AmeriVet Weekly Muni Snapshot

|

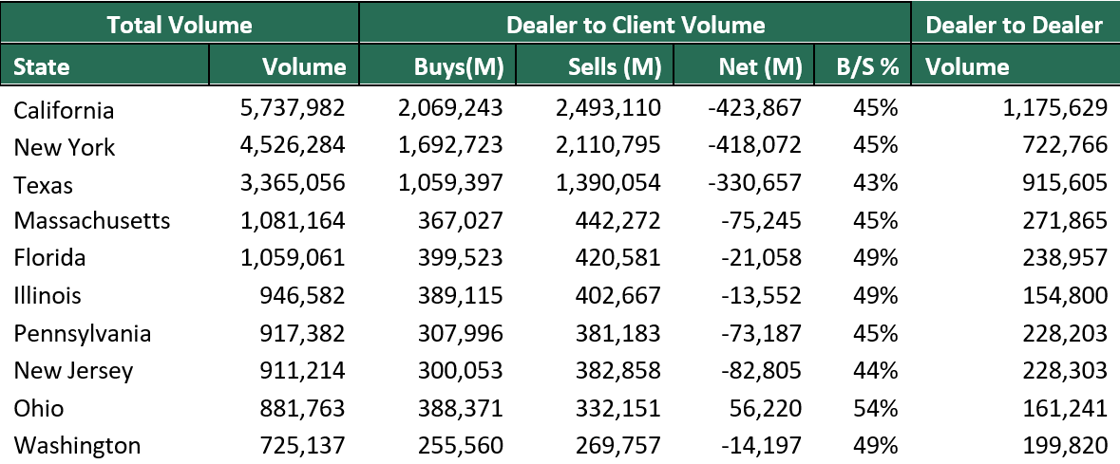

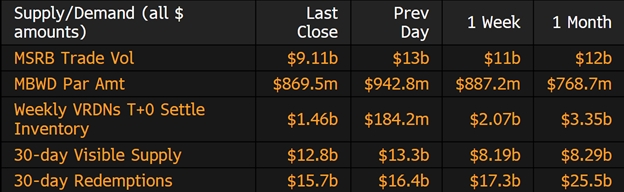

Municipal New Issuance: The first week of March negotiated calendar had a total volume of just over $5 billion for the week with five issuers taking up over half of the issuance. The largest deal for the week which AmeriVet was in the selling group was the $778 million New York City Municipal Water Finance Authority which saw robust demand for their bonds as they tighten even as municipal bonds yields rose. The next largest deal of the week was the $546 million Los Angeles Airport taxable issue. We also saw Michigan State University issue $500 million in taxable bonds. So far this year municipalities have sold $56.8 billion in bonds which is down 8.8% from the same period last year. Municipal Secondary Trading: Secondary trading was very active this week with roughly $30.68 billion in secondary trades with 55% of all trades being dealers selling to clients. Secondary trading has been very high in recent weeks as many traders continue to gauge how much the Fed will raise rates which is anticipated to be 25- basis points and five total for the year. According to Bloomberg customer bids-wanted totaled to $4.9 billion with two days of over $1billion in bids-wanted. |

|

|

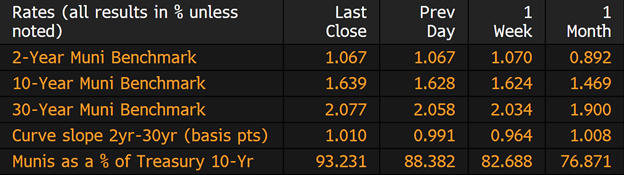

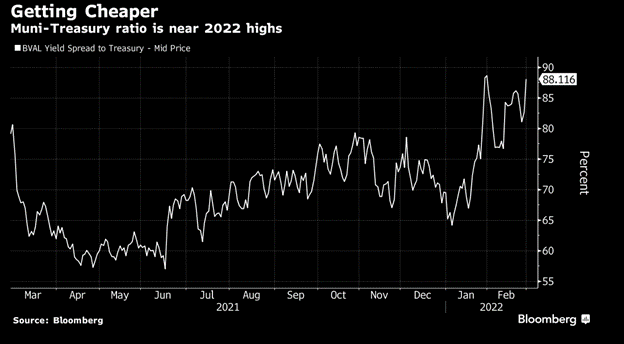

Municipal Spread: Municipal bonds are not off to a good start for March as yields rose across the curve with yields on 10-year notes rising 1.5 basis points to 1.64% marking the fourth straight week of losses. With the rise in yields municipals continue to lag Treasuries as 10-year ratios have risen to 93.23% for the week, compared with 82.68% a week ago. Those same ratios were at 79.69% a month ago signaling that municipal bond are getting cheaper versus Treasuries and a relative value standpoint. This has been the highest the ratio has been November 2020, but far from the high of 365% back since the start pandemic. We did see the municipal bond curve steepen for the week as the gap between yields on short-term and long-term securities steepened by 4.6 basis points in the past week to 101 basis points. |

|

|

According to Refinitiv Lipper US Fund Flows data municipal bond mutual funds saw investors pull about $2.8 billion out of their funds which follows last weeks $1.2 billion loss and marks the sixth weekly outflow in the past seven weeks. Municipal bond funds have lost a roughly $6.9 billion year-to-date and many investors are still concerned about the pending rate hikes as well Russia’s invasion of Ukraine. Volatility in the municipal market is something that we are not use to as we have seen municipal yields rise in bonds maturing in 10-years by 58 basis points from the start of the year which comes out of a loss of 3.29% for the year with the Bloomberg Municipal Bond Index Total Return Index losing about 3.23% for the year. The short end of the curve has fared slightly better than the long end as they have only lost about 2.54% while the long end has struggled this year by losing just over 4.3%. The one positive thing to note is that with municipals have cheapened relative to Treasuries as Treasuries have only declined 2.5%. All though out 2021 municipal bonds have outperformed Treasures to a point where ratios hit a low of 53.87% back in June 2021 and on March 1st the same ratio was at 90.28%. This week will also mark the two-year anniversary of Covid pandemic wreaking havoc on the markets, which brought 10-year bonds to as high as 2.93% and ratios to as high as 365% on March 23,2020. It took roughly three months for those ratios to come back down to its normal levels after the Fed stepping in and added stimulus to the economy. |

|

|

Municipal Supply: This week’s negotiated calendar will have a projected volume of roughly $9.3 billion up from the prior week’s volume of $5 billion. This week we will see two deals that will be over $1 billion. The largest deal of the will be the $2.2 billion State of California which AmeriVet will be a Co-manager on. This will be their biggest bond sale in two years. The University of Michigan will be issued $1.5 billion next week in taxable bonds. AmeriVet will also be in one other deal which will be the $844 million New York City Transitional Finance Authority. |

|