AmeriVet Weekly Muni Snapshot

|

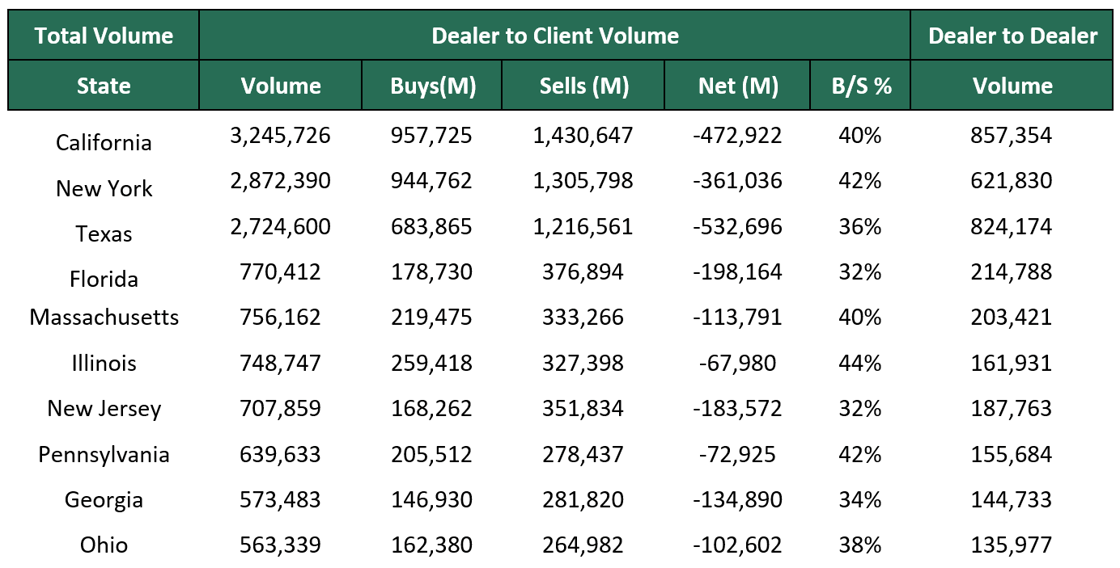

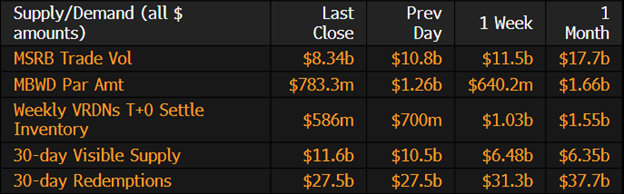

Municipal New Issuance: With the July 4th holiday last week, the negotiated calendar totaled to just slightly over $684 million for the week with the largest deals being the $300 million Los Angeles Community College issue which included taxable bonds and tax-exempts, followed by the $116 million Dickinson Independent School District issuance. Municipal Secondary Trading: With just four trading days and many taking Monday off as well last week, secondary trading totaled to roughly $21.78 billion with 61% of trades being dealer sells. According to Bloomberg, clients bids-wanted was also down as clients put up just over $3 billion for the week. |

|

|

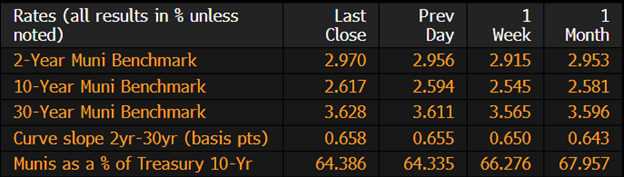

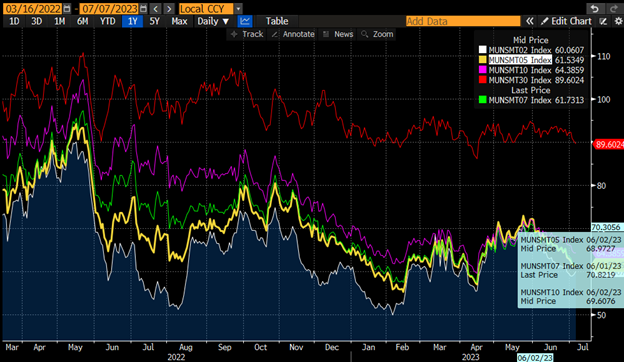

Municipal Spreads: For the first week of July, muni yields rose with 10-year notes rising by 7.2 basis points to 2.61%. With Treasuries rising this past week, munis continued to outperform Treasuries with 10-year notes now yielding 64.38% compared to 66.27% from the prior week. Just one month ago that very same ratio was at 70.15%. Although yields rose last week, the curve steepened slightly by just .8 basis points to 66 basis points. |

|

|

According to Refinitiv Lipper US Fund Flows data, this past week investors pulled roughly $856 million from muni bond funds following the prior weeks outflow of $25 million. Until we start to see muni yields improve, we should continue to see investors pull money out of muni funds. |

|

Since the start of June, munis have been relatively unchanged for the most part with yields rising by an average of just 1.7 basis points. With Treasuries rising at the same time due to better-than-expected economic statistics in the last couple of weeks, Treasuries has once again caused munis to become even richer with 10-year ratios now yielding 64.38% compared to 71.68% on June 1st. With two potential rate hikes left this year, we possibly could continue to see munis become richer. Investors should continue to look further out into the curve as the long end is currently the cheapest. |

|

|

Municipal Supply: The negotiated calendar will pick up from the prior week with an estimated volume of $5.7 billon. The largest deal of the week will be the $969.9 million Independent School District followed by Intermountain Power Agency which is scheduled to sell $547.1 million. The University of Southern California plans on selling $500 million in taxable bonds using a corporate cusip. AmeriVet will be in one issue for the week which will be the $25.8 million Maryland Department of Housing and Community Development as a Selling-Group-Member. |

|