The Fed: It’s Not About Another 25

When Chairman Powell stepped to the podium to discuss the most recent Fed decision, he categorized the funding issues as having no implications for the economy or monetary policy. True, this is not a credit issue but the proper funding of the US government market is vital to the economy and very much a part of monetary policy

In a speech from May 4, 2018, “Liquidity Regulation and the Size of the Fed’s Balance Sheet”, Vice Chairman for Supervision Randal K. Quarles offered his closing remarks:

“The final and most general point is simply to underscore the premise with which I began these remarks: Financial regulation and monetary policy are, in important respects, connected. Thus, it will always be important for the Federal Reserve to maintain its integral role in the regulation of the financial system not only for the visibility this provides into the economy, but precisely in order to calibrate the sorts of relationships we have been talking about today”

The Fed continues to conduct short-term operations to navigate the US funding markets through this interim period before the October meeting when we expect them to formally address the recent distortions.

“With the heightened events over the past few weeks in the funding markets, policy decisions and the discussion regarding funding imbalances are no longer mutually exclusive events”. “To date, although the Fed has discussed certain aspects of the short term markets, and with particular attention to the balance sheet, a more proactive stance is necessary“

We look at this current window of time as offering three distinct, yet very related buckets for the Fed:

1) The trigger (confluence of events all requiring cash out. Some events were known, some weren’t)- increase balance sheet buffer.

2) The lack of response (regulatory bias holding back cash)- Powell backed away from this when questioned at the September meeting. Leave regulatory alone, reserves higher.

3) Market structure (concentration of cash)- Structural facility, broader accommodation.

The Fed and the US government is actively involved, and in many cases responsible for all of these issues, and needs to address all three in the coming months in our view. Short-term, liquidity overrides. But to inject liquidity blindly without a broader plan would miss some of the bigger picture here.

As part of the way forward, we do think the Fed needs to increase the balance sheet, but with focus on the very short-end and consistent with their easing stance.

Our coverage by MarketWatch this week:

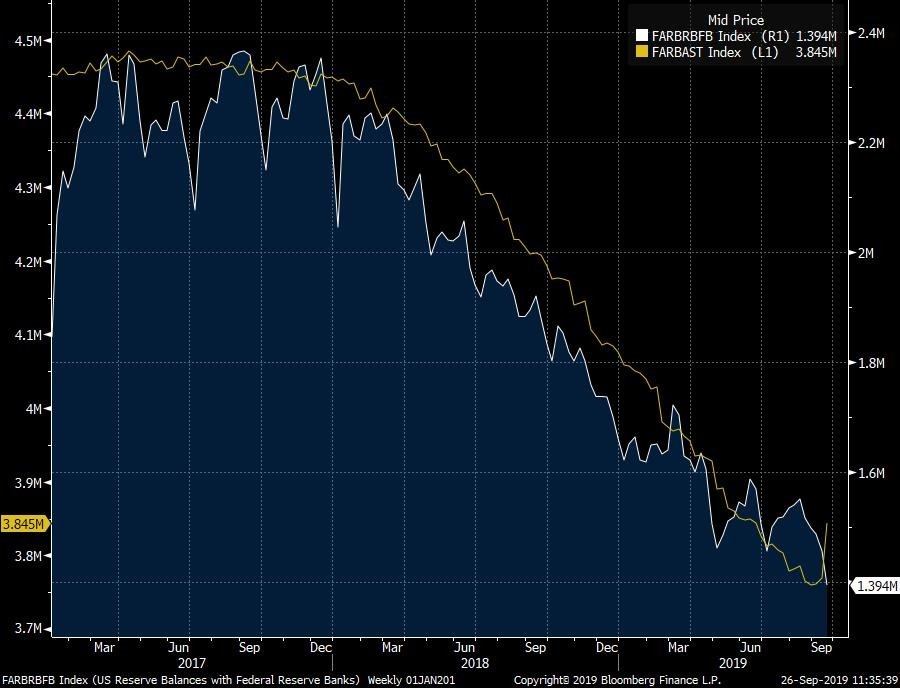

Balance Sheet versus decline in ER

“It’s more important for the Fed to stabilize the short term US funding markets at current levels than provide the market with another 25-basis point cut”- we are not suggesting the Fed won’t cut next month, but the more important issue here is the underlying money markets supporting the funding of the US government“

Not all balance sheet expansion is QE. Nor is balance sheet expansion the be all and end all of the issues at hand: Far from it.

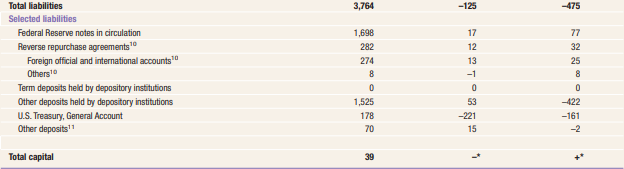

But the Fed will need to start somewhere as the daily operations are not sustainable, yet the structural Standing Repo Facility will take more time for implementation should they choose to include this. Through time, the Fed’s balance sheet has expanded in the past and not always with formal quantitative easing. The non-reserve liability side of the Fed’s balance continued to grow in 2019 including foreign entity accounts and currency in circulation. $’s continue to be in demand and for practical reasons.

Chart below: Fed balance sheet, Excess reserves, SOFR and Currency in Circulation. Through $4 billion in balance sheet and $1.75 in excess reserves, the market began showing signs of stress. The average month-end spike in SOFR for 2018 was roughly 6-basis points. For 2019, that same month-end spike averaged 16-basis points.

