Pandemic Times Still Exist

Boom, CPI. Base effects but we’ve been calling for a decline with inflation. Base effects come and go but charts and history don’t lie. We love “higher for longer” as a pathway to success for this Federal Reserve. I accentuate “love.” Get slightly higher and sit. Let the market prove you wrong. Rate markets of late have been reflecting supply, continued balance sheet runoff, search for a new terminal rate, and a clear alleviation of the banking conditions in March.

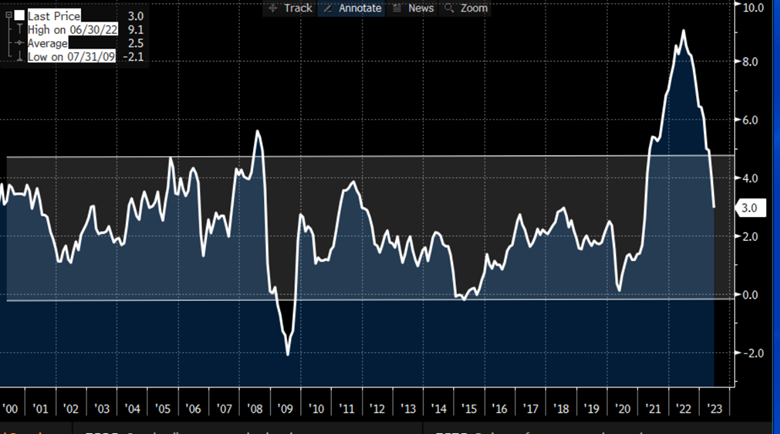

Headline CPI: extreme moves up and down. Core matters. We are likely to find a new range like 2000-2023 in the years ahead. For now, risk, and risk-free assets, enjoy a great pocket of time. Tactical and practical was our theme for 2023. We stick; eyes and ears wide open moving forward.

But:

Years, not months, to resolve practically the pandemic. But this is a good pocket of time. And it is a good pocket of time because of the greatness of American ingenuity. We do not need to chase every aspect, but the embracement is clear. We are in the midst of something very big. For now, it makes the job of a central banker tougher. Ultimately, central banks, markets, the cost of money, and ingenuity will find common ground.

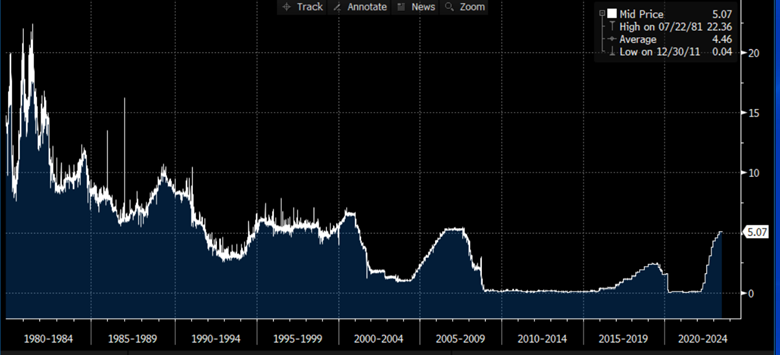

I have long felt, and still believe, central banks move benchmark rates too much. The cost of money should never be free. In the United States, these issues are now front and center. In the United Kingdom, issues surfaced in 2022. Higher and normalized rates globally are not the devil. The rebalancing we are seeing, as painful for things that have surfaced, is healthy. More so than we can understand. A positive return on simple cash is the bedrock of society for those that work, earn and have the ability to save.

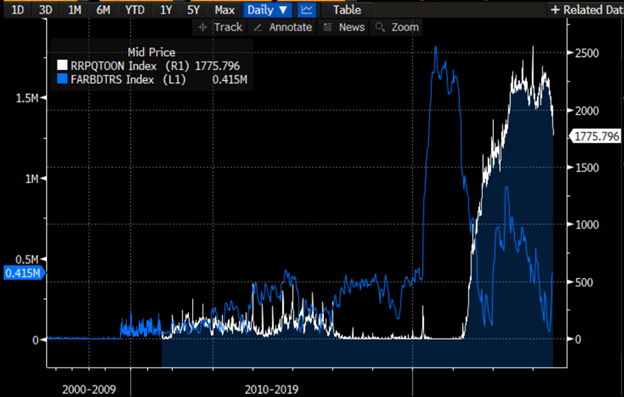

Highlight the Fed’s balance sheet versus Money Market Accounts. Unlike in 2008, money is not flowing for safety. IT’s return versus what bank savings are paying, inflated asset prices for years and the notion that one can sleep at night earning 5%!!!!

