Treasuries Extend Selloff, Pushing 10-Year Yield to 16-Year High

- Long-end led selloff fueled by high rates, rising supply

- ‘The Fed is no longer your friend,’ says AmeriVet’s Faranello

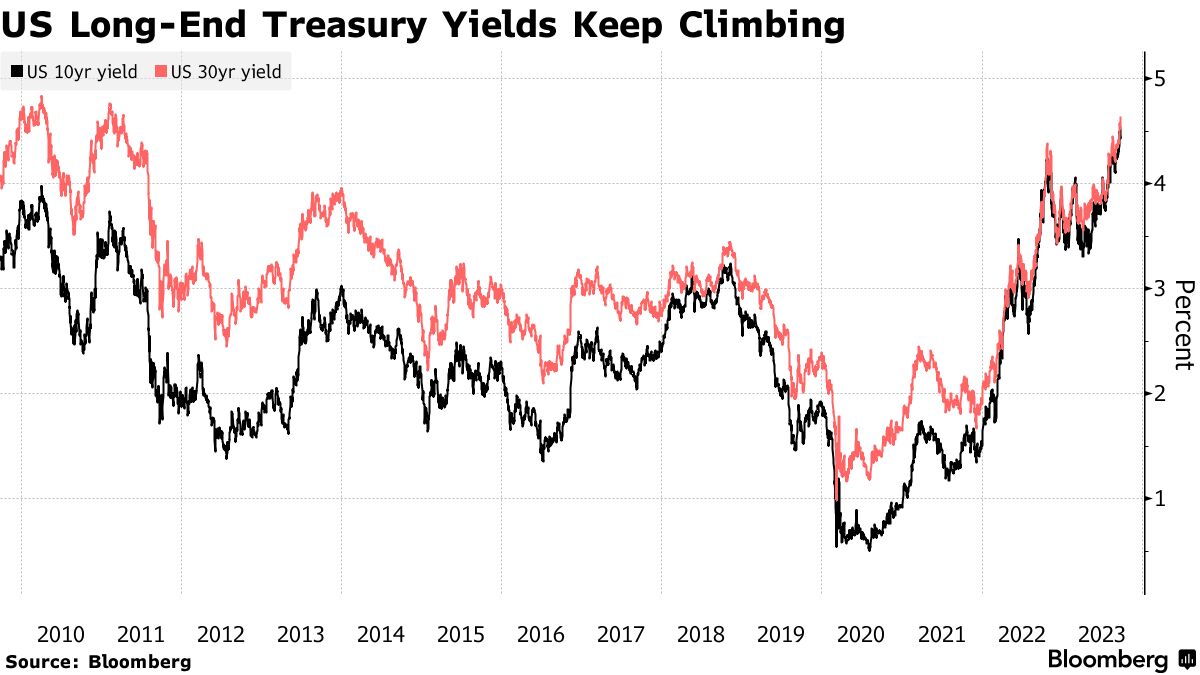

US Treasuries extended their decline, driving 10- and 30-year yields to new multi-year highs, on expectations the Federal Reserve will hold interest rates high and the supply of new bonds will keep rising as the federal government contends with mounting deficits.

The 10-year yield rose as much as 10 basis points Monday to 4.53%, the highest since October 2007. The 30-year rose as much as 12 basis points to 4.64%, a level not seen since April 2011.

Bond yields have been rising since the Fed last week signaled that it may raise rates once more this year and dialed back expectations for rate cuts in 2024, indicating it’s likely to keep monetary policy tight well into next year to tame inflation.

“The structural pain trade is higher from here and the Fed is no longer your friend,” said Gregory Faranello, Head of US rates Trading and Strategy for AmeriVet Securities.

The recent selloff has fallen most heavily on longer-dated bonds, with shorter-term securities seeing smaller jumps in their yields. That’s reduced the scale of inversion in the yield curve, with 10-year yields now about 60 basis points below two-year ones, the narrowest gap since May.

The long-end selloff was accompanied by a rise in yields on Treasuries with inflation protection, indicating that concerns about rising consumer prices are being displaced by the risks of rising Treasury debt sales as the Fed continues to pull back from the market by shrinking its debt holdings. The 10-year real, or inflation-adjusted yield, rose as much as 9 basis points to 2.14%, the highest since March 2009.

There is “significant room for a selloff on 10 to 30-year bonds, possibly 50 to 75 bps higher before the end of the year,” said Earl Davis, head of fixed income and money markets at BMO Global Asset Management, on Bloomberg TV Monday, referring to inflation-protected securities.

— By: Michael Mackenzie with assistance by Carter Johnson