A Post-Fed Wall Street Buckles Up for High-Stakes Economic Data

Ever since the Federal Reserve kicked off its historic tightening campaign, Wall Street has clung to every word and deed of Jerome Powell and his colleagues.

Now economic data really is in the driver’s seat, with the potential to push market volatility near historic levels before the Fed’s next meeting in September.

After delivering a widely expected interest-rate hike on Wednesday, the Fed chief declined to be pinned down on when officials may hike again while they assess the “totality of the data” on the employment and inflation picture.

That means Wall Street traders will no longer enjoy the Fed’s unusually reliable road map on how to trade the bond market.

After all, for most of the past year, they could expect interest rates would march higher at each meeting, and would lean on Powell’s remarks to figure out whether to buy, sell or hold. Now, with mixed signals on inflation, the path of monetary policy is less clear than it has been in a long time, while Fedspeak is set to be scarce over the next month.

Add the dog days of summer — when liquidity can shrivel as trading volumes ebb — and market gyrations may remain elevated.

“It’s a tactical market at the moment and that will be the theme over the next six to eight weeks, where positioning matters and the incoming data is quite meaningful,” said Michael de Pass, global head of rates trading at Citadel Securities. “The meeting today was all noise by design. Powell intentionally offered the market very little in the way of forward guidance. Forward guidance is useful at points in the cycle, but not at this point in the cycle.”

The Fed has rapidly raised rates from near-zero in March 2022 and inflation has notably eased from last year’s peak. But with consumer prices still elevated amid a tight labor market, Powell said Wednesday that the Fed couldn’t provide “a lot of forward guidance.” Instead he cited an upcoming raft of data including two employment reports, two reports on consumer-price inflation and data on employment costs.

“All of that information is going to inform our decision as we go into that meeting,” Powell said. “I would say it is certainly possible that we would raise funds again at the September meeting if the data warranted and I would also say it’s possible that we would choose to hold steady at that meeting.”

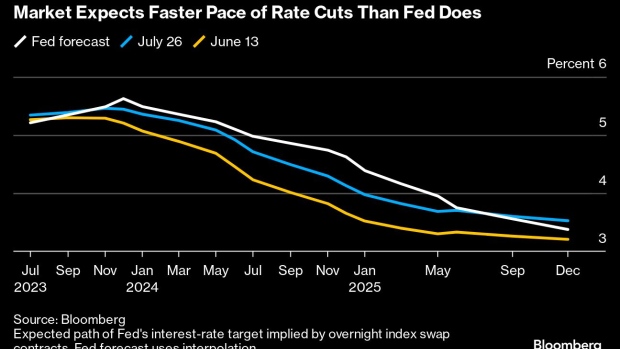

As the dust settled Wednesday, policy-sensitive Treasury yields were modestly lower late in New York trading. Swap rates for late 2024 still anticipate that the central bank will cut rates more deeply than officials expect, projecting the benchmark rate will be in the 4%-4.25% range.

Of the incoming data over the next two months, the inflation readings clearly pose a big test for traders in the potentially lucrative market for interest-rate swaps and short-dated government bonds. That will also ripple into the Treasury curve trade, where the gap between 2- and 10-year benchmarks has oscillated around minus 100 basis points this month.

The recent decline in Treasury volatility also faces a test, with any spike challenging recent sellers in the options market who may be expecting that the Fed pause will result in a quiet market.

“He told markets what to watch: ECI, 2 more CPI and employment readings,” said Gregory Faranello, Head of US Rates Trading and Strategy for AmeriVet Securities, citing Powell’s remarks Wednesday.

–With assistance from Elizabeth Stanton and Matthew Boesler.