December Credit Snapshot

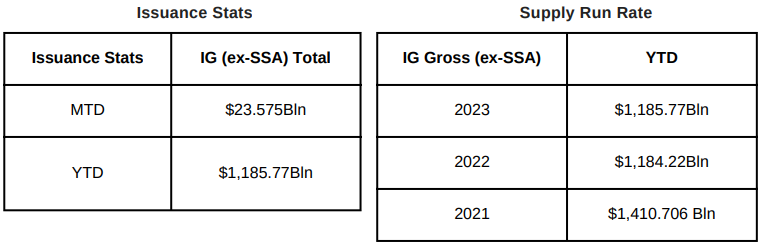

The Credit markets in December 2023 fell shy of expectations, pricing $23.575 billion on expectations of $35 billion. The U.S. Treasury market saw 2’s-10’s close inverted by 35 basis points, while 2’s-30’s closed inverted by 20 basis point. Spreads were tighter across the board by 5-to-20 basis points and traded in a 15-40 basis point range.

December saw light secondary trading activity, but the real story continued with the third consecutive Fed “Pause” that super charged risk assets again pushing spreads tighter and yields lower. The month closed with $1.65 billion of Net Client selling as markets digested lower U.S. Treasury yields, tighter spreads, and a rally across most risk assets into year end.

The Fed will meet to start the new year on January 31st and is expected to be done with rate hikes, as the tide has shifted. The rally in spreads and U.S. Treasuries over the last 2 months has been a welcome sign for issuers as it has created a solid backdrop for new deals and lower all-in borrowing costs to begin the year.

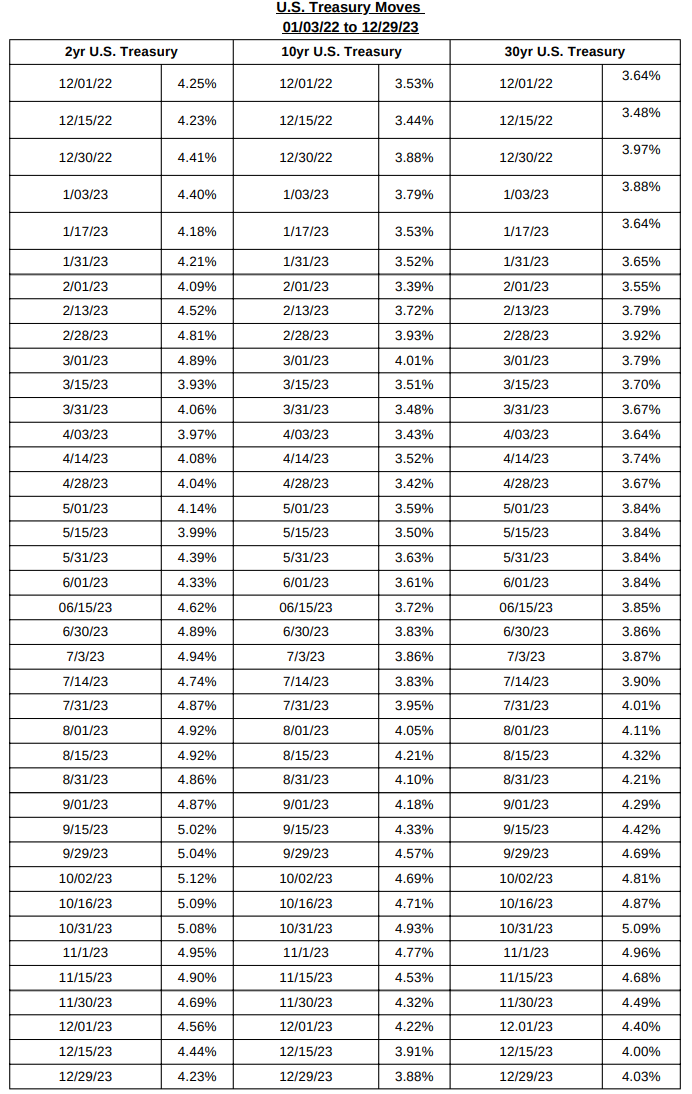

IG Credit spreads in December were 5-20 basis points tighter for another month as volatility dissipated and spreads traded in a 15-40 basis point range. The US Treasury market saw 2yr notes lower by -35 basis points, 10yr notes lower by -34 basis points and the 30yr closed the month -37 basis points lower. Looking at U.S. Treasury rates in December we saw the month begin with 2’s — 10’s inverted by 34 basis points and 2’s — 30’s inverted by 16 basis points, closing the month with 2’s — 10’s inverted by 35 basis points and 2’s — 30’s inverted by 20 basis points. As we look at the markets, the Fed has raised rates 500+ basis points since March of 2022 but a shift in policy and thinking has now given way to light at the end of the tunnel and the markets are currently reacting positively to this news.

