Eerie Calm in Treasuries at the Mercy of Jobs and Virus Data

(Bloomberg) — An eerie calm has enveloped the Treasury market, and although the worsening pandemic and updates on the U.S. economy could stir things up a bit in the days and weeks ahead, few traders expect a quick end to the boredom.

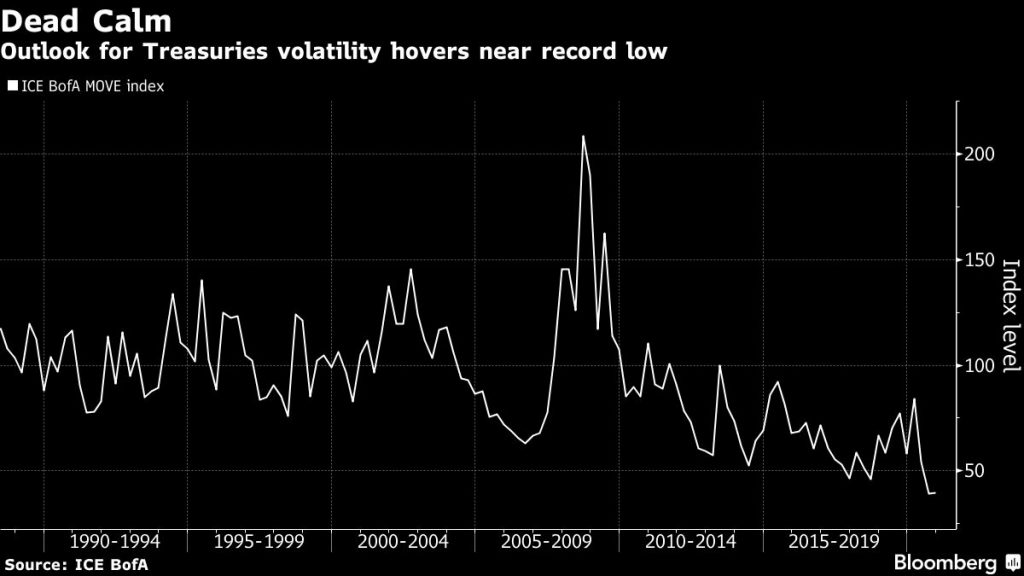

Even as global stocks head for the best month on record, the U.S. bond market’s pulse has slowed significantly in recent months. The ICE BofA MOVE Index, which measures expected price swings in the Treasury market, spiked in the lead-up to the U.S. election but has since almost dwindled back to the record low reached at the end of September.

Covid-19’s spread could certainly turn that around in a hurry: just witness how the MOVE index surged in March to its highest level since 2009. Traders may well find reason to react to the virus’s impact on the labor market Friday when the latest monthly U.S. payrolls report comes out, or a day earlier when weekly unemployment data is published. And who knows what Federal Reserve Chairman Jerome Powell will say when he testifies before Congress this week?

But many expect the Treasury market to simply take all this and more mostly in stride — unless the pandemic takes an unexpected turn for the worse. For months now, a steady flow of dismal news has failed to move it much. Ten-year yields, currently at 0.84%, have swung between 0.50% and 0.97% since August.

“It may remain a range-bound slog with markets waiting for the next shoe to drop regarding the virus,” said Marty Mitchell, an independent strategist. “The unemployment figure on Friday could prove weaker than expected given claims have been rising. But the overriding influence for trading will remain the virus — with potential for headlines regarding more shutdowns and containment measures.”

With Joe Biden on course to be inaugurated as the new U.S. president in January and the Fed making clear that policy will remain accommodative for years, the ICE BofA MOVE Index of Treasury volatility has dropped to 39.62. That’s close to September’s record low of 36.62 and way below the peak from March when virus concerns sent the gauge — which is based on one-month options — to 163.7.

Ten-year Treasury yields were little changed in Asia trading on Monday while S&P 500 futures began the week higher, then slipped, as did Australian and Japanese shares. Global equities are up 13% in November as positive vaccine news helped drive expectations that a global economic recovery can pick up in 2021.

Treasury purchases by passive fund managers could help cap yields. The Bloomberg Barclays Treasury Index, a benchmark for many investors, will go through its monthly rebalancing on Monday, and this could extend duration by about 0.16 year, matching the August increase that was the biggest since 2009.

Index rebalancing could add to recent forces that have helped keep a lid on yields. Other factors include a tempering of economic growth expectations due to surging virus cases. And with Congress unlikely to push through new fiscal stimulus measure before the end of the year, several pandemic jobless benefit programs are set to expire at the end of December — affecting an estimated 12 million people.

Gregory Faranello, head of U.S. rates at AmeriVetSecurities, has been emphasizing to his clients just how important economic data and Covid case counts are to the outlook for markets, noting that the Fed “is clearly becoming more concerned over the growing number of cases and the lack of more fiscal support.”

What to Watch

- The economic calendar

- Nov. 30: MNI Chicago PMI; pending home sales; Dallas Fed manufacturing index

- Dec. 1: Markit U.S. manufacturing PMI; ISM manufacturing; construction spending; vehicle sales

- Dec. 2: MBA mortgage applications; ADP employment change; Fed Beige Book

- Dec. 3: Challenger job cuts; weekly jobless claims; Bloomberg consumer comfort; Markit US services PMI; ISM services

- Dec. 4: Monthly jobs report; trade balance; factory, durable goods and capital goods orders

- The highlight of the Fed calendar is Powell’s appearance on Capitol Hill

- Dec. 1: Powell before Senate Banking Committee; Fed Governor Lael Brainard; San Francisco Fed’s Mary Daly; Chicago Fed’s Charles Evans

- Dec. 2: Powell appears before House Financial Services Committee; New York Fed’s John Williams

- Dec. 4: Fed Governor Michelle Bowman

- The auction calendar:

- Nov. 30: 13-, 26-week bills

- Dec. 1: 42-day, 119-day cash management bills; 52-week bills

- Dec. 3: 4-, 8-week bills

Read more at: https://www.bloombergquint.com/business/eerie-calm-in-treasuries-is-at-the-mercy-of-jobs-and-virus-data

By: Liz McCormick

Copyright © BloombergQuint