“Perfect Number” – Stocks & Bonds Soar After “Universally Weak” Payrolls Data, Dollar Dumps

Weak jobs growth and easing wage growth – just the kind of ‘bad’ news that markets love, and sure enough stocks and bonds are soaring as the dollar dives on dovishly-diving rate-change expectations. As Capital Economics points out:

“The strongest argument for the Fed to abandon its tightening bias is that wage growth continues to slow with average hourly earnings rising by a muted 0.2% month on month and the annual growth rate falling to 4.1% — the lowest since mid-2021.

“The decline in the job quits rate continues to suggest it will drop below 4% soon. Overall, we suspect the softening in labor-market conditions has much further to run and still expect the Fed to be cutting interest rates again in the first half of next year.”

Rate-cuts are coming…

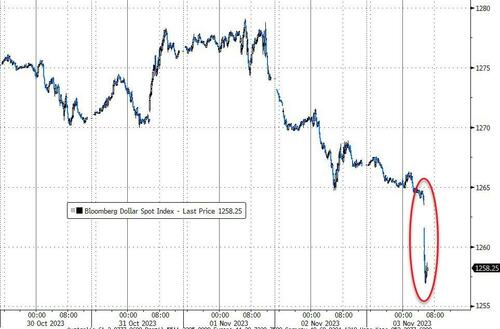

Source: Bloomberg

Gregory Faranello, Head of US Rates Trading and Strategy for AmeriVet Securities, says the “employment report fits our view that the economy is slowing,” and in the wake of this week’s dovish Fed meeting and presser, adds: “It’s clear why Chair Jay Powell stood confident this week.”

“This is a perfect number for stock rally,” said Brent Donnelly, president of Spectra Markets.

And indeed it was, lifting Small Caps and Nasdaq to weekly gains of 6%…

Additionally, John Brady at RJ O’Brien calls payrolls “a bond-friendly number.”

“Don’t think the AHE numbers will be of much concern. Bad news (clearly softening labor market) is market good news.”

And he is right, yields have collapsed at the long- and short-end…

30Y yields are down

Source: Bloomberg

2Y yields are down 25bps from Wednesday’s highs…

Source: Bloomberg

“The two-year’s move is stunning,” said Steve Sosnick, of Interactive Brokers, adding:

“It’s a big move across the curve, but 14 basis points on the short end is enormous. WIRP now showing a cut by June instead of July. Modest payrolls and wage growth could imply that Goldilocks is really coming. Too early to say after one report, but for today, it’s exactly what bond bulls wanted to hear.”

Barry Knapp of Ironsides Research says this report is “for sure” a turning point for bond bulls.

Equity markets, on the other hand, “need the Fed to fully pivot,” he said.

The dollar puked, extending its weekly decline…

Prya Misra, portfolio manager at JP Morgan Investment Management, says:

“The market is responding as you expect on the weaker than consensus payrolls, downward revisions and wages.”

Gold initially spiked on the headlines as the dollar dives with spot prices topping $2000… but then it was curb-stomped back down again…

Ali Jaffery, an economist at CIBC Capital Markets, has this take:

“Weighing down the headline job number was 33,000 decline in motor vehicle and parts employment as a result of the UAW strike which should mostly reverse next month.”

“Overall, even abstracting from the UAW strike, today’s report suggests labor demand has been a bit cooler than the data was telling us in September and labor supply stalled at least momentarily.”

So it’s bad news… which is just good enough for the algos to bid everything higher.

Meanwhile, the underemployment rate, or U-6, climbed to 7.2%, the highest since February 2022. This is a broader measure of unemployment that tracks the unemployed, as well as those marginally attached to the labor force and part-time for economic reasons.

Are we really ‘celebrating’ a two-year high in white unemployment?

Academy Securities’ Peter Tchir agrees that it was indeed a “universally weak report”.

Maybe as we dig through the details, we will find something “strong” in this report, but it seems weak across the board.

Jobs, only 150k is bad enough. Comes with 101k of negative revisions (why do we torture all those economists who made predictions, that looked wrong at the time of the release (their estimates were supposedly too low) only to find out 2 months later they were probably right?). Private sector was below 100k and manufacturing lost a significant number of jobs, despite re-shoring etc. (presumably the strikes impacted that though).

Hourly earnings were lower (in line with some other estimates yesterday of declining wage pressure, despite the high profile union deals).

The unemployment rate ticked up to 3.9% while the participation rate declined a touch – exactly the response you do NOT want to see. Fewer people looking trying to work and the unemployment AND underemployment rates nudged higher. This was because the household survey was a miserable job loss of 348k, making for net job losses over the past 3 months.

Hours worked, which hasn’t really supported the strength in prior job reports, inched down as well, not signally that this could be a one-time glitch.

I know that weather cannot be an excuse this time (it does get trotted out). The strikes could have had an impact, but I find it difficult to believe the impact is so big to drag down the entirety of this report (sure, the manufacturing side, but the report as a whole).

While the margin for error of both reports is obscenely high relative to how they are presented (BLS margin of error) I’m starting to wonder if the Household doesn’t reflect reality better, since it asks potential employees, not employers. The one argument I’ve heard, that I like, is that if someone is laid off, but receiving severance pay, the company reports them as employed, but the employee (or, technically, about to be former employee) views themselves as unemployed. To save you time on the link, the margin for error, to be “statistically significant” is 130k for the Establishment and 600k for the Household. I wonder, if with he lower response rates for the Establishment, the margin for error there isn’t even larger? In any case, why don’t we just get the raw data and let anyone who wants use Ai or their own algos to do all the adjustments? Maybe we’d get some interesting data that way?

Since I mention response rates (BLS response rates) the Current Employment Survey Statistics response rate was 32.5% for the July survey (last they had published). That was 67% as recently as December 2019! If I’m sending out a survey and the response rate is cut in half in less than 4 years (after being stable for a decade), I’d question the validity of the survey and the responses.

Sorry if I got a bit wonky at the end, but Garbage In, Garbage Out is one of the tenets that I live by and this data, between he margin for error issues and the response rate, seems fraught with garbage, despite being one of the biggest data days for the market (and companies) every month.

Bottom Line

Rates rally from here, sub 4.5% on 10s and we see whether any shorts (and a bunch got reset post Fed) get stopped out.

Risky assets should rally for now, but recession chatter will act as a dampening effect (along with the already large surge we’ve seen this week).

I really, really like top quality IG bonds here on a spread basis.

I think investors, as they figure out how “safe” treasuries are, will start being more overweight top quality IG bonds, over treasuries, helping spreads perform well.

By: Tyler Durden