Weekly Muni Snapshot | September 20, 2021

|

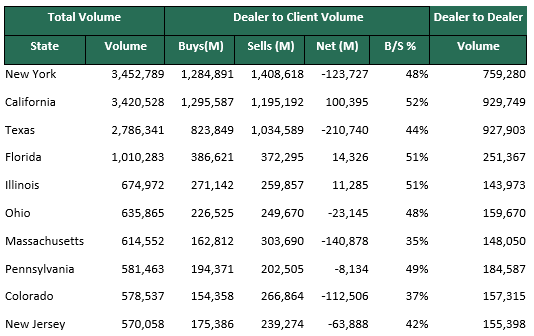

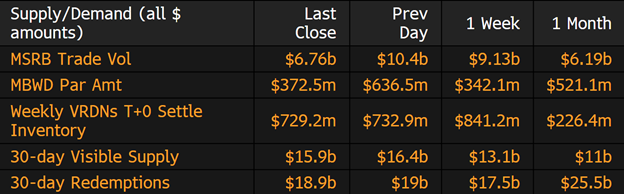

Municipal New Issuance: New issue volume is projected to increase as we move into the 4th quarter of 2021. Combined competitive and negotiated new issues should total approximately $13.0 billion this week up sharply from the year-to-date average of $9.0-$10.0 billion. The largest deal from the prior week was the combined $2.1 billion State of California issue, AmeriVet was an active syndicate member on that financing. In addition, AmeriVet participated in one other deal for the week which was the $542 million New York City Water Finance Authority issue. Municipal Secondary Trading: Secondary trading volume picked up for the week as market activity showed a solid increase after the Labor Day holiday. Secondary trading totaled approximately $23.2 billion for the week with majority of the trading being done by broker-dealers selling to clients. With the nice boost in secondary trading, we did see clients put out more bonds for the bid with customers bid wanted totaling roughly $2.4 billion in size. |

|

|

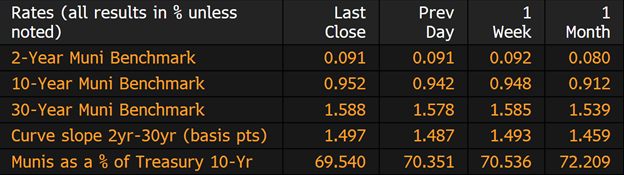

Municipal Spread: Municipal bond yields remained mostly unchanged this week as a relatively stable treasury market and continued positive new money inflows have kept rates in a narrow trading range. The lack of market volatility has been a consistent trend for the past month or so. Yields on the Bloomberg 10-year benchmark for the week fell just 0.4 basis points to 0.952% from 0.948%, while 30-year fell by 0.4 basis points to 1.497%. With the small movement in yield, municipal bonds did outpace Treasuries for the week as the 10-year ratios is now yielding 69.54% of Treasuries compared to 70.53% a week ago. With yields, and ratios falling we did see the municipal bond curve flatten slightly by 0.4 basis points to 149 basis points. |

|

|

2021 was projected to see a significant amount of municipal taxable bond issuance and stated the year strongly, but the pace of new issuance has been slowing down. Taxable bond issuance had been increasing over the past few years as issuers took advantage of historically low interest rates and increasing investor demand to both refund outstanding tax-exempt bond issues and finance new projects. The renewed flight to quality and the aggressive Federal Reserve stimulus helped to spark a rally in U.S Treasuries which allowed many issuers to issue taxable bonds instead of tax-exempt bonds. Prior to the downturn in taxable issuance the peak of taxable issuance was 32% of total municipal bond issuance but has since declined to 23% of the overall volume. With the scarcity of new bonds and supply declining we have seen AA taxable bonds tighten by another 20 basis points since July. In 2019, there was some noticeable spread pickup between taxable municipal bonds and corporate bonds but that spread has tighten significantly and now many buyers have found the relative value of purchasing municipals vs corporates as a way to enhance portfolio performance. |

|

|

Municipal Supply: The negotiated calendar will see expected volume of roughly $8 billion this week, with the largest deal being the $995.1 million California Housing Finance Authority. The next largest deal of the week will be the Department of Airports of the City of Los Angeles will be issuing $875.8 million in subordinated Revenue bonds. AmeriVet will be a syndicate member on two deals this week the first being the $880 million Triborough Bridge and Tunnel Authority refunding bonds, and second will be the New York State Housing Authority $165 million Affordable Housing Revenue bonds. |

|

|