Bottom Line: the higher the Fed goes, so too this chart. Getting money out of the Reverse Repo Facility is KEY!

The Effective Fed Funds Rate since 1980. We are IN and entering known territory. Context:

The summer months used to be sacred in financial markets. When the pandemic in 2020 hit, it was hard to decipher. It is still hard to believe the Federal Reserve changed their framework in August 2020 to inflation averaging. Think about that in the context of where we arrive in 2023. We have written throughout the course of 2022 about the extreme moves with interest rates and the potential impact on balance sheets. Of course, we did not foresee the precise events that occurred in March of this year, but after years of Zero Interest Rate Policy, it was inevitable. In many ways, unfortunate.

Things will look quite different over the next 10 years. Artificial Intelligence is the rave. But the cost of money sets the stage and matters. And the journey to reverse years of free money will be long. The Federal Reserve must and will go higher. The quest to hold rates steady will be challenging but necessary.

When we look back to the extreme measures when the pandemic hit, coupled with looking forward, it is the Federal Balance sheet that resonates. The benchmark rate came down only 150-basis points in March of 2020. And now higher by 500-basis points.

How Much Excess Supply is Still in the System? A lot but coming down. NVDA, the Fed’s Balance Sheet, and Bitcoin below. Recently, Dallas Federal Reserve President, Lorie Logan, indicated the possibility for the Fed to continue balance sheet runoff while even cutting rates. We agree. Ultimately, the Fed needs to get their Reverse Repo Facility that ballooned throughout the pandemic down to normalized levels. Many charts looked normal before 2010.

NVDA (great company), the Fed’s Balance sheet, and Bitcoin.

Context: The Fed’s Reverse Repo Facility versus the Treasury’s General Account. It highlights the extremities of the pandemic, debt ceiling issues, and a normalizing process.

Equities, the Fed Funds Rate and Consumer Sentiment over the past 20 Years

Investors are nervous. The obvious issues are in front of us, and the first half of 2023 has highlighted that. The economy has slowed. And it will continue to slow. Lately, risk assets have been moving higher in conjunction with the repricing in rates.

Keep in mind, the repricing in the second quarter of 2023 was an alleviation from the extremes in March. The economy, markets and the Fed are back in silos. Unlike 2022. It is complicated on many levels and especially for the Federal Reserve. Consumer sentiment has been low because of higher inflation, geo-political tensions, and overall uncertainty. We live in complicated times. Real inflation adjusted rates will matter. They are front and center for the Fed. Chair Powell is likely pleased with the recent move higher.

The Federal Reserve will not succeed in getting core inflation down to target without 10-year Real Yields going higher or remaining firm. It is the story of the moment for the second half of 2023 bar none. A bit higher and longer resonates. It will require a combination of both jawboning and action. But the market has been resilient to Fed speak so long as the data cooperates. We still have competing forces between monetary and fiscal policy.

SPX (a few names), the Effective Funds Rate, and University of Michigan Sentiment:

10-year UST Real Yields: 2000-2023. Highlights levels and the range we have formed coincided with the bottom in equities (October 2022, former Fed Vice Chair Brainard: long and variable lags. i.e., slow down) We are at an important juncture with interest rates and economies globally. And with economy predicted to slow in the second half of 2023 into 2024, a continued move higher in real yields will be problematic for risk assets. The major indices are ignoring the economy. And that’s a challenge for the Federal Reserve.

Conclusion

We have been critical of this Federal Reserve. It is easy to offer opinions when you are not in the seat. Chair Powell has moved the needle. And the decision, although questioned to pause in June, was the right one. A few more rate hikes, icing on the cake, seems logical given the mark-to market events and the story of the real economy.

The success of the Federal Reserve within this pocket of time is not going “higher and higher” yet getting well above the rate of core inflation and sitting. Let the economic dynamics prove you wrong. It is a concept we haven’t embraced in quite some time. But we believe in it.

It is meaningful toward leverage in this economy. It may continue to be painful in aspects we don’t know or understand. But it’s necessary. Central banks around the world have an opportunity to reflect, understand, introspect, and create a different pathway forward.

This is one of the biggest interest rate shifts for a lifetime. It should be respected. It will not be understood entirely day to day, but we are learning and adapting as we move forward.

God Bless America. This is not a traditional economic cycle. Our labor force is shrinking. We need to continue to mentor, encourage and lead.

Despite short-term elevated inflation, perhaps mistakes on the monetary and fiscal side, the future of our country remains extremely bright.