March 2021 Credit Snapshot

In March, the credit markets saw a robust new issue calendar that eclipsed monthly expectations as issuers rushed to come to market as the Treasury curve steepens.

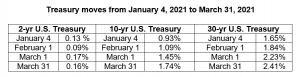

Spreads traded in a volatile range as the volatility in Treasuries has caused investors to move assets around the curve. With the 10-yr Treasury beginning the month at 1.45% and closing at 1.74% that caused credit spreads to close 10 basis points tighter to as much as 15 basis points wider with paper trading in 5 to 50 basis point ranges.

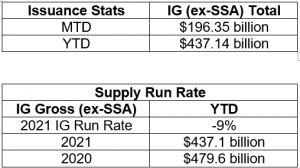

The new issue market topped monthly estimates of $135 billion and closed the month at $196.35 billion just missing the $200 billion mark.

The positive news on the vaccine front has been met with concerns about another $2 trillion in fiscal spending, a complete repricing of the U.S. Treasury curve and the most recent events surrounding the Archegos Capital Management unwinding of massively leveraged equity bets.

The markets continue digest moves by the new administration, the latest infrastructure package and the effects on the economy that is expected to be booming in the second quarter.

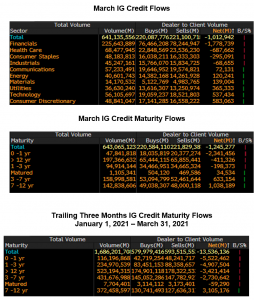

Secondary activity saw net client buying of over $1 billion, but that was heavily weighted in financials, which accounted for just over $1.7 billion in net client buying.

The big story continues to be where on the curve money is being allocated by investors as the steepening trade in the treasury market is creating new opportunities.

IG credit spreads were 10 basis points tighter to 15 basis points wider as Treasury volatility picked up dramatically.

Following a steady grind tighter in spreads to begin the year, the U.S. Treasury moves that have taken place have caused investors to pause in some cases and put money to work in the front end of the market and also buy long dated credit, as the 10-yr and 30-yr Treasuries have moved +81basis points and +76 basis points higher year to date. (See 2-yr, 10-yr and 30-yr Treasury levels below).

The CDX Investment Grade Index opened the month at 52.917 and traded as tight as 51.5 on March 17, before moving wider on March 24 at 58.7 and closing at 51.96 (see chart below for more information).

The Bloomberg Barclays US Agg Avg Oas closed out the month at 0.91, just off the monthly low level of 0.90 seen on March 1, but there was plenty of volatility that saw the high at 1.00 on March 9 (see chart below).

IG credit flows in March were strong and came in at $641 billion, topping February’s $512 billion and January’s $525 billion. The trailing six-month average volume is $507 billion.

March’s strong new issue calendar did not hold back solid secondary volume, as we saw investors and portfolio managers moving paper around the credit curve with the steepening of the U.S. Treasury curve.

Volume showed strong demand for secondary paper, most of that net client buying, was seen in financials which accounted for $1.7 billion of the over $1 billion of the months total. The real story lies in the credit curve, as we saw over $2.5 billion in net client buying in 0-3yr maturities and 12-30yr maturities saw almost $500 million in net client buying in the back end of the curve; considering the move in the 30-yr Treasury bond going from 2.23% to 2.41%, it is not surprising.

Looking at the trailing three months, back to January 1, 2021, investors have been plowing money into 0-3yr maturities with over $10.4 billion in net client buying coupled with buying in the back end of the credit curve with over $3.4 billion in net client buying.

The lone outlier has been the 7-12yr part of the curve that has seen just over $3 billion in net client selling of credit (see IG Credit Flow chart below).

In March, we saw a new issue calendar that topped monthly expectations, strong secondary trading flows, choppy spreads that saw wide ranges and a month end tightening in spreads.

Steepening in the U.S. Treasury curve has put the credit market on notice and investors are making moves along the curve based on the move in rates. The landscape in the rates market has investors focusing on the long end of the yield curve as it has steepened dramatically and now yields have gotten to much more attractive levels.

We are expecting $25 billion for the first week of April in new issue investment grade deals, with a total of $100 billion for the month.

The primary market went into the Easter holiday weekend on a mixed note with some deals seeing a better reception than others. Book sizes have been smaller for some issuers recently, while others have seen strong demand during the syndicate process, suggesting investors are being a bit more selective than they have been in recent months when all deals were well oversubscribed. Though investment-grade debt issuance may not top 2020’s record, 2021 volume could surpass historical averages, according to Bloomberg Intelligence.

Finally, I want to close by congratulating the Amerivet Securities team on a great job in the month of March, as we were Co-Managers on deals from Deutsche Bank NY, MasterCard, PSEG, Edison Intl, Appalachian Power, as well as a nine-part $25 billion deal from Verizon, followed up by $2.75 billion three-part EUR deal for Verizon and a three-part $6 billion deal for AT&T. In addition, Amerivet Securities brought in over $208 million in differentiated orders from Tier II and Tier III accounts on Verizon and over $80 million in orders for AT&T.