We would look for a balance sheet adjustment of at least $250 billion to start. The discussion beyond the balance sheet, though, will need to incorporate regulatory and structural changes.

“The Fed’s mandate, though, is increasing aggregate reserves. ‘Where’ those reserves end up, and why, matters. So should the Fed expand the reserve pool the discussion needs to be broader and more explicit”

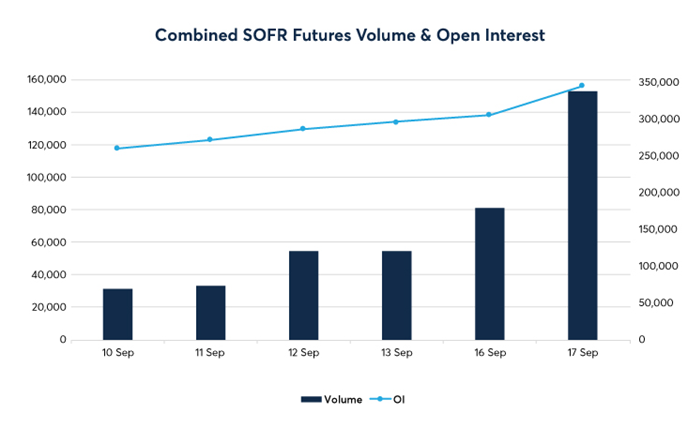

Lastly on the Repo distortions. The Fed is well along on its way for the Libor to SOFR conversion. Converting a $200 trillion dollar market has systemic risk. One of the main reasons SOFR was chosen was because of the transaction based nature of the Repo market (trillion plus a.d.v.) versus dwindling activity in Libor post GFC.

Should SOFR ultimately succeed, the stability of the ‘underlying’ in seemingly normal times is critical. In other words, small month-end spikes will be evened out through the averaging calculation. There is no reason, however, that secured lending of US government debt should be at 10% in seemingly normal conditions. Additionally, on a volume basis alone , the Repo market dwarfs that of Fed Funds. More of a reason for the Fed to pay very close attention to the events of the past two weeks as SOFR is calculated off a Repo composite.

SOFR futures volume increase in September as a function of Repo activity

The Fed Mindset

We’ve been following Vice Chair Clarida very closely over the past year. A brief summary on his comments of late:

1) Range of committee views healthy 2) Meeting to meeting, data dependent (global too) 3) Insurance/risk management 4) Global risks not just US/China 5) Negative yields symptom of slowing growth 6) Repo dislocation expected. Balance sheet composition on calendar for October. Short-term operations for now

Yesterday, Vice Chair Clarida gave a speech. Text of the speech below:

https://www.federalreserve.gov/newsevents/speech/clarida20190926a.htm

Much within the speech was consistent with Clarida’s themes from this year. We reference one paragraph below where Clarida clarifies the Fed’s current inflation stance:

“As a practical matter, our current strategy shares many elements with the policy framework known as “flexible inflation targeting.” However, the Fed’s mandate is much more explicit about the role of employment than that of most flexible inflation-targeting central banks, and our statement reflects this by stating that when the two sides of the mandate are in conflict, neither one takes precedence over the other”

It’s no secret several Fed officials favor a more aggressive Fed stance solely off the back of inflation shortfalls. The Fed leaned on this to justify the Pivot and clearly, it’s incorporated in many of the discussions related to the current risk management endeavor. Clarida’s favorite metric for inflation is the 5-year forward, 5-year break-even: lately declining again and back down toward 2016 levels.

The Fed still has room on the inflation side, although likely not much if the data holds up next month. Core PCE released today is running around 1.8%. So, still missing the Fed’s target but not by much and trending slightly higher.

In general, the data still presents consistent with the theme of late: manufacturing weak and consumer still holding up. Keep in mind, data now means global data short-term. So, focus still on data abroad and the outcome of the trade discussions in the coming weeks for Fed pricing.

Conversely, article this week from Chicago Fed President Evans. Evans has been on the dovish side, while expressing views this week the Fed is in a good place after two cuts this year. Open to more, yet sounding very much like he’s done for 2019.

Current pricing of a 50% chance of another 25-basis point cut in October seems rational all things considered. The next few weeks will offer more as we get closer to the meeting.

US Rates

With the short-term distortions in the US funding market less, the long end of the US curve is looking for a new catalyst. Given the most recent price action (August-September), we are viewing the broader range in 10-year notes to be 1.50-2.00%.

In general, we still feel the bigger driver in rates will be potential for real, substantive progress on the trade front. Not going to be a complete deal, but real progress needed.

“And progress on the trade front can very well still coincide with more Fed easing. The global data is still very weak and damage has already been done.”

Powell was very clear the Fed will be watching the data closely and that includes global. In other words, this doesn’t have to be an outcome where the trade war subsides and central bank liquidity immediately ends. We have no doubt the Fed would factor it in, but again Powell was clear China is not the only variable.

In general, 10-year notes continue to gravitate toward 1.70%. From a directional basis, levels don’t offer much but we suspect over the next few weeks a reason will surface to make a run at one of the broader range levels (1.50/1.90) Looking at the yield curve, the same story: very stable.

The market is looking for the next catalyst. And as we move into October the trade negotiations, impeachment developments, Brexit and global data will provide a new catalyst for the next move to the range extremes. And right now it feels like 1.50% will be the winner in 10-year space.