US Non-Farm Payrolls Up By 224,000 in June

US non-farm payrolls grew by 224,000 in June, according to the US Department of Labour. That number far surpasses the disappointing 75,000 jobs added in May. Though the unemployment rate ticked slightly upward to 3.7%, it’s still the lowest rate in almost 50 years. The new non-farm payrolls report shows the highest job gain since January.

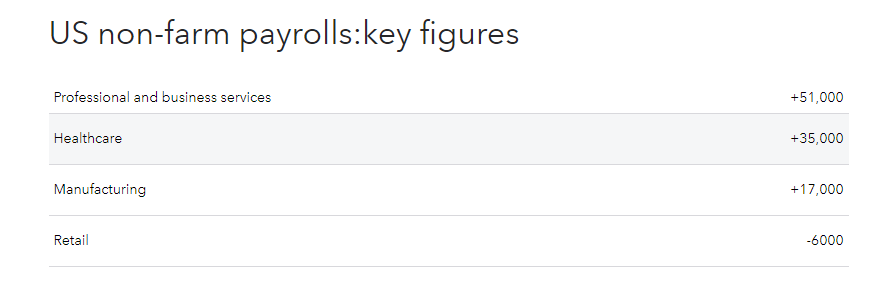

Where did non-farm payrolls grow in June?

Professional and business services added 51,000 jobs in June. The healthcare industry added 35,000 new payrolls. Even manufacturing jobs grew by 17,000 last month despite the US-China trade impasse affecting the industry. The only sector that had negative news was retail as 6000 jobs were lost in June.

What do financial experts say about the June non-farm payrolls?

Martha Gimbel, director of economic research for the Indeed Hiring Lab, believes that the positive jobs report shows the resilience of the US economy.

“The jobs growth number this month is comforting after a few months of uncertainty. While job growth may be slowing down from its astonishing rate last year, it’s reassuring that the economy is still creating jobs at a reasonable pace,” said Gimbel.

While the amount of jobs are growing, wages haven’t kept pace. Hourly wages grew by 0.2%, less than the expected 0.3%. Jason Guggisberg, vice-president of staffing firm Adecco, encourages corporations to raise wages, but some companies are unsure about how long the economic boom will last.

“That wage conversation has been going on for years now. They’ve [employers] been dragging their feet, waiting to see what happens. The answer’s always, “it’s not in the budget,” said Guggisberg.

Will good June non-farm payrolls be bad for Fed rate cuts?

Ironically, the good news about June non-farm payrolls could be bad news for financial experts wanting a US Federal Reserve interest rate cut. While Fed chair, Jerome Powell, vowed to act to help the US economic expansion, the better-than-expected jobs report could mean the Fed won’t feel an urgency to reduce rates.

Gregory Faranello, head of Amerivet Securities’ US rates, said that a half-point rate cut is unlikely, but the Fed may still act to reduce interest rates later this month.

“The [US stock] market is priced for a fairly definitive scenario. A 50 basis-point rate cut is almost certainly off the table for July, but we [investors] will largely stay priced for 25 basis points through the end of July,” said Faranello.

By: Nyandabeh Ella Vincent | Financial writer, Chicago