AmeriVet Weekly Muni Snapshot

|

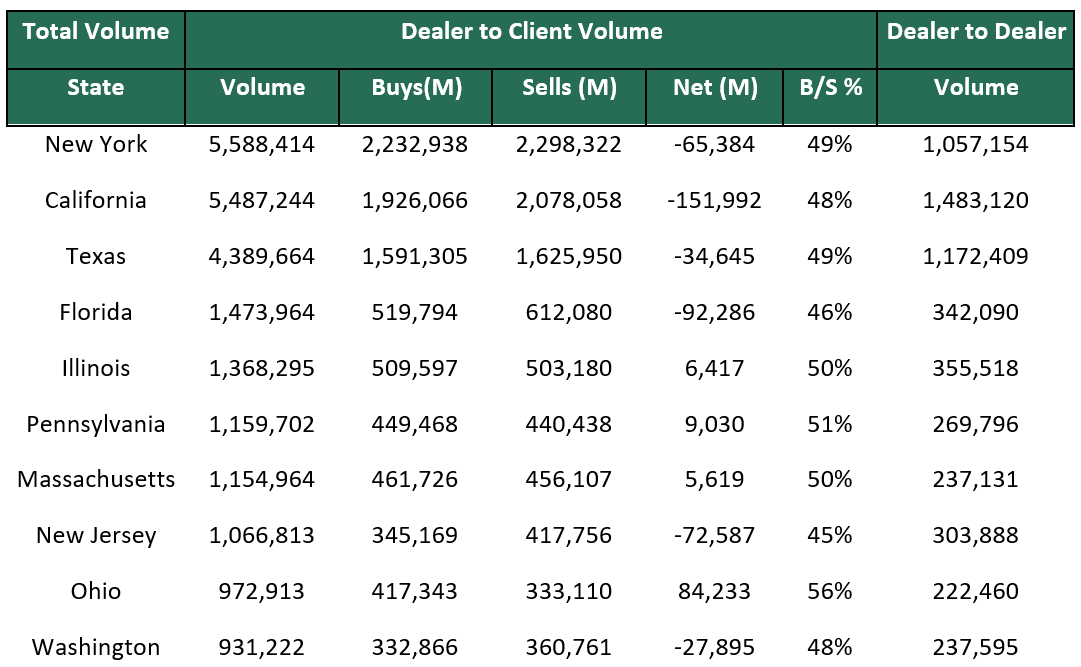

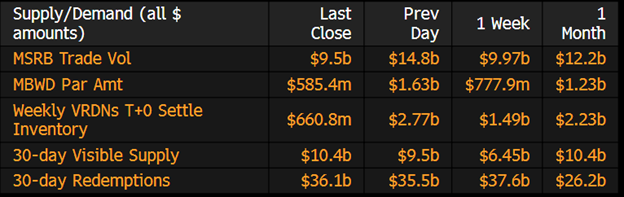

Municipal New Issuance: With the FOMC rate decision this past week, many issuers took a hiatus in issuing as the negotiated calendar totaled to about $2.4 billion for the week, with the largest deal being the $ 526 million Louisiana Stadium and Expo which included taxable and tax-exempt portions of the deal. AmeriVet was in two issues for the week, the first as a Co-Manager on the Wisconsin Housing & Economic Development Authority Housing Revenue Bonds issue which sold $121 million and the $60 million Minnesota Housing Finance Agency Residential Housing Finance Bonds issuance which AmeriVet participated as a Selling-Group-Member. Municipal Secondary Trading: Secondary trading for the week totaled to roughly $38.9 billion with roughly 52% of trading being dealer sells and with the bulk of the trading being done on Wednesday with Friday having the lightest trading volume. According to Bloomberg, clients put up roughly $7.88 billion for the bid last week compared to the previous week in which clients put up $7.65 billion for the bid. |

|

|

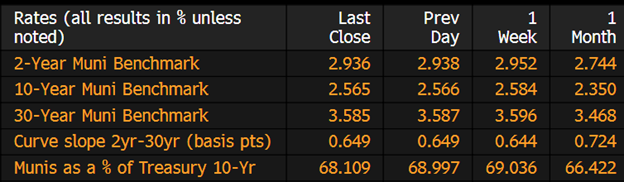

Municipal Spreads: This past week, muni yields fell slightly with yields on 10-year notes falling by 1.9 basis points to close out the week at 2.56%. With yields falling this past week, we were able to see the muni-to-Treasury ratio fall as the 10-year ratio is now 68.10% of Treasuries compared to 69.03%. With the slight drop in yields, we did see the muni curve steepen slightly by 0.5 basis points this past week to end the week at 65 basis points. |

|

|

After seeing inflows for the first time in 16 consecutive weeks, muni funds once again saw outflows from their funds as investors pulled about $257 million out of muni funds this past week. This outflow follows the prior week’s inflow of $460 million. Although we are slowly starting to see some stability in the muni markets, it still may take some time for investors to have more confidence in the muni market. |

|

With the Fed taking a hawkish pause on raising rates this past Wednesday, many fear that the Fed could potentially hike rates two more times this year which left munis relatively unchanged as munis yields across the curve only bumped by an average of just 1.4 basis points. The Fed pause is something the muni markets has been waiting for as the bumps in yields pushed June’s return to .72% with the year-to-date return of 2.38%. Prior to the Fed’s announcement, June returns were at .56% with a year-to-date return of 2.23%. With this pause, we can start to shed some light in the markets as investors will start to flock to tax-exempts. |

|

|

|

Municipal Supply: With only four trading days next week due to the Juneteenth Holiday on Monday, the negotiated calendar will total to just over $ 4.5 billion for the week, with the largest deal of the week being the $380 million Port Authority of NY & NJ issuance followed by the $320 million New York City Housing Development Corporation which will consist of taxable and tax-exempt bonds. AmeriVet will be in the Selling Group for the New York City Housing Development Corporation issuance. The next largest deal of the week will be the $307 million New York State Housing Finance Agency which AmeriVet will be participating as a Co-Manager on. |

|

|