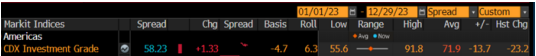

The CDX index opened December ’23 at 61.55 and briefly traded higher to 63.25 before moving lower mid-month as the fed paused with the CDX Index hitting 56.01. Over the next week we saw range trading as the index hit the monthly low on 12/27/23 of 55.60 before selling off into month end and closing at 57.29 on 12/29/23. The avg spread for the month was 59.1. The CDX Index began January 23’ at 80.53 closing the year some 23 basis points tighter.

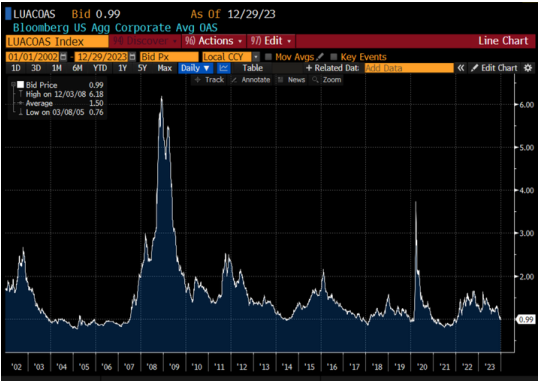

The Bloomberg Barclays US Agg Avg Oas opened December 23’ at 1.05 and steadily traded lower hitting .99 mid-month on 12/14/23 and then saw range trading before hitting the month low of .98 on 12/28/23 before closing the month at .99 on 12/29/23. The avg spread for the month was +1.01. The Bloomberg Barclays US Agg Oas began January 23’ at 1.32 closing the year 33 basis points lower.

CDX Investment Grade Index

December 2023

CDX Investment Grade Index

December 2023

Bloomberg Barclays U.S. Aggregate Corporate Average OAS

01/01/02 to 12/29/23

Bloomberg Barclays U.S. Aggregate Corporate Average OAS

01/01/02 to 12/29/23

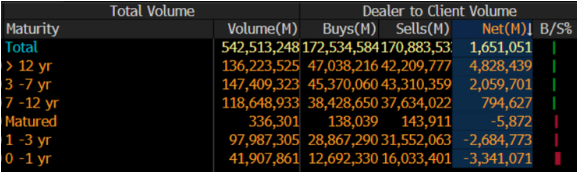

IG credit flows in December came in at $541Bln vs trailing months, November $632Bln, October $594Bln, September $522Bln, August $551Bln, July $517Bln, June $577Bln, May $619Bln, April $505Bln, March $683Bln, February $617Bln, January $620Bln. The trailing 6-month avg volume is $559billion.

Spreads moved tighter again in December from 5-20Bps as volatility subsided and all in yield levels came down again. December saw $1.65Bln of net client selling on the move tighter in spreads and lower rates in U.S. Treasuries.

The 12yr and longer, 3-7yr and 7-12yr parts of the credit curve led the selling with $7.6Bln, while 0-1yr and 1-3yr paper saw $6Bln of net client buying. Financials, Technology, Consumer Staples, Energy, Industrials and Materials lead the charge in net client selling with Consumer Discretionary, Utilities, Communications and Health Care seeing net client buying.

Looking at the markets from a ratings perspective, A1/A3 paper saw the most net client selling, $1.7Bln, Baa1/Baa3 saw $203mm and Aaa saw $76mm while Aa1-Aa3 saw light net client buying.

IG Credit Flows by Sector

December 2023

IG Credit Maturity Flows

December 2023

IG Credit by Investment Grade Ratings

December 2023

December’s new issue calendar saw a very light month to close out the year as secondary trading flows were mild along with light net client selling. We saw lower yields across the board in U.S. Treasuries along with tighter spreads. The U.S. Treasury curve saw 2’s 10’s close inverted by 35 basis points and 2’s 30’s reinverted by 20 basis points.

In 2024 we will be on the lookout for changes to Fed policy, spread reactions to easing credit conditions, consumer spending, geopolitical risks, and the upcoming Presidential election. As we begin the month of January, we will get Friday’s Unemployment data, key CPI and PPI reports and the Fed will meet on 1/31/24.

Over the past 2 ½ months we have seen risk premiums on U. S. investment grade credit narrowing to the tightest levels in almost 2 years on expectations that the Fed has reached the top of the Fed-tightening cycle. As we continue to get further data reinforcing the sentiment that Fed tightening is done, it will help the new issue investment grade market and borrowers with a very favorable issuing environment. The first week of January is expecting $60 billion and the new issue calendar is calling for $160 billion for the month. Forecast for 2024 are calling for $1.2 trillion to $1.35 trillion.

Great job by the AmeriVet Securities team in December as we were a Sr Co-Manager on $2.75Bln 2-part deal for Wells Fargo Bank and Co-Manager on $750mm deal for Ally Financial. The AmeriVet Securities sales team continues to bring in a large volume of differentiated orders from Tier II & Tier III accounts on new issue deals.