AmeriVet Weekly Muni Snapshot

|

Municipal New Issuance: Last week, the negotiated calendar totaled to just over $5 billion with the largest deal of the week being the $1.6 billion Triborough Bridge and Tunnel issuance which AmeriVet participated in the Selling-Group. The issue doubled in size due to overwhelming demand and did see some large bumps in the scales due to the rally and unexpected high demand. The second largest deal of the week was the $1 billion New York State Thruway Authority General Revenue Bonds issuance which AmeriVet served as a Co-Manager on. |

|

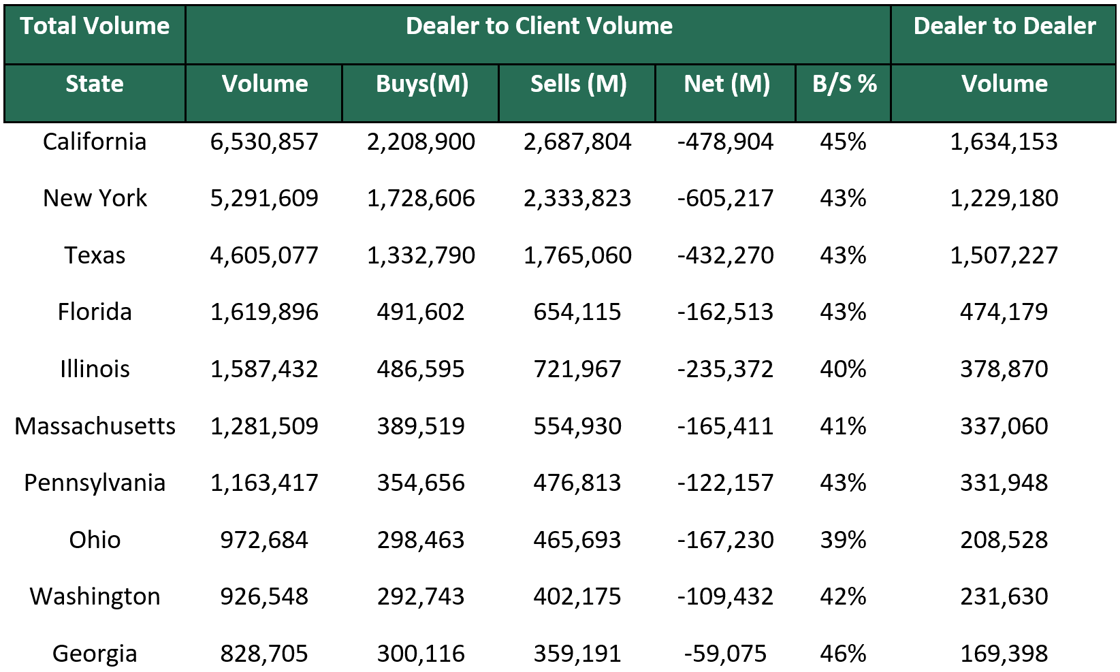

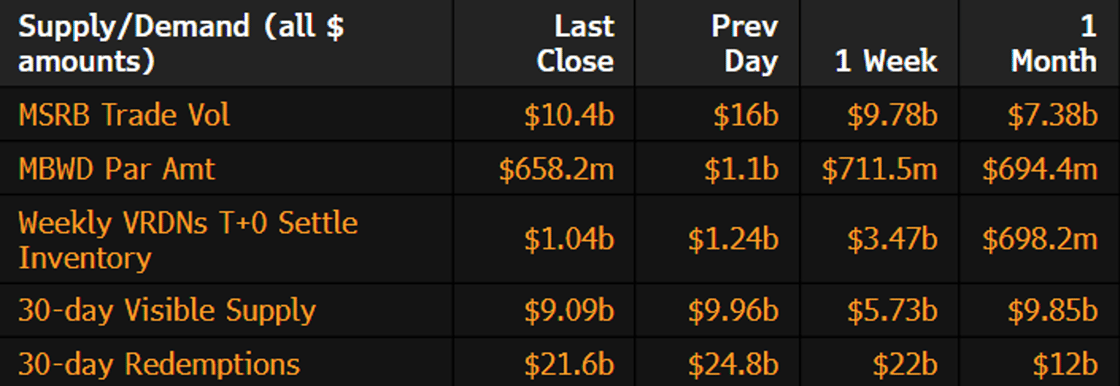

Municipal Secondary Trading: Secondary trading for the week totaled to approximately $39.71 billion for the week with 57% of trading being dealer sells. According to Bloomberg, clients put up roughly $4.34 billion up for the bid with Thursday having the largest volume of bids-wanted totaling to approximately $1.09 billion. |

