AmeriVet– The abridged thought is this: the extreme move over the past year in negative global yields is largely about the global trade war. If you look at the pivot in the chart below, from the time the President slapped additional tariffs on China in September of 2018, through the global central bank pivot and subsequent easing, we have never looked back in the growing negative debt. We have traded negative convexity rate pockets and this dynamic behaves very much the same. As the pool of available positive yields dwindles; “buying begets buying” of what’s left. The latest spree in the US in both high quality US Treasuries and Investment Grade credit.

The impact of growing negative rates on the US yield curve is absolutely undeniable. And certainly the latest round of buying on the long end of the US curve not excluded. Keep in mind, this latest move in US rates was a direct reflection of additional tariffs proposed on August 1st and the growing concern regarding the global outlook.

At the same time, the reason for the move in global negative yields is all to do with global trade and the legitimate threat of recession. It would be very short-sighted for the Fed to discount the move in the US yield curve entirely. Flows and liquidity, however, do matter. The next few weeks will be telling before the September meeting.

Summary

The committee is still divided. And global risks are elevating. We understand the division, but the Fed presents to us as way too complacent.

The market is now firmly priced for 25-basis points in September with a 1.50% forward curve for the end of 2019 and closer to 1% by the end of 2020 based on the US OIS curve.

Powell short-term has moved away from a ‘mid-cycle adjustment’ although interjecting the notion that lower rates alone will not resolve trade issue. True, but..

“what’s going on globally (trade) is not a mutually exclusive event fromthe Fed’s mandate”. When the global central bank community is easing with force & you’re speaking about a “mid-cycle adjustment”, you’re in denial.

The consumer still presents at the biggest risk point. Ironically, it most certainly remains the biggest factor for both the President and the Fed Chair. Their interests are aligned despite the fact they sit on different pages.

“The yield curve at its purest is signaling: it’s not the amount of cuts, but the speed”

The Fed is best served moving sooner than later. And with force now. We are not a proponent of using interest policy to solve the structural issues. Quite the opposite.

But when sitting at the card table, hand unknown, you need to react to stay in the game. How you react initially will keep you playing but the strategy will most certainly change along the way.

And yes, global trade wars are not cheap. Our piece below from December, 2018, highlighting the Trump global reset.