The Fed

This was an active week from the New York Fed. And the continued reversal of the Fed’s approach to the hiccups since mid-September.

We’ve been discussing the notion that the Fed will not run away from the issues of the past few months. There is simply too much at stake between Repo, Federal deficits and the Libor to SOFR conversion with clear end user implications.

Money Market Developments: Views from the Desk

November 04, 2019

Lorie K. Logan, Senior Vice President

From this week: NY Fed: “That said, the Desk is prepared to adjust the pace and other parameters of the reserve management purchases as necessary to maintain an ample supply of reserves and based on money market conditions. We’ll be closely monitoring the attractiveness of propositions and indicators of market functioning to assess whether operational adjustments are appropriate”

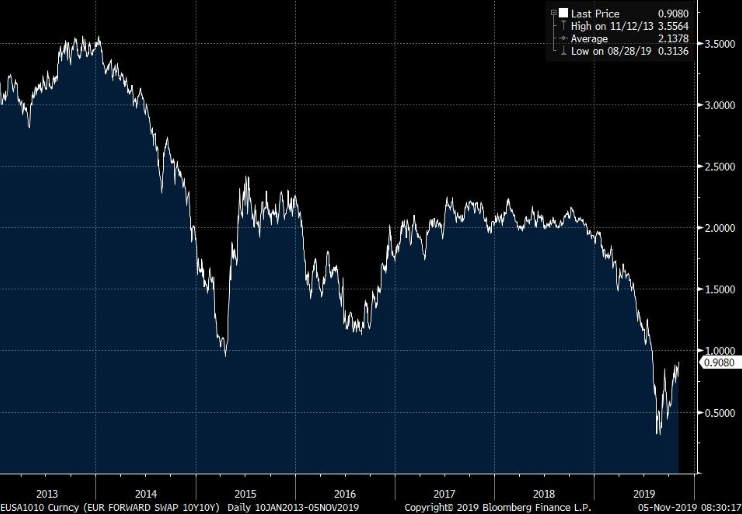

The bazooka is out, and it’s focused on the short end. One of the reasons clearly, we focus on the yield curve here. The Fed wants the curve steeper irregardless. But with regards to the asset purchases, we’ve been discussing how short-term it’s all about the bank reserve levels.

Granted, the banks seem likely to get some relief on the daylight overdraft. And Jamie Dimon referred to this specifically recently. But the broader capital and liquidity ratios become a different animal, especially heading into a very contentious political season. Senator Warren was quick to point out and we’ve discussed.

So, for us, what this means is more buffer not less regarding the reserve levels. And when reading Lorie Logan’s speech, and certainly the comments from Powell and Williams, the message of more not less is clear.

Furthermore, the NY Fed is tying in SOFR with this recent discussion. And they need to. The practical and political implications of the mid-September Repo hiccup transcend just funding.

The regulators have mandated Libor conversion to SOFR. And in a nutshell, SOFR is Repo. No running away from the broader implications for the financial system and economy. The Libor market has touched every corner of the domestic and global economy.

Both pieces attached below and worth a read. Regarding SOFR, the release is around calculation methodology and clearly timed out with the recent bumps in Repo rates and implications for SOFR calculations.

https://www.newyorkfed.org/newsevents/speeches/2019/log191104

https://www.newyorkfed.org/markets/opolicy/operating_policy_191104

In looking back at this past year, and listening to the Fed speak since the October 30th announcement, the thing that stands out the most right now is the conviction the Fed presents with and in both directions.

We spent some time compiling some Fed speak going back to the Fall of 2018, making comparisons to what we are hearing today.

Let’s Take a look:

Clarida today 2019 after 3 rate cuts: It’s ALL in a “good place”

1) Economy

2) Fed policy

3) Jobs report

Clarida from October 25, 2018: And on his way to 3% neutral:

“Even after our most recent policy decision to RAISE the range for the federal funds rate by 1/4 percentage point, monetary policy remains ACCOMMODATIVE, and I believe some further gradual adjustment in the policy rate range will likely be appropriate”

Dallas Fed’s Kaplan 2019.

“Fed policy is in the right place”

Kaplan from August of 2018:

Worried about raising rates too gradually as to not fall behind the curve. “At this juncture, the challenge for the Fed is to raise the federal funds rate in a gradual manner calibrated to extend this expansion, but not so gradually as to get behind the curve so that we have to play catch-up and raise rates quickly”

NY Fed President Williams 2019 (November 2019)

Fed is close to neutral. Policy and economy in a good place.

Williams 2018 (December 2018)

Fed’s Williams says rate hikes ‘over next year or so’ still make sense.

https://www.cnbc.com/2018/12/04/feds-williams-expects-further-us-rate-increases-into-next-year.html

It’s too early to tell if the Fed has it right this time around. Last year they were very off course. This story is far from over, and for now the markets trade with optimism and a belief the Fed has the economy and policy in a good place.