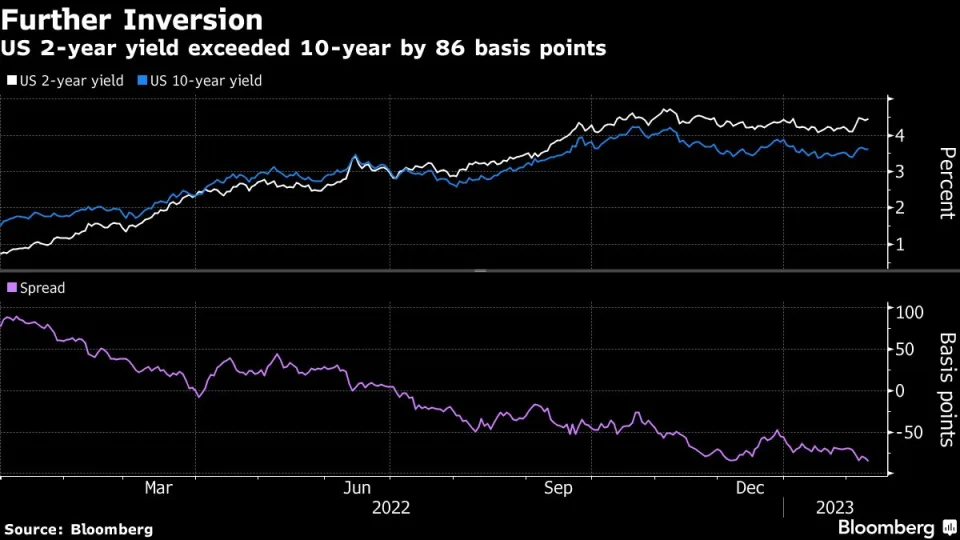

Treasury Yield-Curve Inversion Reaches Deepest Level Since 1980s

(Bloomberg)–US government bond investors pushed two-year yields above 10-year yields by the widest margin since the early 1980s Thursday, a sign of flagging confidence in the economy’s ability to withstand additional Federal Reserve interest-rate hikes.

(Bloomberg)–US government bond investors pushed two-year yields above 10-year yields by the widest margin since the early 1980s Thursday, a sign of flagging confidence in the economy’s ability to withstand additional Federal Reserve interest-rate hikes.

The yield on the shorter-dated Treasury at one point exceeded the longer-dated note’s by as much as 86 basis points. The two-year rate was 4.10% on Feb. 2, before stronger-than-expected January employment data sparked a reassessment of how much higher the Fed’s policy rate might need to go to stifle inflation.

The move faded somewhat as both yields reached session highs toward the end of the US trading day after the Bank of Mexico delivered an unexpected half-point rate hike amid accelerating inflation. The two-year rose as much as eight basis points and exceeded 4.5% for the first time since Nov. 30. The 10-year yield climbed seven basis points to 3.68% following weak demand for a 30-year bond auction.

Overnight index swaps have pushed pricing for a peak in the federal funds rate to about 5.1% in July, suggesting a target range of 5% to 5.25%. But trades in interest-rate options this week hedging the risk of a 6% rate have rattled the policy-sensitive two-year note.

Ten-year yields lower than two-year yields — the status quo since July — signify expectations that elevated policy rates will take an economic toll. A portion of the latest curve shift is attributable to the debut via an auction on Wednesday of a new 10-year Treasury note that trades at a yield slightly lower than the previous one, and thus at a wider negative spread to the current two-year.

“The trend has been a flatter curve and more inversion since the Fed started tightening,” said Gregory Faranello, Head of US Rates Trading and Strategy for AmeriVet Securities. “There’s nothing, when looking at the charts, that says we can’t go further with the inversion.”

Cases of shorter-term rates trading higher than longer-term ones are called curve inversions. They typically arise when central banks are in the process of raising policy rates, a maneuver that pushes up the short-term yields while weighing on longer-term yields by damping expectations for inflation and growth. In the US, they have a track record of preceding economic downturns by 12 to 18 months.

For the two- to 10-year spread, a one-percentage-point gap is in reach following strong demand for Wednesday’s auction, rates strategists at BMO Capital Markets said.

Investors bought nearly 95% of the auction, a record share since at least 2003, according to available data. Thursday’s 30-year bond auction didn’t measure up. The yield was higher than anticipated, and investors took the smallest share in nearly a year.

Consumer price data for January to be released Feb. 14 could be decisive for the curve, Faranello said.

–With assistance from Elizabeth Stanton