|

|

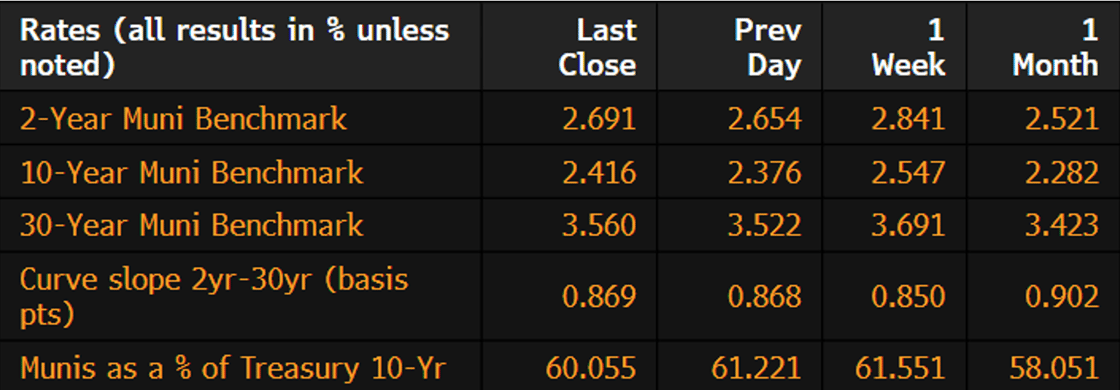

Municipal Spreads: Muni yields fell for the first time this year as 10-year notes fell by 13.1 basis points to close the week at 2.41%. With munis improving this past week, they did outperform Treasuries slightly as 10-year munis are now yielding 60.05% of Treasuries, compared to the prior week when the ratio was at 61.55%. We did see the muni curve steepen this past week by 1.9 basis points to 87 basis points. |

