AmeriVet Weekly Muni Snapshot

|

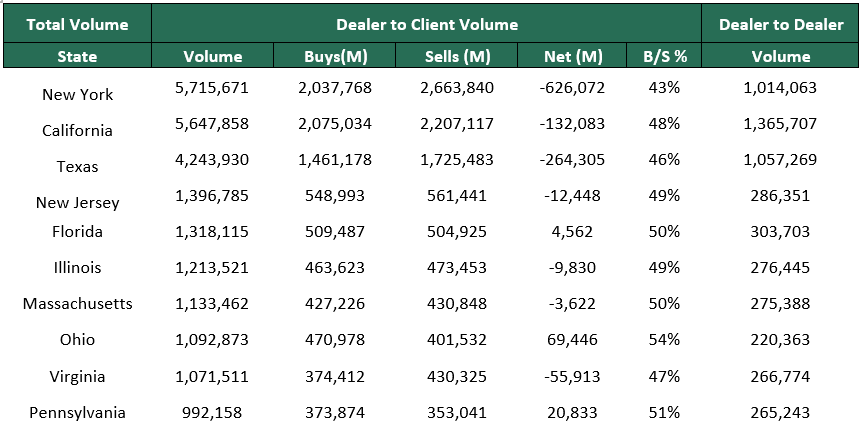

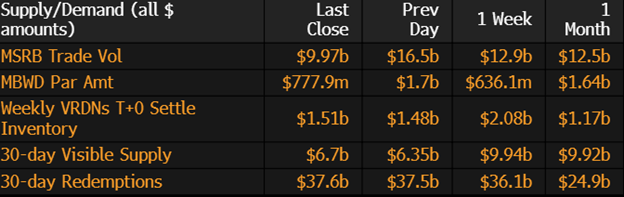

Municipal New Issuance: The negotiated calendar for this past week totaled to just over $8.7 billion as many issuers sought to issue last week ahead of the FOMC rate decision. The largest deal of the week was the $958 million California Community Choice Finance Agency issue followed by the $646 million New York City Housing Development Corporation which AmeriVet participated in the Selling Group. The Port Authority of New York & New Jersey issued $463 million in taxable bonds. Municipal Secondary Trading: Secondary trading for the week totaled to roughly $38.9 billion with approximately 52% of trading being dealer sells and with the bulk of the trading being done on Wednesday. According to Bloomberg, clients put up roughly $7.65 billion for the bid last week compared to the previous week where clients put up $4.9 billion for the bid. |

|

|

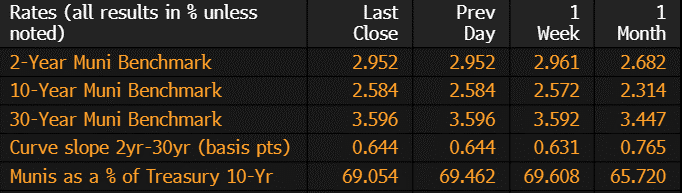

Municipal Spreads: This past week muni yields remained relatively unchanged with 10-year notes rising by just 1.2 basis points to close out the week at 2.58% and with 10-year notes hovering 1 percentage point higher than the three-year average. With yields remaining unchanged, the Muni-Treasuries 10-year ratio remained unchanged as 10-year notes are yielding 69.05% of Treasuries, compared to 69.60% a week ago. Even though yields remained unchanged for the week, we did see the muni curve steepen slightly as the curve steepened by 1.3 basis points this past week to 64 basis points. |

|

|

For the first time in 16 weeks, investors flooded muni bond funds this past week by adding $460 million to muni funds according to the Refinitiv Lipper US Fund Flows data. This past week’s inflow broke the longest withdrawal since 2013. With muni yields at attractive levels, yields are attracting investors to the tax-exempt markets. |

|

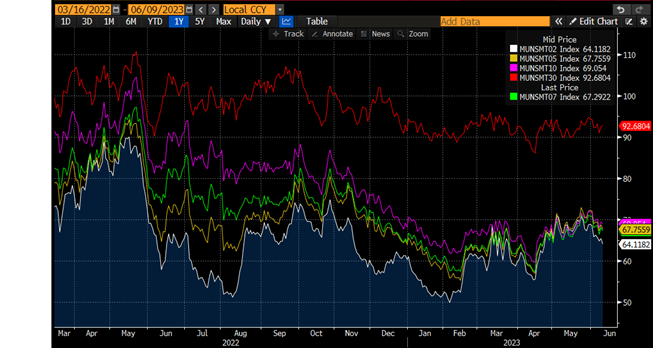

Since the start of the year muni ratios have slowly started to cheapen to levels where investors are slowly looking towards the front end of the curve. Currently, 10-year ratios are hovering around 70%, which, comparably to Treasuries, has been the cheapest since the start of the February. With ratios becoming less volatile, we are slowly seeing positive entry points in the front end even as the front end is still rich compared to the 5-year ratio average. With 5-year munis yielding about 2.65%, coupled with their Treasury ratio hovering at roughly 69% and with 10-year notes yielding about 2.58% with their Treasury ratio hovering at ~69.63%, we should start to see investors move into the 5-year part of the curve and move away from the 7–12-year part of the curve. The long end continues to be the cheapest part of the curve with the 30-year ratio at 92.65%. |

|

|

Municipal Supply: The negotiated calendar for the week will have an expected volume of $2.1 billion as many issuers are waiting on the Fed to see if they will take a pause in hiking rates. The largest deal of the week will be the $549 million Louisiana Stadium and Exposition District which will include taxable and tax-exempt bonds. AmeriVet will be in two issues this week which will be the $121 million Wisconsin Housing and Economic Development Authority as a Co-Manager and the $60 million Minnesota Housing Finance Agency as a Selling-Group-Member. |

|