AmeriVet Weekly Muni Snapshot

|

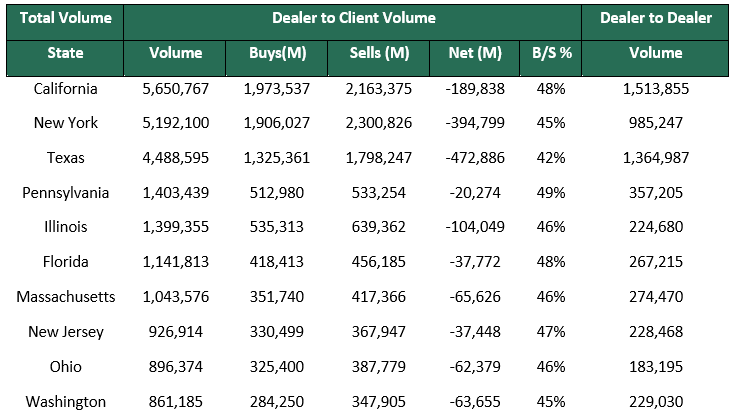

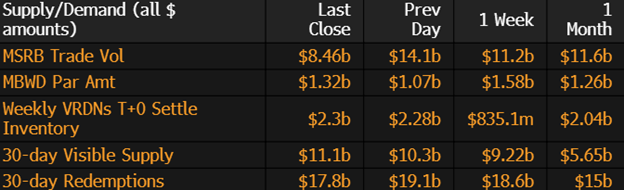

Municipal New Issuance: Last week’s negotiated calendar totaled to just over $4.03 billion with the largest deals being the $599 million Patriots Energy Group Financing Agency followed by the $564 million Philadelphia Water revenue issue. AmeriVet participated on one issue for the week as a Selling-Group-Member which was the $45 million New Hampshire Housing and Finance Authority. In anticipation of the Fed rate decision last Wednesday, many issuers chose not to issue last week. Municipal Secondary Trading: Secondary trading for the week totaled to about $37 billion with 54% of all secondary trades being dealer sells. With yields on the rise this past week, as well as ratios moving higher, investors saw this as an opportunity to buy bonds at cheaper levels. |

|

|

Municipal Spreads: Yields rose sharply this past week as 10-year notes rose by 21.3 basis points to end the week at 3.15%. With the sharp rise in yields, we did see muni ratios also increase as 10-year munis are now yielding 71.30% of Treasuries compared to 67.95%. One month ago, the same ratio was yielding 67.95%. The muni curve also increased this past week as the curve steepened by 2.3 basis points to 81 basis points. |

|

|

According to Refinitiv Lipper US Fund Flows data, investors pulled roughly $27 million from muni bonds funds this past week. This follows the previous weeks outflow of $117 million. With the selloff in munis, investor sentiment is seeming to err on the side of caution as the Fed has indicated that interest rates will continue to be higher for longer. |

|

With the selloff in munis this past week, month-to-date returns fell to -1.42% bringing year-to-date returns to just .15%. This selloff last week was brought upon by many expecting the Fed to have a timeline of when they expect to cut interest rates but the Fed said they expect to have rates higher for longer than many expected. If we continue to trend into negative territory, this will be the second year in a row that muni year-to-date returns were negative. The one positive to this selloff is that we did see muni-to-Treasury ratios move higher as munis have become increasingly expensive over the past year. |

|

|

Municipal Supply: For the final week of September, the negotiated calendar will have an expected size of $6.3 billion with the largest deals being the $1 billion Texas Water Development Board issue followed by the $770 million Florida Development Finance Corporation for the Brightline Florida Passenger Rail Expansion Project. AmeriVet will be in the Selling-Group for the New York City Municipal Water Finance Authority’s deal which is expected to issue $630 million. AmeriVet will be participating as a Co-Manager for the State Public Works Board of the State of California’s $625 million issuance this week. |

|