|

|

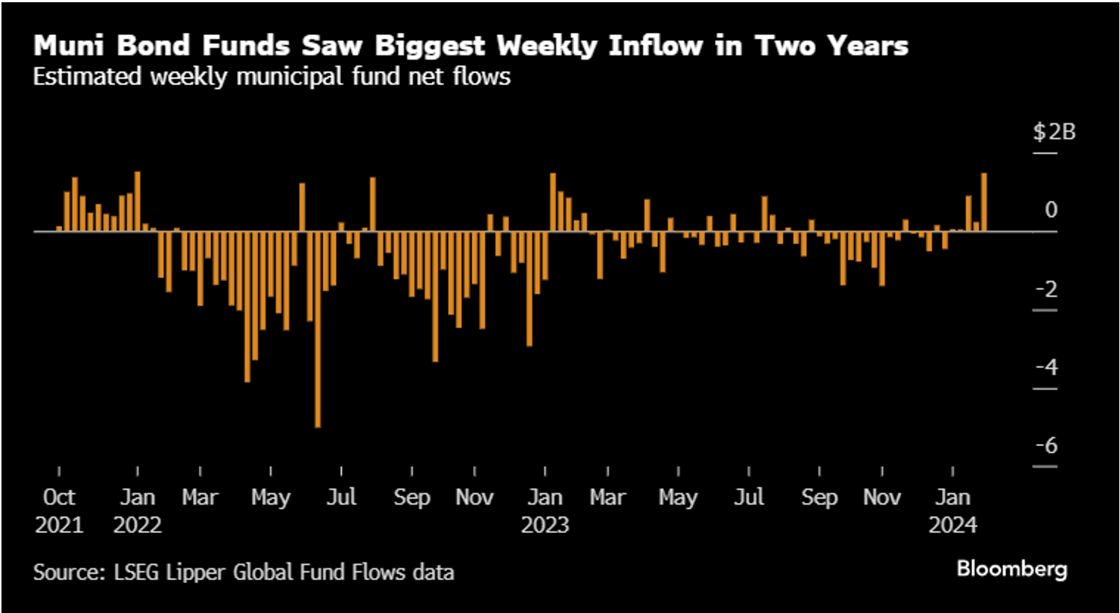

According to LSEG Lipper Global Fund Flows data, municipal bond funds continue to see inflows as investors added about $1.5 billion into their funds. This follows the prior weeks inflow of $211 million and marks the 5th straight week of inflows. This is the first time since over a year ago in which we saw inflows of over $1 billion. |

|

|

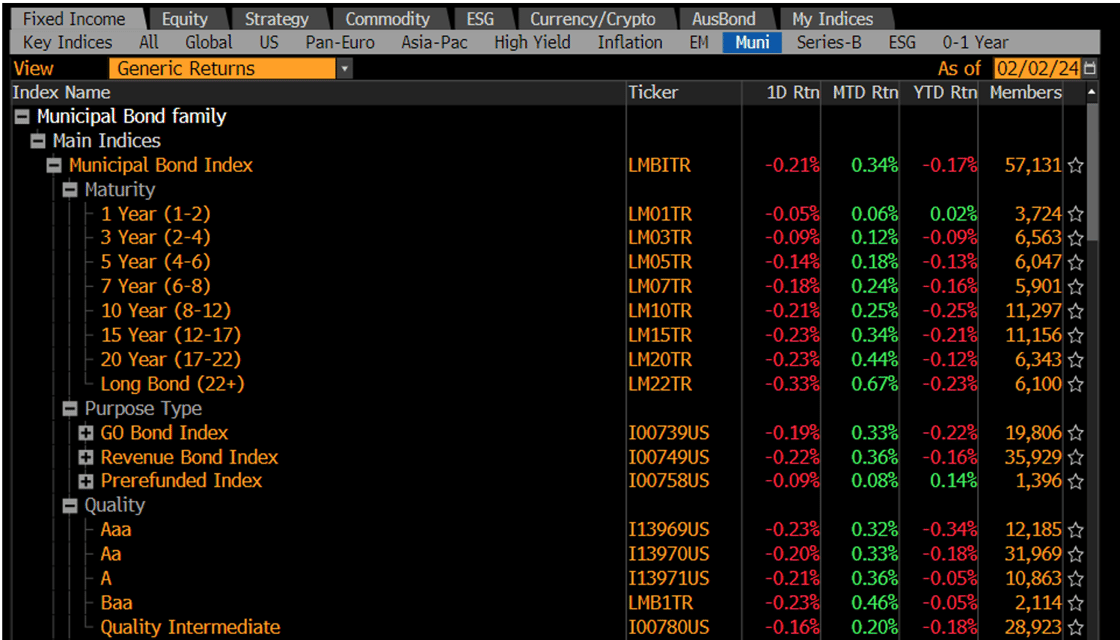

January is typically a positive month for munis and with the strong end to 2023 that we experienced, we anticipated the month of January to be no different. Unfortunately, munis followed suit with Treasuries bringing January into their third losing January in a decade, and the worse return since 2011. Munis ended the month down just .51% due to a late rally in the last couple of days of the month. This past week, munis yields fell an average of about 17 basis points which was the largest gain since December. |

|

|

Municipal Supply: The negotiated calendar this week will have an expected volume of roughly $6.2 billion with the largest deal of the week being the $1 billion New York City Transitional Finance Authority issuance which AmeriVet will be participating in the Selling-Group. The second largest deal of the week will be the $540 million Commonwealth of Massachusetts refunding issue which AmeriVet will also be participating in the Selling-Group. AmeriVet will be serving as a Co-Manager on the $190 million Wisconsin Housing and Economic Development Authority Home Ownership Revenue Bonds issuance. |

|