AmeriVet Weekly Muni Snapshot

|

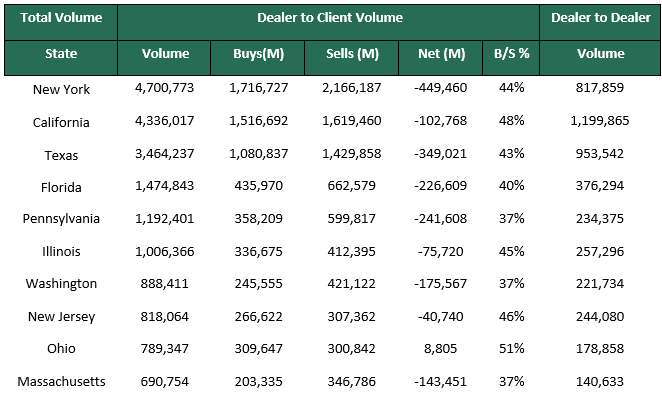

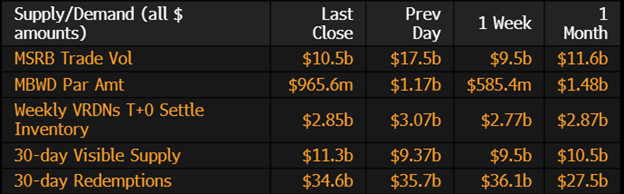

Municipal New Issuance: Last week’s negotiated supply totaled to about $4.3 billion with the largest dealing being the $319 million New York City Housing Development Corporation which AmeriVet participated as a Selling-Group-Member. The next largest deal of the week was the $306 million New York State Environmental Facilities Corporation issuance. AmeriVet was in one other Issue as a Co-Manager for the week which was the $302 million New York State Housing Finance Agency issue. Both Housing issues that AmeriVet was involved in received strong demand as each saw their bonds bump by 10 basis points in each of the maturities. Municipal Secondary Trading: With just four days of trading this past week, secondary trading totaled to about $31.13 billion with 56% of trading being dealer sells. According to Bloomberg, clients put up about $ 4.67 billion up for the bid with Wednesday having the highest volume of bids-wanted. |

|

|

Municipal Spreads: With just four trading days this week, munis continued to be relatively tame for the week with yields on 10-year notes falling by 3.3 basis points to 2.53%. With munis holding steady for the week, munis have been able to outperform Treasuries as the 10-year muni-to-Treasury ratio is now yielding 67.81% of Treasuries compared to 68.11% a week ago. The muni curve remains unchanged for the week at 65 basis points. |

|

|

After seeing outflows in the prior week, muni-bond funds saw investors add to their funds to the sum of $672 million for the week as reported by Refinitiv Lipper US Fund Flows Data. Muni funds have only seen seven weeks of inflows for 2023. |

|

Since the start of month, we have seen ratios in the front end have an average ratio of about 71.53% as we saw some relief in the front end from the relative richness in that part of the curve. Since then, we have seen the munis become even richer as Treasury yields have risen while muni yields have been relatively stable in that same time frame. Currently, the front end of the curve has an average ratio which has dropped about 7 percentage points to roughly 64.33% in three weeks. Although we are still about 10 percentage points away from the lows back in February, there is push by investors to start to looking further out into the curve as 30-year notes are yielding roughly 100 basis points more than 10-year notes and are about 25 percentage points cheaper in a relative value aspect to Treasuries. |

|

|

Municipal Supply: The negotiated calendar for the week will have an expected volume of just over $7.5 billion with the largest deals of the week being the $1.49 billion City of Los Angeles California Note deal followed by the $993 million Commonwealth of Massachusetts which will have a refunding portion of the deal. AmeriVet will be participating on 2 issues this week which will be the $600 million Triborough Bridge and Tunnel Authority as a Selling-Group-Member and the State of New York Mortgage Agency as a Co-Manager which will be selling $95 million in tax-exempt bonds and $30 million in taxable bonds. |

|