February 2020

The Credit markets closed out the month of February under extreme

volatility after rising concerns about the rapidly spreading coronavirus

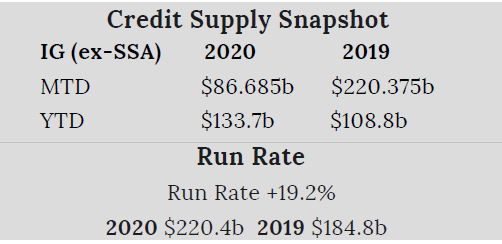

and its effect on the markets, economy and earnings. The New Issue

Investment Grade market saw $86.685 billion price for the month just shy

of the $90-100 billion anticipated. Last week we were expecting $30

billion in new issues but the extreme volatility we saw in equities froze

the new issue market and put issuers on the sidelines. Credit had a very

strong start to the new year in January with issuance of $133.7 billion and

February we were on pace for another big month despite coronavirus

fears in the market place but the volatility did not start to weigh heavily

on the markets until the third week of February and then the new issue

market shut down. Despite the volatility, the market continued to see

decent demand with buyers gravitating to new debt as well as secondary

paper for the better part of the month. As we closed out this past week,

US corporate debt markets were under massive pressure, equities were

in free fall and treasuries continued a month long rally.

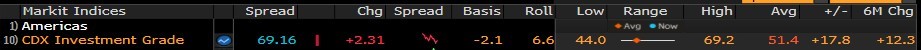

The March consensus for new issues is $100-125 billion however we will need stability and a calming in the equity and debt markets for a few days to reopen the new issue market. IG Credit spreads for the month of February were 25-30 basis points wider with the bulk of this move in the last two weeks of the month driven by Coronavirus concerns and the massive equity selloff. Investor demand in February was not as strong as we have seen in recent months. The CDX Investment Grade Index closed the month at 69 at the MTD and YTD high. The CDX investment Grade Index traded as low as 44 on just 2/13/20 further illustrating the volatility we saw in the month and now sits at the 6month high(see Chart Below) The Bloomberg Barclays US Agg Avg Oas closed out the month of February at 122 at the MTD wide level after seeing it trade at 95 on 02/12/20 (Chart Below)

CDX Investment Grade Index

Bloomberg Barclays US Agg Corporate Avg OAS

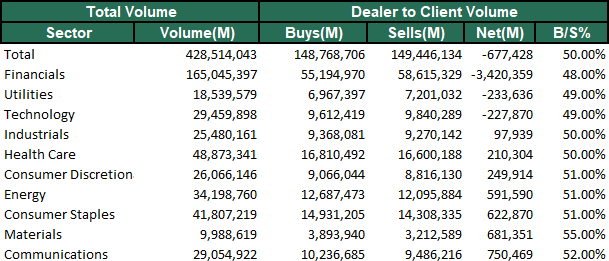

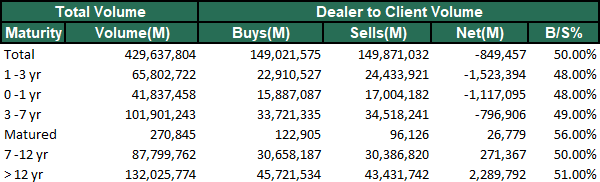

IG credit flows for the month of February came in at $428 billion vs January came in at $457 billion vs December at 260.1 billion vs November at 281.5 billion and October at 327.1 billion. Demand for credit in February continued but not at the strong pace we had been seeing for previous months. Net Client Buying for February came in at $677 million (January was $3.9 billion & December was 7.3 billion net) . The bulk of net client buying for February was in the 0-7yr part of the curve (3.4 billion), with the Financials sector coming in at $3.4 billion and dominating the Net Client buying. Almost all other sectors saw Net Client selling (See IG Credit Flow chart below)

Investment Grade Credit closed out the month of February on weak footing with dramatically wider spreads, slightly lighter volumes and lighter than expected New Issue calendar all directly attributed to the Coronavirus, a massive rally in Treasury rates and a violent risk off trade in equities to close out the month. The volatility has the new issue market currently on hold and frozen until we get a few days of stability that will allow issuers the confidence to come back to the primary market. Credit Indices closed at the highs of the month and March projections for New Issues are calling for $100-125 billion in new supply a lot of which is a backlog from the new issue markets sitting idle for a week to close out the month. We cautioned in last month’s Credit Snapshot that Credit Markets would be quick to react to developments from the Coroanavirus and the treasury market that will effect credit clients buying habits on the curve and could start to hinder investor demand. The markets surely reacted and reacted in a big way, the 10yr went from 1.632% on 2/12/20 and closed 2/28/20 at 1.15% , the 30yr went from 2.075% on 2/13/20 and closed the month at 1.676% and in the Credit Markets we saw a 25-30 basis point widening in spreads. We have seen a trend for the past 2 months to begin the year with Net Client buying heavily concentrated in the 0-7 year part of the curve and seeing selling in the 7-12 year and also 12 years and longer. The effects of the Coronavirus are going to continue to take time to unfold and will not totally be seen for 3-6 weeks as there effects on the economy and earnings become evident. We will continue to monitor this closely as March unfolds.